Top TSX Dividend Stocks To Consider In May 2024

As we approach May 2024, the Canadian market continues to navigate through a landscape shaped by fluctuating economic trends and evolving market conditions. In this context, dividend stocks remain a focal point for investors seeking stable returns amidst uncertainty. A good dividend stock not only offers regular income but also the potential for capital appreciation, making it an appealing option in the current economic environment.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.43% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.04% | ★★★★★★ |

Power Corporation of Canada (TSX:POW) | 5.79% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.51% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.50% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.49% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.32% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.06% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.85% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.51% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top TSX Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

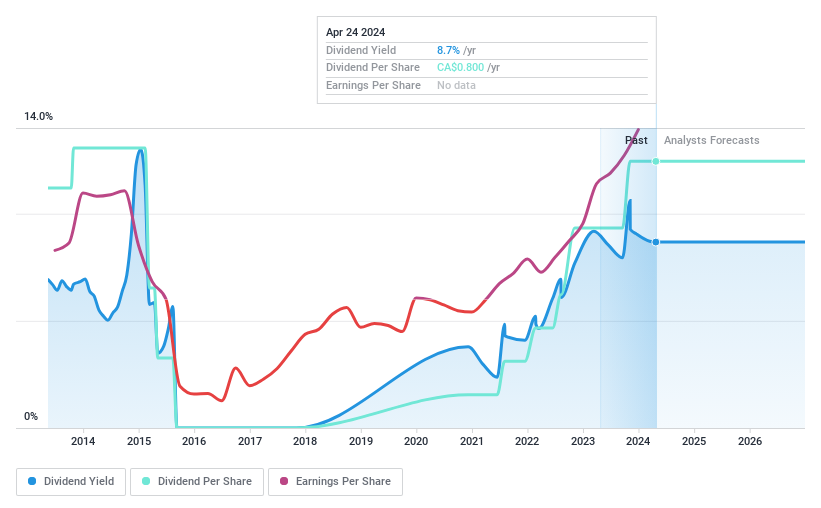

PHX Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PHX Energy Services Corp. offers horizontal and directional drilling services, along with renting and selling performance drilling motors and equipment to oil and natural gas companies in Canada, the U.S., Albania, the Middle East, and other global markets, with a market capitalization of CA$421.69 million.

Operations: PHX Energy Services Corp. generates revenue by providing horizontal and directional drilling services, as well as renting and selling performance drilling motors and equipment to oil and natural gas companies across Canada, the U.S., Albania, the Middle East, and various international locations.

Dividend Yield: 8.9%

PHX Energy Services, trading at 60.4% below its estimated fair value, offers a high dividend yield of 8.95%, ranking in the top 25% of Canadian dividend payers. However, its dividends have shown volatility and inconsistency over the past decade, with significant drops and unreliable growth patterns. Despite a low payout ratio suggesting earnings coverage, the dividends are poorly supported by cash flow with a high cash payout ratio of 139.1%. Recent financials indicate declining net income and basic earnings per share year-over-year as of Q1 2024.

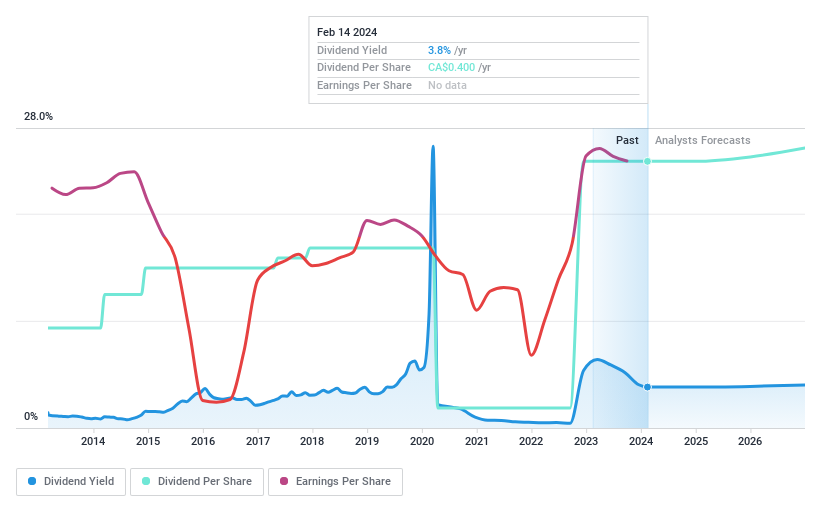

Secure Energy Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in waste management and energy infrastructure primarily across Canada and the United States, with a market capitalization of approximately CA$2.99 billion.

Operations: Secure Energy Services Inc. generates revenue through two main segments: Energy Infrastructure, which brought in CA$7.81 billion, and Environmental Waste Management (EWM), contributing CA$1.09 billion.

Dividend Yield: 3.5%

Secure Energy Services, trading 26.5% below its estimated fair value, offers a stable dividend yield of 3.51%, though it falls short of the top quartile in the Canadian market at 6.33%. The company has consistently increased its dividends over the past decade, supported by a low payout ratio of 20.6% and a reasonable cash payout ratio of 63.8%. Despite robust earnings growth this past year (179.6%), analysts predict an average earnings decline of 32.9% annually over the next three years. Recently, SES announced significant share repurchase programs funded from available cash and credit facilities, reaffirming their capital return commitment to shareholders.

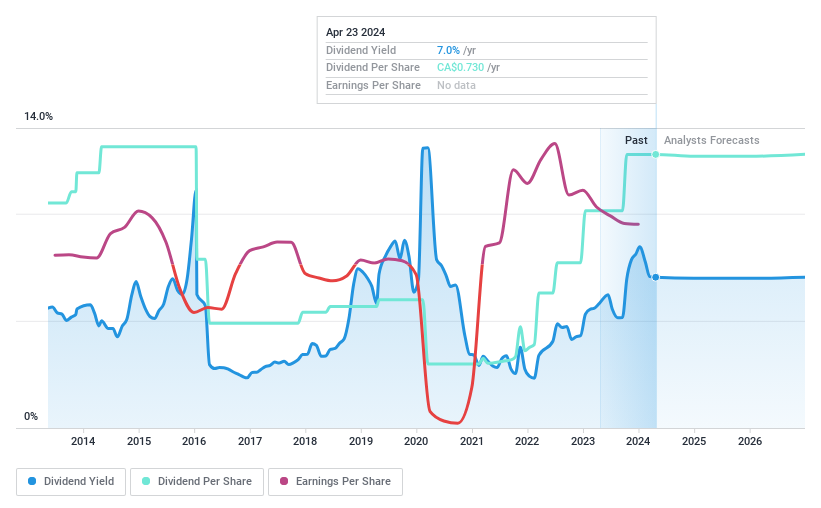

Whitecap Resources

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc. is an oil and gas company that acquires, develops, and produces oil and gas assets in Western Canada, with a market capitalization of approximately CA$6.13 billion.

Operations: Whitecap Resources Inc. generates its revenue primarily from oil and gas exploration and production, totaling CA$3.23 billion.

Dividend Yield: 7.0%

Whitecap Resources offers a compelling dividend yield of 7.04%, ranking in the top 25% within the Canadian market. Its dividends are well-supported with a payout ratio of 56.1% and cash flow coverage at 82%. Despite lower profit margins this year, dropping to 21.3% from last year's 33.5%, the company maintains stable and growing dividends over the past decade. Recently, Whitecap announced a significant share buyback program, planning to repurchase up to 9.87% of its issued shares by May 2025, signaling confidence in its financial health and commitment to shareholder value.

Turning Ideas Into Actions

Reveal the 31 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:PHX TSX:SES and TSX:WCP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance