Treasuries Rally as Cool Inflation Boosts Bets on Three Fed Cuts

(Bloomberg) -- Treasury yields tumbled after benign inflation data renewed confidence that the Federal Reserve will cut interest rates at least twice this year.

Most Read from Bloomberg

Biden Vows to Stay in 2024 Race Even as NATO Gaffes Risk His Campaign

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Most rates slid to their lowest since March, with those on two-year debt — more sensitive than longer maturities to changes in the Fed’s policy outlook — sinking as much as 13 basis points to 4.486%. Economists at JPMorgan Chase & Co. responded by pulling forward their forecast for the start of Fed easing to September from November, and traders fully priced in a September cut for the first time in months.

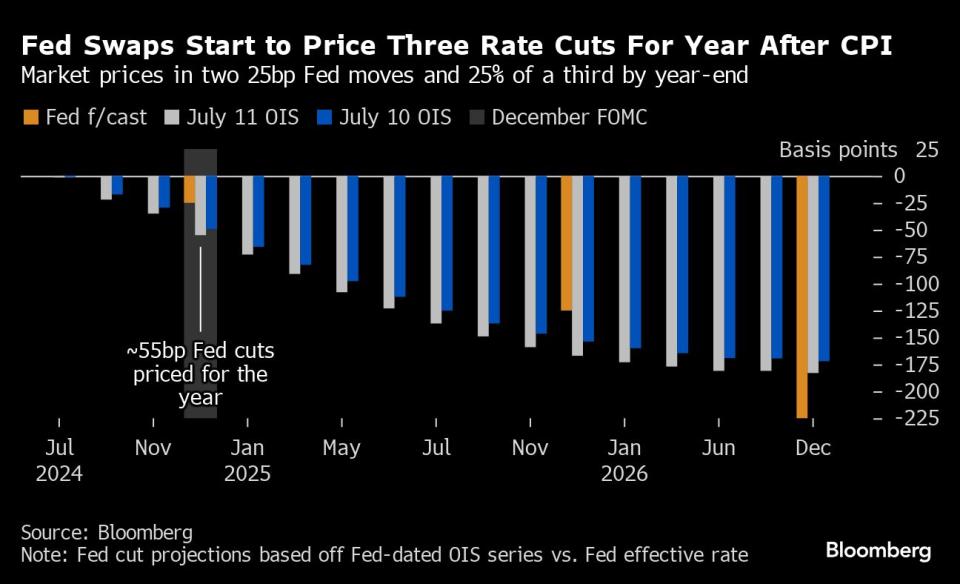

The odds of a September rate cut jumped from around 70% before the data. For all of 2024, the contracts imply 60 basis points easing — at least two quarter-point moves — from about 49 basis points earlier.

“The data makes a September cut a slam dunk now,” said Andrew Brenner, head of international fixed income at NatAlliance Securities LLC. “You are going to get three cuts this year — September, November and December — and the market is starting to price that.”

The 10-year Treasury yield, which peaked above 5% last year after 11 Fed rate increases and has since retreated to around 4.20%, can return to 4%, last seen in February, Brenner said.

Options Bet

Ahead of the data, interest-rate options traders had been ramping up positions that would benefit from the market pricing in three Fed rate cuts this year. On Wednesday, one such structure was bought in large size for about $2 million in premium.

Thursday’s flows after the data included a large block trade in October federal funds futures that stands to gain from the market pricing in closer to a half-point rate cut in September or a quarter-point cut at policymakers’ next decision on July 31.

Extending the bond rally may require further evidence of a weakening economy, especially labor-market conditions. Weekly jobless claims data also released Thursday showed an unexpected improvement that countered signs of weakness in June employment statistics released last week.

This week, Fed Chair Jerome Powell indicated the central bank is prepared to cut rates if the unemployment rate increases from its current level of 4.1%. The Fed has a dual mandate of seeking full employment and price stability in the US economy.

“I’m looking at both numbers under the Fed’s dual mandate to see what this rate cut cycle is going to look like,” said Kevin Flanagan, head of fixed income strategy at WisdomTree. “And what it’s telling me is that you get a move in September, maybe December, and then we revisit 2025 until the labor market numbers tell me something different.”

The rally lowered the yield investors received in Thursday’s auction, at 1 p.m. New York time, of 30-year Treasury bonds and that dimmed demand for the sale. The bonds were sold at 4.405%, above an indicated pre-auction level of 4.383%. The 30-year yield has fallen from a peak of about 4.54% since the sale was announced last week.

Auctions of three- and 10-year notes over the past two days were awarded at lower-than-anticipated yields, a sign of strong investor demand.

June consumer price index data showed a decline in overall prices — the first in years — and a smaller-than-anticipated increase for the core index that strips out food and energy prices, seeming to give the Fed some of the additional favorable data on inflation it’s been seeking.

“The preconditions for starting the cuts in September and messaging a sequence of cuts going forward are now in place,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investment. “Everything is coming up aces for the Fed at the moment.”

--With assistance from Edward Bolingbroke, Michael Mackenzie and Mark Tannenbaum.

(Adds 30-year auction result and updates yield levels)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

He’s Starting an Olympics Rival Where the Athletes Are on Steroids

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance