Traditional Fast Food Stocks Q1 In Review: Papa John's (NASDAQ:PZZA) Vs Peers

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the traditional fast food industry, including Papa John's (NASDAQ:PZZA) and its peers.

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

The 14 traditional fast food stocks we track reported a decent Q1; on average, revenues were in line with analyst consensus estimates. Inflation progressed towards the Fed's 2% goal at the end of 2023, leading to strong stock market performance. The start of 2024 has been a bumpier ride, as the market switches between optimism and pessimism around rate cuts due to mixed inflation data, and while some of the traditional fast food stocks have fared somewhat better than others, they collectively declined, with share prices falling 3.5% on average since the previous earnings results.

Papa John's (NASDAQ:PZZA)

Founded by the eclectic John “Papa John” Schnatter, Papa John’s (NASDAQ:PZZA) is a globally recognized pizza delivery and carryout chain known for “better ingredients” and “better pizza”.

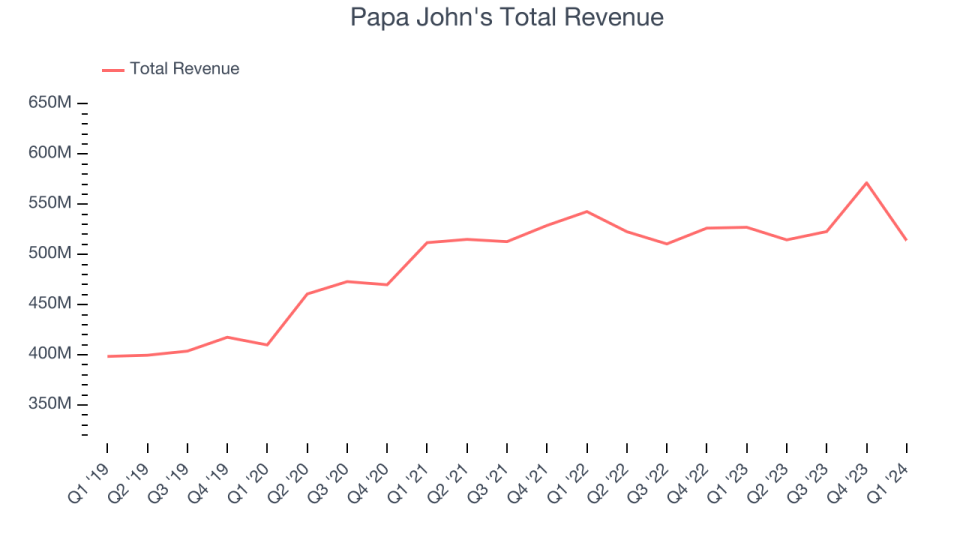

Papa John's reported revenues of $513.9 million, down 2.5% year on year, falling short of analysts' expectations by 5.4%. It was a decent quarter for the company, with an impressive beat of analysts' gross margin estimates.

“Our teams are taking a disciplined approach to running the business, improving restaurant-level margins and increasing operating profits despite a challenging environment in the first quarter,” said Ravi Thanawala, Papa Johns Interim Chief Executive Officer and Chief Financial Officer.

The stock is down 17% since the results and currently trades at $47.4.

Is now the time to buy Papa John's? Access our full analysis of the earnings results here, it's free.

Best Q1: El Pollo Loco (NASDAQ:LOCO)

With a name that translates into ‘The Crazy Chicken’, El Pollo Loco (NASDAQ:LOCO) is a fast food chain known for its citrus-marinated, fire-grilled chicken recipe that hails from the coastal town of Sinaloa, Mexico.

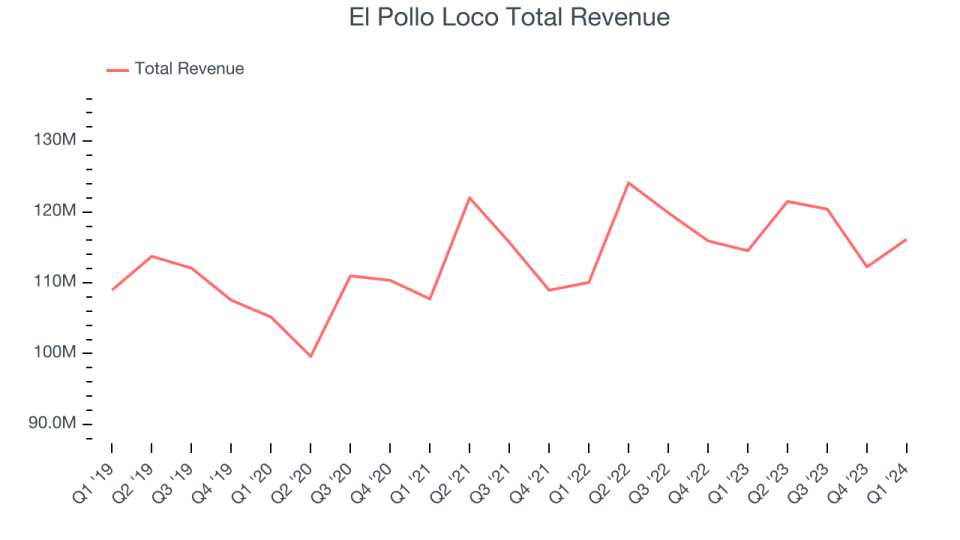

El Pollo Loco reported revenues of $116.2 million, up 1.4% year on year, outperforming analysts' expectations by 4.6%. It was an incredible quarter for the company, with an impressive beat of analysts' earnings estimates.

The stock is up 22.7% since the results and currently trades at $10.54.

Is now the time to buy El Pollo Loco? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Starbucks (NASDAQ:SBUX)

Started by three friends in Seattle’s historic Pike Place Market, Starbucks (NASDAQ:SBUX) is a globally-renowned coffeehouse chain that offers a wide selection of high-quality coffee, beverages, and food items.

Starbucks reported revenues of $8.56 billion, down 1.8% year on year, falling short of analysts' expectations by 6.5%. It was a weak quarter for the company, with a miss of analysts' gross margin and earnings estimates.

The stock is down 9.6% since the results and currently trades at $79.99.

Read our full analysis of Starbucks's results here.

Dutch Bros (NYSE:BROS)

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE:BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Dutch Bros reported revenues of $275.1 million, up 39.5% year on year, surpassing analysts' expectations by 7.6%. It was a very good quarter for the company, with an impressive beat of analysts' earnings estimates and a solid beat of analysts' gross margin estimates.

Dutch Bros pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The stock is up 38.9% since the results and currently trades at $39.5.

Read our full, actionable report on Dutch Bros here, it's free.

McDonald's (NYSE:MCD)

Arguably one of the most iconic brands in the world, McDonald’s (NYSE:MCD) is a fast-food behemoth known for its convenience, value, and wide assortment of menu items.

McDonald's reported revenues of $6.17 billion, up 4.6% year on year, in line with analysts' expectations. It was a strong quarter for the company, with an impressive beat of analysts' gross margin estimates.

The stock is down 7.1% since the results and currently trades at $254.28.

Read our full, actionable report on McDonald's here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance