TSX Dividend Stocks To Watch In June 2024

In the past week, the Canadian market has experienced a 2.1% decline, yet it maintains a robust annual growth of 9.1%, with earnings expected to increase by 15% annually. In this dynamic environment, dividend stocks that demonstrate consistent payouts and potential for earnings growth are particularly compelling to watch.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.72% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.32% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.53% | ★★★★★☆ |

Boston Pizza Royalties Income Fund (TSX:BPF.UN) | 8.46% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.42% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.01% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.56% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.45% | ★★★★★☆ |

Canadian Western Bank (TSX:CWB) | 3.32% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.22% | ★★★★★☆ |

Click here to see the full list of 32 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

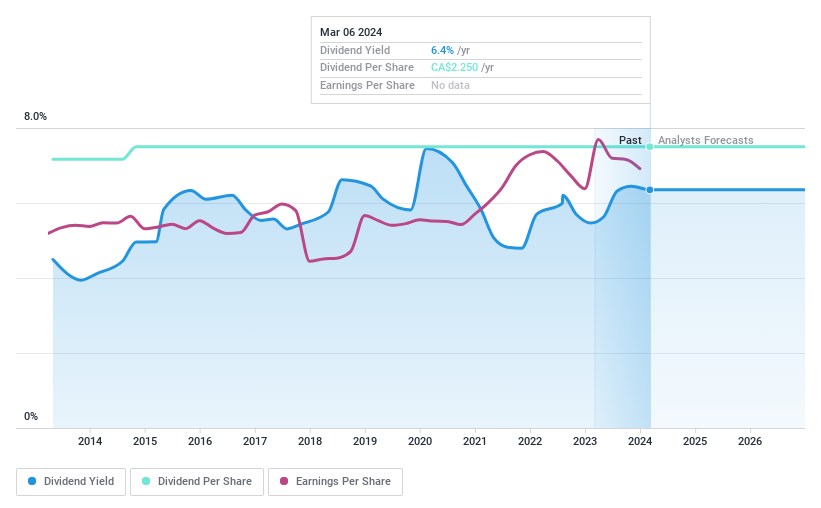

IGM Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. is a Canadian wealth and asset management company with a market capitalization of approximately CA$8.66 billion.

Operations: IGM Financial Inc. generates its revenue primarily through two segments: Asset Management, which brought in CA$1.19 billion, and Wealth Management, contributing CA$2.26 billion.

Dividend Yield: 6.2%

IGM Financial has maintained stable dividend payments over the past decade, currently offering a 6.16% yield, slightly below the top quartile of Canadian dividend stocks. Despite a recent drop in quarterly revenue to CA$811.67 million and net income to CA$223.39 million, dividends are well-covered with a payout ratio of 69.5% and cash payout ratio of 75%. The company is also trading at a significant discount—41.7% below estimated fair value—potentially indicating good value for investors focused on dividends.

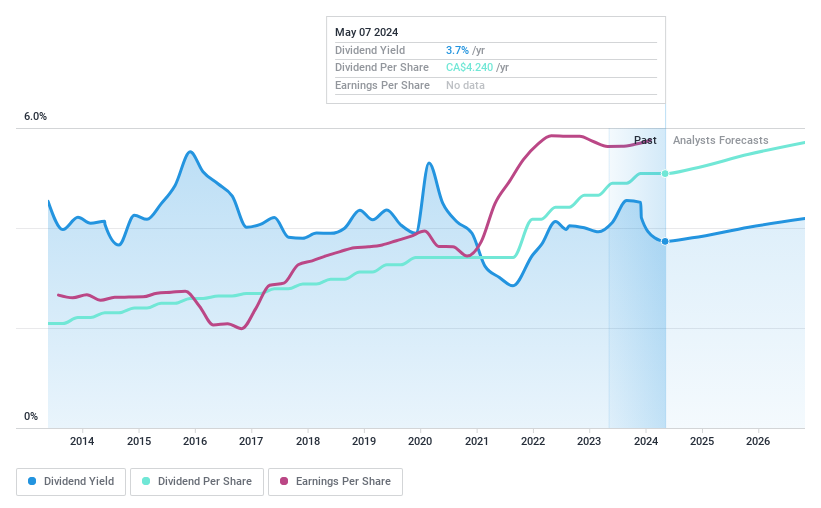

National Bank of Canada

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers a range of financial services to individuals, businesses, institutional clients, and governments both in Canada and globally, with a market capitalization of approximately CA$36.38 billion.

Operations: National Bank of Canada generates its revenue through three primary segments: Wealth Management (CA$2.61 billion), Personal and Commercial Banking (CA$4.33 billion), and Financial Markets (CA$2.76 billion), along with contributions from U.S. Specialty Finance and International operations (CA$1.16 billion).

Dividend Yield: 4.1%

National Bank of Canada offers a steady dividend yield of 4.11%, though it's below the top quartile in its market. Dividends are well-supported with a low payout ratio of 42.5% and consistent growth over the past decade, suggesting reliability. The bank's recent financial performance shows robust earnings growth, up 5.2% year-over-year, with dividends forecast to remain covered by earnings for the next three years. However, it trades at a significant discount (43.6%) relative to its estimated fair value, which could signal undervaluation or investor caution regarding future prospects.

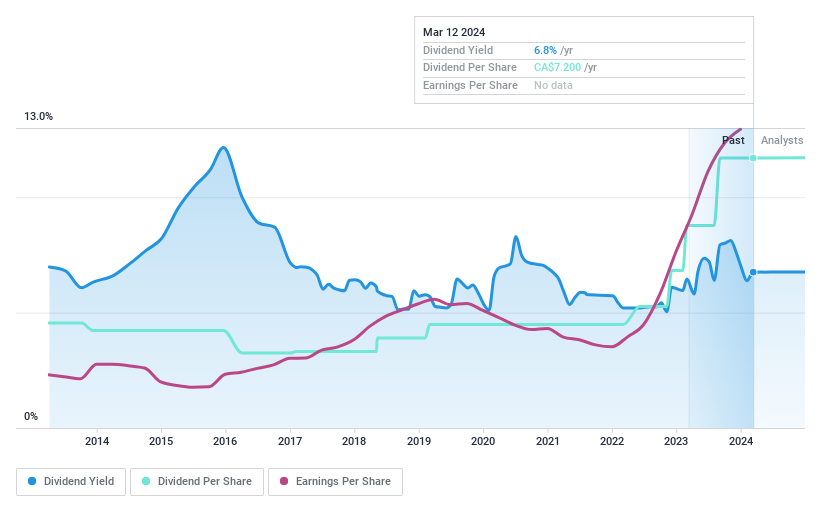

Olympia Financial Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc. specializes in trust services in Canada through its subsidiary, Olympia Trust Company, with a market capitalization of approximately CA$237.02 million.

Operations: Olympia Financial Group Inc. generates revenue through several segments, including Health (CA$10.04 million), Corporate (CA$0.18 million), Exempt Edge (CA$1.37 million), Investment Account Services (CA$78.05 million), Currency and Global Payments (CA$8.63 million), and Corporate and Shareholder Services (CA$3.78 million).

Dividend Yield: 7.3%

Olympia Financial Group maintains a dividend yield of 7.31%, ranking in the top 25% of Canadian dividend payers. Despite a high payout ratio of 63.4% and cash payout ratio of 76%, dividends are covered by both earnings and cash flows, indicating sustainability from current operations. However, the company's dividend history shows volatility with inconsistent growth over the past decade, and earnings are expected to decline by an average of 10% annually over the next three years. Recent affirmations confirm ongoing monthly dividends at CAD$0.60 per share, supporting short-term predictability despite longer-term concerns about earning trends and dividend stability.

Seize The Opportunity

Unlock more gems! Our Top TSX Dividend Stocks screener has unearthed 29 more companies for you to explore.Click here to unveil our expertly curated list of 32 Top TSX Dividend Stocks.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:IGM TSX:NA and TSX:OLY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance