TSX Dividend Stocks To Watch In July 2024

As the first half of 2024 concludes, Canadian markets have shown resilience with solid gains, particularly benefiting from sectors like utilities and gold while maintaining lower volatility. This backdrop sets an intriguing stage for investors focusing on TSX dividend stocks, which may offer a blend of stability and potential income in the evolving economic landscape. In light of current market conditions, a good dividend stock typically features robust fundamentals and a history of reliable dividend payouts, qualities that are especially appealing in an environment marked by positive economic indicators and favorable market trends.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.78% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.29% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.45% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.48% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.30% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.90% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.51% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.31% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.23% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.08% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

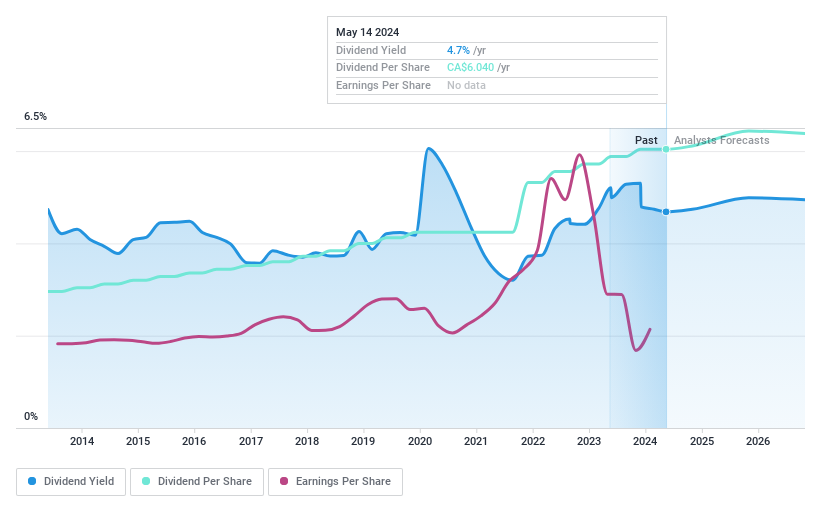

Bank of Montreal

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal offers a range of financial services mainly in North America, with a market capitalization of approximately CA$83.74 billion.

Operations: Bank of Montreal generates revenue through several key segments: BMO Capital Markets with CA$6.38 billion, BMO Wealth Management at CA$7.68 billion, U.S. Personal and Commercial Banking bringing in CA$9.04 billion, and Canadian Personal and Commercial Banking which contributes CA$10.14 billion.

Dividend Yield: 5.4%

Bank of Montreal has a current dividend payout ratio of 71.6%, indicating dividends are covered by earnings, with a forecast to maintain coverage in three years at 52.8%. Despite a low dividend yield of 5.4% compared to the Canadian market's top quartile at 6.62%, the bank has demonstrated stable and increasing dividends over the past decade, suggesting reliability in its distributions to shareholders. However, it maintains a low allowance for bad loans at 76%, which could pose risks if defaults rise unexpectedly.

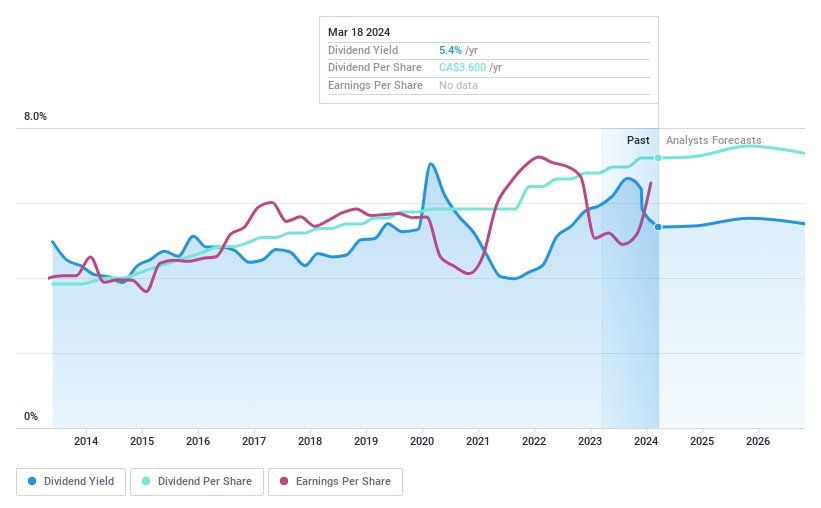

Canadian Imperial Bank of Commerce

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce (TSX:CM) is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients across Canada, the United States, and other international locations, with a market capitalization of CA$61.34 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue through its Canadian Personal and Business Banking (CA$8.53 billion), Capital Markets and Financial Services (CA$5.66 billion), U.S. Commercial Banking and Wealth Management (CA$1.75 billion), and Canadian Commercial Banking and Wealth Management segments (CA$5.37 billion).

Dividend Yield: 5.5%

Canadian Imperial Bank of Commerce offers a dividend yield of 5.53%, which is below the top quartile for Canadian dividend stocks at 6.62%. Despite this, the bank has shown consistent dividend payments with a stable and increasing pattern over the past decade. It trades at 47.9% below its estimated fair value and dividends are well covered by earnings, with a current payout ratio of 53.9% and forecasted coverage in three years at 49.9%. Recent activities include multiple fixed-income offerings, enhancing its financial flexibility, although shareholder dilution occurred over the past year.

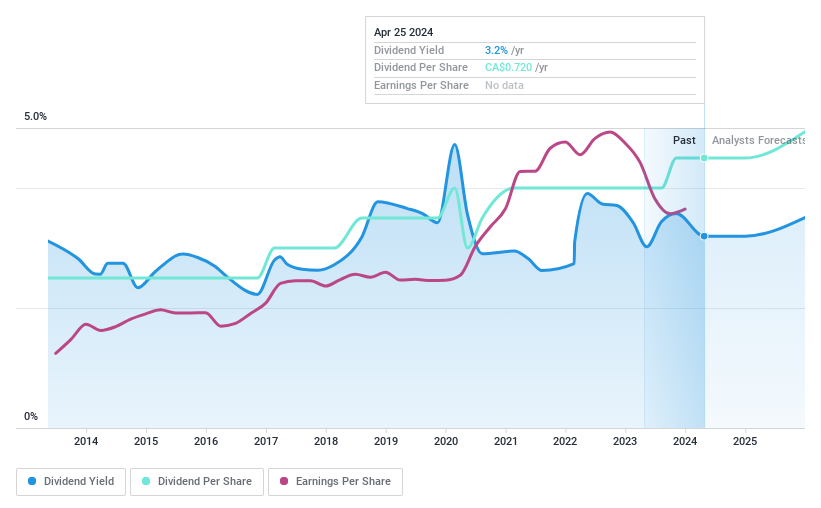

Leon's Furniture

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Leon's Furniture Limited, a Canadian retailer specializing in home furnishings, mattresses, appliances, and electronics, has a market capitalization of approximately CA$1.56 billion.

Operations: Leon's Furniture Limited generates CA$2.50 billion from the sale of home furnishings, mattresses, appliances, and electronics.

Dividend Yield: 3.1%

Leon's Furniture Limited, with a dividend of CA$0.18 per share, exhibits a low dividend yield of 3.15% relative to the Canadian market's top quartile at 6.62%. Despite this, dividends are well-supported by earnings and cash flows with payout ratios of 31.9% and 25.1%, respectively. However, the company has faced volatility in its dividend payments over the past decade, indicating some instability. Recent financial performance shows improvement with Q1 sales rising to CA$562.25 million from CA$513.01 million year-over-year and net income increasing to CA$18.82 million from CA$12.92 million.

Turning Ideas Into Actions

Reveal the 33 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:BMO TSX:CM and TSX:LNF.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance