TSX Growth Companies With High Insider Ownership For June 2024

As recent economic indicators suggest a moderating pace of inflation and a cautious approach to interest rate adjustments in Canada, the market environment is becoming increasingly conducive for investors to consider growth companies. High insider ownership in such companies often signals strong confidence in the business’s future, making them potentially attractive investments under the current economic conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

Vox Royalty (TSX:VOXR) | 12.4% | 58.7% |

goeasy (TSX:GSY) | 21.5% | 15.8% |

Payfare (TSX:PAY) | 15% | 46.7% |

Propel Holdings (TSX:PRL) | 40% | 36.4% |

Allied Gold (TSX:AAUC) | 22.5% | 68.2% |

Aritzia (TSX:ATZ) | 19% | 51.2% |

Aya Gold & Silver (TSX:AYA) | 10.2% | 51.6% |

Silver X Mining (TSXV:AGX) | 14.2% | 144.2% |

Ivanhoe Mines (TSX:IVN) | 13% | 65.5% |

Almonty Industries (TSX:AII) | 12.3% | 105% |

Below we spotlight a couple of our favorites from our exclusive screener.

Aritzia

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aritzia Inc. is a Canadian fashion retailer specializing in women's apparel and accessories, primarily operating in the United States and Canada, with a market capitalization of CA$4.40 billion.

Operations: The company generates CA$2.33 billion in revenue from its apparel and accessories segment.

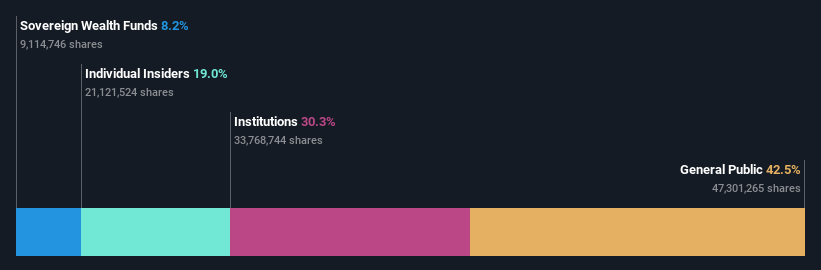

Insider Ownership: 19%

Revenue Growth Forecast: 11% p.a.

Aritzia's financial performance shows mixed signals for growth-oriented investors with high insider ownership. While trading at a significant discount to its estimated fair value, the company has experienced a substantial drop in net income from CAD 187.59 million to CAD 78.78 million year-over-year, alongside decreased profit margins from 8.5% to 3.4%. However, Aritzia forecasts robust annual earnings growth of over 50% and expects revenue increases between 10% to 14%, adjusted for fiscal variations, signaling potential recovery and expansion ahead.

Get an in-depth perspective on Aritzia's performance by reading our analyst estimates report here.

Upon reviewing our latest valuation report, Aritzia's share price might be too pessimistic.

Ivanhoe Mines

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ivanhoe Mines Ltd. specializes in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$22.53 billion.

Operations: The company primarily generates its revenue from the exploration and development of mineral and precious metal resources in Africa.

Insider Ownership: 13%

Revenue Growth Forecast: 83.3% p.a.

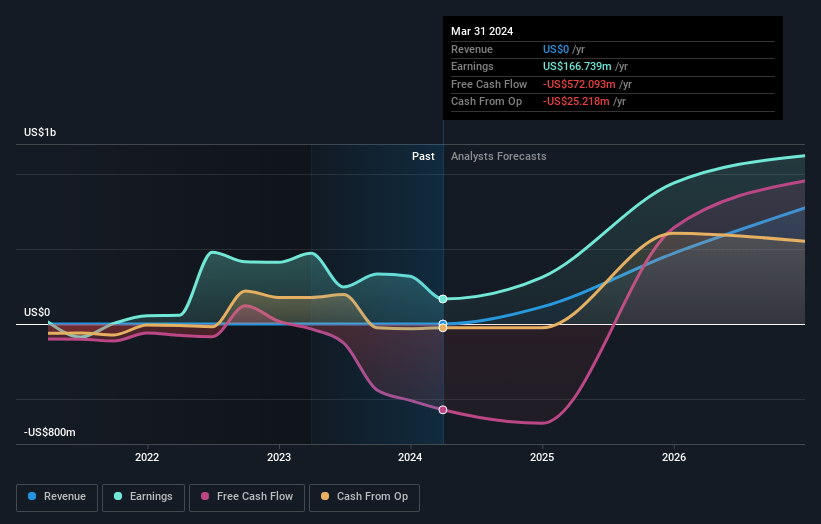

Ivanhoe Mines, a growth-oriented company with significant insider transactions, recently announced the early and on-budget completion of its Phase 3 concentrator at the Kamoa-Kakula Copper Complex. This expansion is set to significantly boost copper production, positioning the mine among the world's largest copper complexes. Despite a recent quarterly net loss of US$65.55 million, Ivanhoe forecasts substantial earnings growth and continues to pursue strategic acquisitions and expansions, demonstrating robust potential for revenue acceleration.

Click to explore a detailed breakdown of our findings in Ivanhoe Mines' earnings growth report.

The valuation report we've compiled suggests that Ivanhoe Mines' current price could be inflated.

Artemis Gold

Simply Wall St Growth Rating: ★★★★★☆

Overview: Artemis Gold Inc. is a gold development company engaged in the identification, acquisition, and development of gold properties, with a market capitalization of approximately CA$2.01 billion.

Operations: The company primarily engages in the development of gold properties.

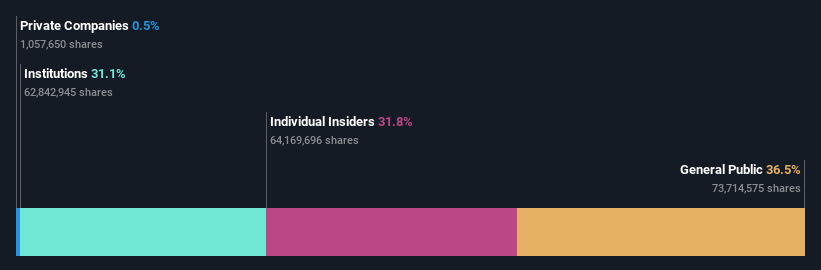

Insider Ownership: 31.8%

Revenue Growth Forecast: 52.6% p.a.

Artemis Gold, a Canadian growth company, is expected to see its revenue increase by 52.6% annually, outpacing the broader market significantly. Despite making less than US$1m in revenue and experiencing shareholder dilution over the past year, insider activity has been balanced with more shares purchased than sold recently. The company is trading well below estimated fair value and anticipates profitability within three years amidst ongoing high earnings growth forecasts. Recent developments include steady progress at their Blackwater Mine project, maintaining full funding and adherence to budget timelines for a pivotal first gold pour scheduled in late 2024.

Turning Ideas Into Actions

Embark on your investment journey to our 29 Fast Growing TSX Companies With High Insider Ownership selection here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSX:ATZ TSX:IVN and TSXV:ARTG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance