Top Undervalued Small Caps With Insider Action In Hong Kong July 2024

As the global economic landscape presents mixed signals, with cooling labor markets and fluctuating manufacturing indices, the Hong Kong market has shown resilience, particularly in the small-cap sector. This backdrop sets an intriguing stage for investors looking for value in undervalued small caps, where insider actions might hint at unrecognized potential. In such a market environment, identifying stocks that exhibit strong fundamentals yet remain underappreciated by the broader market could offer substantial opportunities.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

China Overseas Grand Oceans Group | 2.7x | 0.1x | 2.69% | ★★★★★☆ |

Wasion Holdings | 11.2x | 0.8x | 33.52% | ★★★★☆☆ |

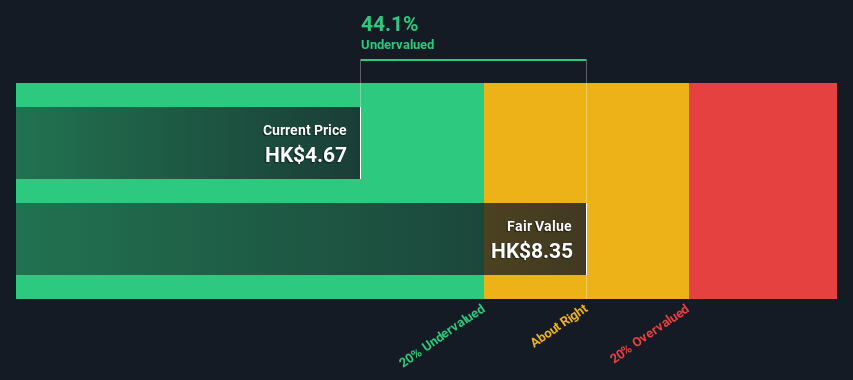

Xtep International Holdings | 10.8x | 0.8x | 43.78% | ★★★★☆☆ |

Sany Heavy Equipment International Holdings | 7.7x | 0.7x | -20.19% | ★★★★☆☆ |

Ever Sunshine Services Group | 5.7x | 0.4x | 17.78% | ★★★★☆☆ |

Nissin Foods | 14.4x | 1.3x | 41.16% | ★★★★☆☆ |

Kinetic Development Group | 3.9x | 1.7x | 20.86% | ★★★★☆☆ |

China Leon Inspection Holding | 9.4x | 0.7x | 30.68% | ★★★★☆☆ |

Shenzhen International Holdings | 7.9x | 0.7x | 15.42% | ★★★★☆☆ |

Giordano International | 8.3x | 0.7x | 38.38% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Xtep International Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Xtep International Holdings is a company that specializes in the design, development, manufacturing, and marketing of sportswear products, with a market capitalization of approximately CN¥11.95 billion.

Operations: The company generates its revenue primarily from three segments: Mass Market, which contributes CN¥11.95 billion, Fashion Sports with CN¥1.60 billion, and Professional Sports at CN¥0.80 billion. Over the reviewed periods, it has experienced a fluctuating gross profit margin with an interesting upward trend peaking at 44.31% in late 2019 before stabilizing around 42% in subsequent years.

PE: 10.8x

Xtep International Holdings, a notable player in the Hong Kong small-cap arena, recently saw insider Shui Po Ding acquire 2 million shares for HK$14.15 million, signaling strong insider confidence. This move aligns with a robust earnings forecast of 14.03% growth per year, despite the company's reliance on higher-risk external borrowing as its sole funding source. Recent executive shifts aim to enhance focus on financial strategy and investor relations, further positioning Xtep for potential growth amid operational adjustments like dividend increases and bylaw amendments noted in May 2024.

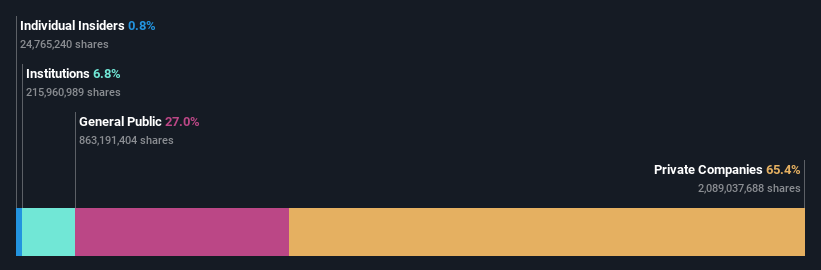

Sany Heavy Equipment International Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sany Heavy Equipment International Holdings is a company specializing in the manufacture and sale of heavy machinery and equipment, with a market capitalization of approximately CN¥5.43 billion.

Operations: The company's gross profit margin has shown a fluctuating trend over the years, ranging from 0.15% to 0.31%, reflecting changes in cost of goods sold and revenue dynamics. The net income margin has also varied significantly, indicating shifts in operational efficiency and expense management.

PE: 7.7x

Amidst a challenging financial landscape, Sany Heavy Equipment International Holdings recently showcased resilience with its first quarter earnings. Despite a slight dip in sales to CNY 5.13 billion and net income falling to CNY 516 million, the company's strategic adjustments and insider confidence—highlighted by recent share purchases—signal strong belief in its future prospects. Additionally, the firm's commitment was underscored by a generous dividend of HK$0.19 per share and proactive amendments to company bylaws, positioning it well within Hong Kong’s undervalued investment opportunities.

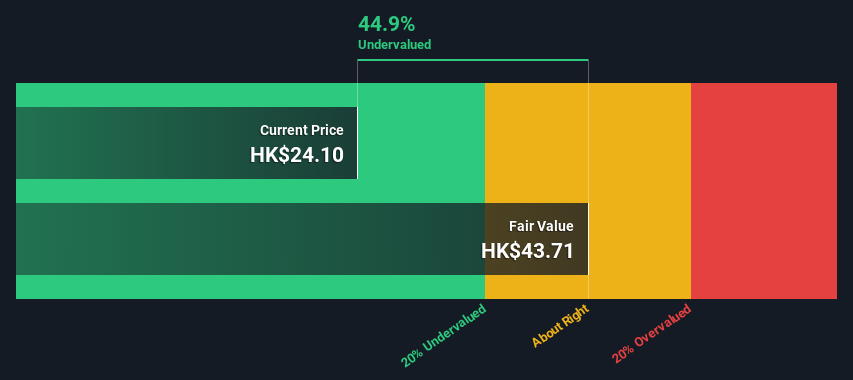

Ferretti

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats.

Operations: In 2023, the company generated €1.23 billion in revenue, with a net income of €83.05 million. The gross profit margin stood at 37.08%, reflecting the cost of goods sold at €773.32 million and gross profit at €455.82 million after accounting for these costs.

PE: 11.6x

Ferretti, a lesser-known entity in Hong Kong's investment landscape, recently confirmed its 2024 revenue forecast, targeting growth between 9.8% and 11.6%, with expected revenues reaching up to €1.24 billion. This outlook was shared during their Q1 earnings call and reiterated at the UniCredit Italian Investment Conference. Highlighting insider confidence, key executives have recently purchased shares, signaling strong belief in the company’s direction amid operational enhancements like bylaw amendments to cancel repurchased shares. With dividends set for distribution on June 26, Ferretti's financial health appears robust as it continues navigating through competitive waters.

Click to explore a detailed breakdown of our findings in Ferretti's valuation report.

Gain insights into Ferretti's historical performance by reviewing our past performance report.

Make It Happen

Dive into all 21 of the Undervalued SEHK Small Caps With Insider Buying we have identified here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1368 SEHK:631 and SEHK:9638.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance