Top UK Dividend Stocks To Consider In February 2024

Embark on a journey to financial resilience with the cream of the crop in UK dividend stocks! These three stalwarts not only provide a steady stream of income but also hold the promise of enduring stability for your portfolio.

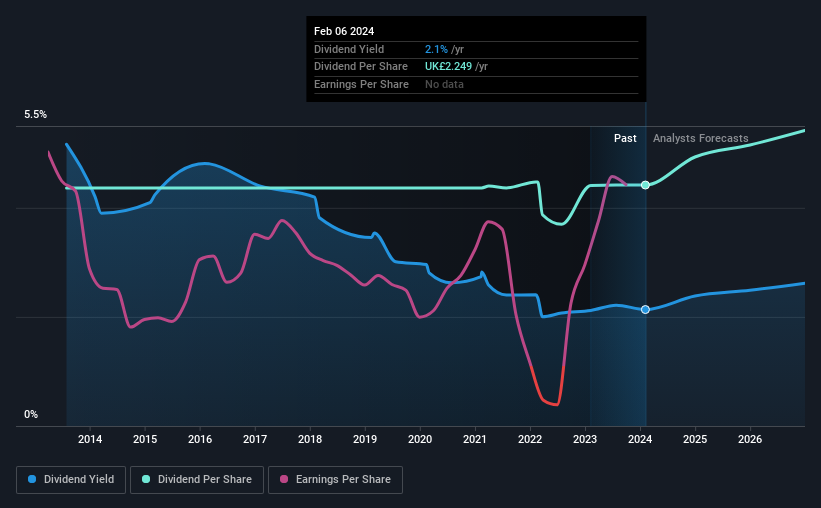

AstraZeneca (LSE:AZN)

AstraZeneca PLC, a biopharmaceutical giant with a market cap of £163 billion, thrives on its Biopharmaceuticals segment which generates £44.99 billion in revenue. The company has shown fiscal prudence by reducing its debt to equity ratio from 168% to 76.8% over five years while growing earnings annually by 12.9%. Although AstraZeneca's net profit margins improved significantly to 13.1%, and the past year's earnings growth outpaced the five-year average, its dividend yield at 2.13% remains modest compared to the UK market's top payers. Debt levels are high but manageable with strong operating cash flow coverage and interest payments comfortably covered by EBIT. Dividends have been consistent over a decade, suggesting reliability; however, forecasted profit and revenue growth are not expected to be high, which may temper expectations for substantial future dividend increases. Unlock comprehensive insights into our analysis of AstraZeneca stock here.

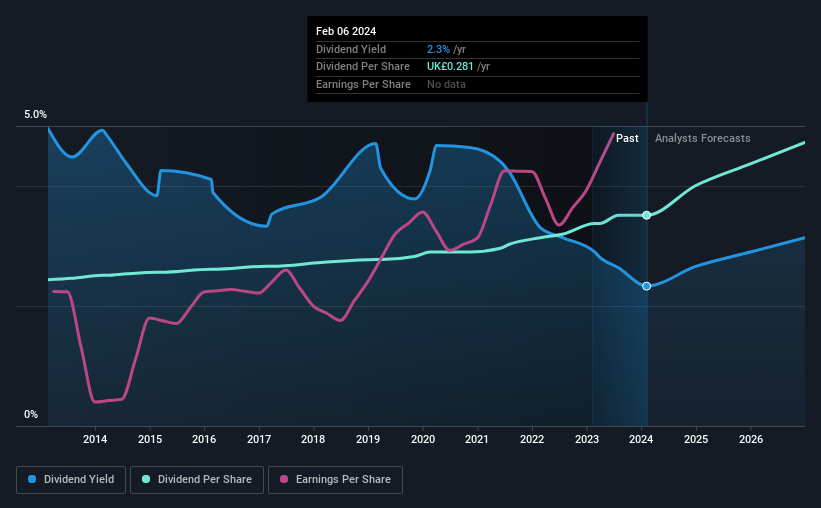

BAE Systems (LSE:BA.)

BAE Systems, a global defense, aerospace, and security company with a market cap of £36.42 billion, primarily generates revenue through its Air and Maritime segments alongside Electronic Systems. The firm has strengthened its financial health by reducing its debt to equity ratio from 70.9% to 47.3% over five years and has seen earnings grow annually by 11.8%. Notably, BAE's profit margins have improved from last year's figures with current net margins at 8.6%. Its dividends are well-supported by both earnings and cash flows, indicating sustainability in payouts which have consistently grown over the past decade despite a dividend yield that is lower than the top quartile of UK dividend payers. While debt levels are deemed satisfactory with ample coverage from operating cash flow, the expected growth in profits and revenues is not projected to be exceptional though it remains positive for future prospects within the realm of dividend stocks. Get an in-depth perspective on BAE Systems' performance by reading our analysis here.

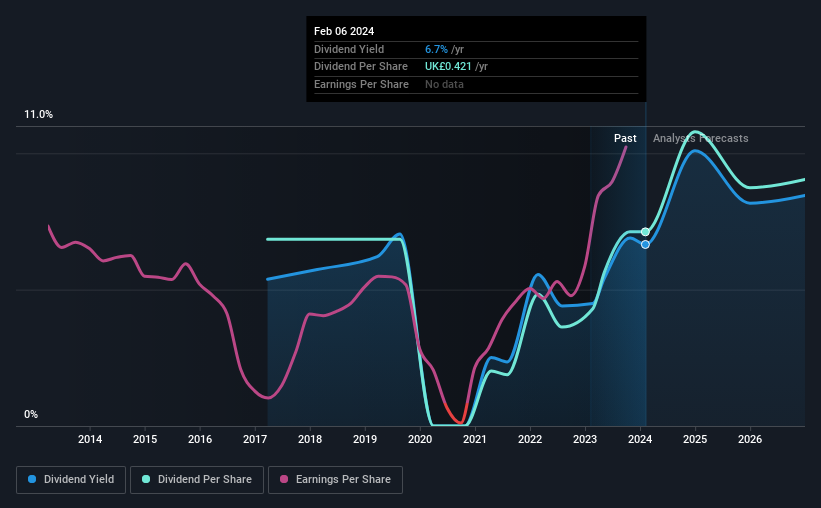

HSBC Holdings (LSE:HSBA)

HSBC Holdings, with a global presence in banking and financial services and a market cap of £119.19 billion, leans on its Wealth and Personal Banking segment as its largest revenue contributor. The analysis highlights HSBC's prudent risk management reflected by a low allowance for bad loans at 59% and an appropriate Loans to Assets ratio of 35%. With non-performing loans kept under control at 1.8%, the company has demonstrated robust profit growth, significantly outpacing its five-year average with current net profit margins rising substantially from the previous year. Despite this strong performance, HSBC's dividend history is shorter and less consistent than some peers; dividends have increased but show volatility over the last seven years. Nevertheless, with a payout ratio under 40%, dividends are currently well covered by earnings—a trend expected to continue in the near term—though forecasted declines in earnings and revenue may challenge future dividend growth sustainability. Navigate through the intricacies of HSBC Holdings with our comprehensive report here.

Taking Advantage

Harness the insight of the Simply Wall St screener to navigate the landscape of UK dividend stocks with informed confidence. Click this link to deep-dive into our Top Dividend Stocks screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance