TruFin's (LON:TRU) Wonderful 355% Share Price Increase Shows How Capitalism Can Build Wealth

Active investing isn't easy, but for those that do it, the aim is to find the best companies to buy, and to profit handsomely. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. In the case of TruFin plc (LON:TRU), the share price is up an incredible 355% in the last year alone. Also pleasing for shareholders was the 58% gain in the last three months. In contrast, the longer term returns are negative, since the share price is 65% lower than it was three years ago.

Check out our latest analysis for TruFin

TruFin wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, TruFin's revenue grew by 44%. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 355% in the last year. We're always cautious when the share price is up so much, but there's certainly enough revenue growth to justify taking a closer look at TruFin.

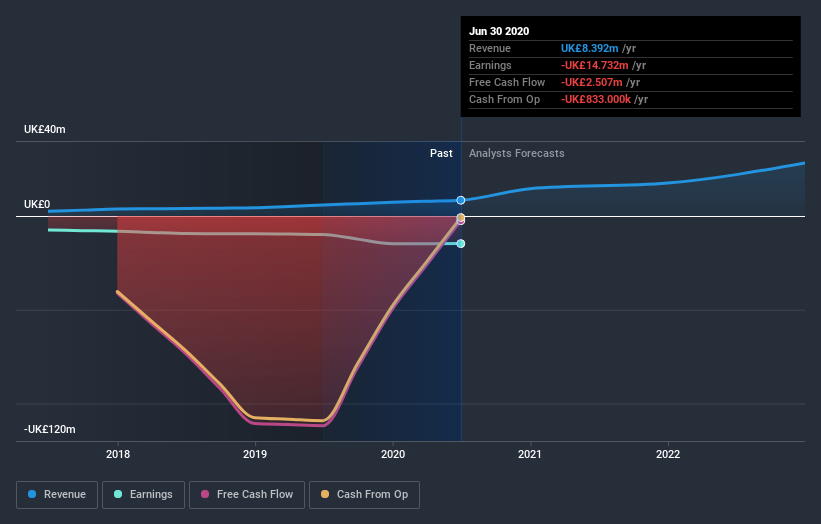

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on TruFin's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that TruFin shareholders have gained 355% (in total) over the last year. What is absolutely clear is that is far preferable to the dismal 8% average annual loss suffered over the last three years. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. It's always interesting to track share price performance over the longer term. But to understand TruFin better, we need to consider many other factors. Take risks, for example - TruFin has 4 warning signs (and 1 which is concerning) we think you should know about.

We will like TruFin better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance