TreeHouse Foods' (THS) Strategic Efforts Aid Amid Challenges

TreeHouse Foods, Inc. THS has been on track with its transformation journey, with its primary focus being strengthening its position in the snacking and beverage spaces. Additionally, the company remains committed to implementing the TreeHouse Management Operating System (“TMOS”) and other supply-chain initiatives aimed at enhancing execution, margin performance and enriching ties with customers.

These efforts seem relevant amid supply-chain concerns and inflated costs. While TreeHouse Foods’ second-half 2024 results are expected to improve sequentially, management’s view for the second quarter suggests a decline from the year-ago period. Let’s delve deeper.

Favorable Prospects

TreeHouse Foods is focused on enhancing the supply chain and ensuring exceptional service delivery, ultimately driving organic growth and creating sustained value for all shareholders. Execution against its 2024 plans has been strong, with several key wins achieved across categories like cookies, refrigerated dough, pickles and pretzels, among others. These aspects signal promising growth in the second half of the year.

Additionally, the company expects volume contributions from recent acquisitions in the coffee and pretzel sectors in the first half of the year, along with the annual volume from the Bick's pickle business acquired in January 2024. THS’ top-line performance is on an upward trajectory, reflecting a positive outlook bolstered by new sales opportunities that are anticipated to contribute to volume growth in the second half of the year. The company has also undertaken significant strides in restarting the broth facility, positioning it well to meet its objectives in this business segment during the latter part of the year.

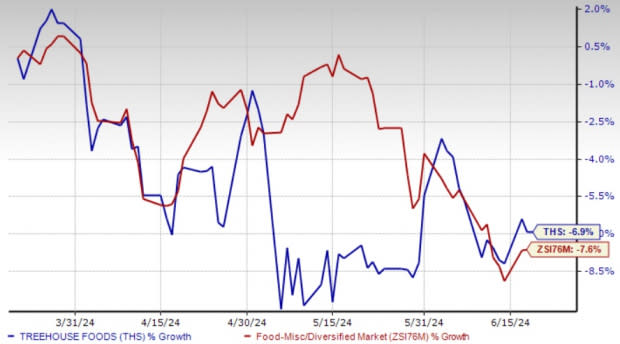

Image Source: Zacks Investment Research

Moving on, THS’ key priorities include TMOS, procurement and improvements in the distribution network. The ongoing advancements in these supply chain initiatives are expected to bolster margins in the years ahead.

It is worth noting that in the first quarter of 2024, the company's TMOS initiatives led to improved overall equipment effectiveness and better service levels. TreeHouse Foods expects to realize benefits from its efforts to enhance procurement, logistics and distribution. It expects gross cost savings of nearly $50 million in the latter half of the year and anticipates margin expansion in the second half of 2024.

Near-Term Headwinds

TreeHouse Foods has been battling supply-chain headwinds for a while now. In the second quarter of 2024, operations and supply-chain-related challenges served as a headwind of $8 million, mainly due to increased labor costs and the broth facility restart effect. The restart of the broth facility also affected the company’s volumes, which hurt sales.

Supply-chain hurdles associated with the broth facility also affected the gross margin. Considering the company's commodity basket and the trends observed so far this year, certain input costs have remained inflationary. The company expects modest overall inflation across its basket for the full year. It is also undertaking pricing actions in areas experiencing higher inflation, such as cocoa. Shares of THS have fallen 6.9% in the past three months compared with the industry’s decline of 7.6%.

Wrapping Up

For the second quarter of 2024, TreeHouse Foods anticipates net sales to range between $770 million and $800 million, implying a roughly 2% decline at the midpoint but showing improvement compared to the first quarter. Adjusted EBITDA for the second quarter is projected between $55 million and $65 million compared with adjusted EBITDA from continuing operations of $76.4 million recorded in the second quarter of 2023.

That said, management expects sales and adjusted EBITDA for 2024 to be more skewed toward the second half. For 2024, the Zacks Rank #3 (Hold) company expects net sales in the band of $3.43-$3.5 billion, which indicates growth of nearly flat to 2% from the 2023 level. For 2024, adjusted EBITDA from continuing operations is likely to be in the band of $360-$390 million in 2024 compared with the $365.9 million reported in 2023.

3 Appetizing Bets

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently sports a Zacks Rank #1 (Strong Buy). VITL has a trailing four-quarter average earnings surprise of 102.1%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Vital Farms’ current financial-year sales and earnings indicates growth of 22.5% and 59.3%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ, which manufactures a diverse range of salty snacks, currently carries a Zacks Rank #2 (Buy). UTZ has a trailing four-quarter earnings surprise of 2%, on average.

The consensus estimate for Utz Brands’ current financial-year earnings indicates growth of 26.3% from the year-ago reported numbers.

Ingredion Incorporated INGR, which manufactures and sells sweeteners, starches, nutrition ingredients, and biomaterial solutions, currently carries a Zacks Rank of 2. The Zacks Consensus Estimate for INGR’s current fiscal-year earnings indicates growth of 3.6% from the year-ago reported figure.

Ingredion Incorporated has a trailing three-quarter earnings surprise of 10.1%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance