Is a Turnaround Ahead for Walgreens?

Walgreens Boots Allicance Inc. (NASDAQ:WBA) recently completed a leadership transition with a new CEO. One of his first acts was to cut the dividend by 48%. Thus, the company, which has paid increasing dividends for 47 years, is no longer a "Dividend Aristocrat."

New leader

The new CEO of Walgreens is Tim Wentworth. He brings nearly three decades of health care leadership experience to the company, having recently served as the CEO of Evernorth, Cigna's (NYSE:CI) health services platform, and previously as the CEO of Express Scripts (ESRX), the largest pharmacy benefit manager in the United States. Before that, he held positions at Mary Kay, PepsiCo (NASDAQ:PEP) and RCA Records.

Wentworth's appointment is part of Walgreens' efforts to position itself more of a health care company than a retailer and lead its next phase of growth into a customer-centric health care organization. He officially assumed the role on Oct. 23, 2023.

Walgreens has been through a tumultuous decade as the company struggles to find its footing in a changed market. Over the past 10 years, the advent of e-commerce, online and mail-order pharmacies and the increasing power of pharmacy benefit managers has shifted the power balance in the pharmaceutical ecosystem against retailers such as Walgreens. Its stock has steadily lost its value; it is now almost 75% below its high.

Earnings update

In his remarks during his first earnings call on Jan. 4, Wentworth addressed analysts, highlighting the challenging retail environment and economic pressures faced by Walgreens. Despite the difficulties, the first-quarter results showed resilience, with adjusted earnings of 66 cents per share. The U.S. Retail Pharmacy demonstrated cost discipline, while the International segment, notably Boots UK, performed well. The U.S. health care segment, VillageMD, showed progress in cost realignment and achieved growth in full-risk lives.

He said that to navigate economic challenges, the company is taking swift actions, including workforce reduction, cost-saving measures and a 48% reduction in the quarterly dividend. Strategic actions, such as monetizing investments and evaluating the portfolio, aim to strengthen the long-term balance sheet. The CEO expressed confidence in building on the company's health care services, emphasizing the unique advantage of their physical presence and an engaged workforce. Acknowledging the industry's headwinds, Wentworth outlined ongoing initiatives, including the expansion of services like clinical trials, shields and specialty pharmacy, anticipating Food and Drug Administration-approved gene and cell therapies. The company is also engaging in discussions with payers for more comprehensive reimbursement models that recognize the value provided by pharmacies beyond dispensing.Emphasizing the need for innovative thinking in both health care and the company's future, he conveyed a commitment to exploring all options to enhance shareholder value. While maintaining the identity of Walgreens as a premier neighborhood retail pharmacy, the focus is on redefining the role to support payers, providers and pharma in achieving their goals. The CEO expressed optimism about building on the company's pharmacy strength and trusted brand. With a strong team is in place to drive execution, the company is open to changes to position itself effectively. He said the leadership team is eager to engage with customers, teammates and shareholders to listen, learn and swiftly create sustainable value.During the call, Interim Chief Financial Officer Manmohan Mahajan summarized the company's performance for the quarter. He said first-quarter results were in line with expectations as sales increased 8.7% on a constant currency basis, driven by growth in U.S. Retail Pharmacy (6.4%), International (4.4%) and U.S. Healthcare pro forma (12%).

Adjusted earnings per share, however, declined 44% on a constant currency basis, primarily due to lower U.S. retail sales and a higher adjusted effective tax rate. The U.S. Retail Pharmacy segment experienced a 6.4% sales increase, but a 37.2% decline in adjusted operating income due to lower retail sales volume and margin. The U.S. Pharmacy unit reported a 13.1% increase in comp sales, driven by brand inflation and higher contributions from pharmacy services. The International segment exceeded expectations with a 4.4% sales increase, led by Boots UK. The U.S. Healthcare segment showed improvement with sales increasing 95%, driven by the acquisition of Summit Health and growth across all businesses. Adjusted Ebitda also increased, reflecting progress in VillageMD and profit growth from other businesses.

As a result, Mahajan said the company maintains its fiscal 2024 adjusted earnings per share guidance, expecting tailwinds from pharmacy services and improved tax rates, but faces headwinds from consumer spending pullback, reduced sale and leaseback gains and slightly lower market volume growth for prescriptions. The U.S. Healthcare segment is expected to achieve breakeven adjusted Ebitda at the midpoint of the guidance range, representing a significant improvement over the previous fiscal year. The second quarter is anticipated to be impacted by lower contributions from sale and leaseback activity, consumer spending pressures and higher retail shrink, partially offset by a lower tax rate. The company anticipates improving earnings in the second half of the year, driven by ongoing cost reduction efforts, scaling profitability in the U.S. Healthcare segment, modest retail market growth and a lower tax rate.

AnalystfForecast

The average stock forecast for Walgreens Boots Alliance in the next 12 months is $28.09. This price target corresponds to an upside of 15.78%. The range of stock forecasts for Walgreens is $20.20 to $47.25. Based on the ratings of 24 analysts, the consensus recommendation for Walgreens is hold.

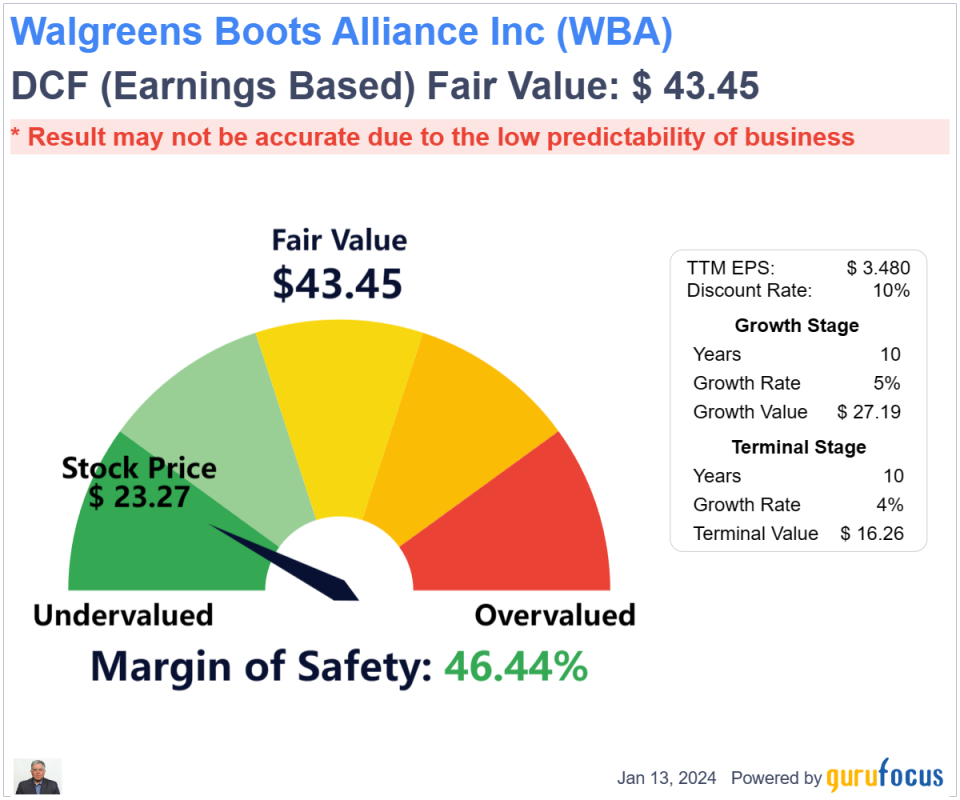

Analysts are only predicting minimal earnings per share growth in the next three years, thus a forward price-earnings ratio of around 7 seems appropriate for now. The GuruFocus discounted cash flow calculator with standard inputs shows the stock is undervalued. However, Walgreens in recent years has shown very low predictability, so this valuation should be taken with a dose of skepticism.

Commentary

The recent quarter was decent with all three segments delivering good performance. A new CEO has taken charge and the dividend has been "right sized." This was both expected and accepted by the market as a fait accompli given the drop is the value of the stock. The company continued its transition towards scaling up health care by closing the acquisition of urgent care provider Summit Health. Walgreens is the second-largest pharmacy operator in the U.S. (after CVS (NYSE:CVS)) with about 8,800 locations and thus enjoys a good network effect and reach to the U.S. population. Its main long-term strategic challenge is to build up its U.S. Healthcare Services primary care clinic business and seek synergies of the same with its extensive retail pharmacy operation, while fending off competition from mail-order pharmacies and resisting the squeezing of gross margins by increasingly powerful PBMs (who themselves are controlled by health maintenance organizations.) The local clinics would be co-located with physical pharmacies or near them, offering consumers convenience. At the core of this strategy is the launch of Walgreens Health, a technology-enabled model designed to offer personalized health care to consumers. This model will be available in various settings, including in-store, at home, in doctors' offices and through mobile apps.

The aim is to work with payers and providers to enhance consumer experiences, improve health outcomes at reduced costs while delivering profitable revenues to Walgreens. The company has acquired VillageMD and CareCentrix to bolster its capabilities in primary and post-acute care and now Summit Health. These investments will particularly benefit high-risk patients with chronic conditions, which are high-cost areas for HMOs and where Walgreens think it can add value.

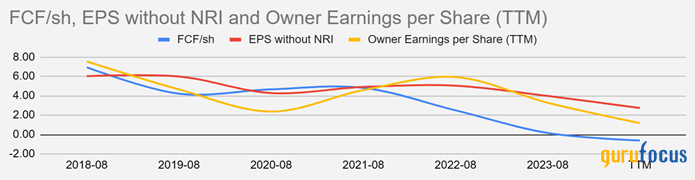

With his extensive background working with PBMs and HMOs, Wentworth should be able to guide the company to deliver better value from a HMO perspective, who are now the company's biggest customers. Walgreens needs to deliver demonstrated superior benefits to its customers and health care consumers via its physical pharmacy locations and clinics versus lower-cost mail-order pharmacies. This would help it get back in favor with HMOs as a preferred service provider with a broad offering.While recent revenue growth looks healthy, profitability has been suffering with net earnings, owner earnings and free cash flow per share trending down.

Profit margins have also been heading downward for many years, showing the business model is in trouble. The biggest immediate problem area is the "front shop" of the pharmacies where sales and profits have been declining. While Walgreens offers it customers convenience of picking up prescriptions and shopping in the same location, high inflation and prices has made the front store uncompeitive as compared to other merchants like Walmart (NYSE:WMT) and Kroger (NYSE:KR). Thus, consumers view Walgreens with disfavor despite the convenience it offers.

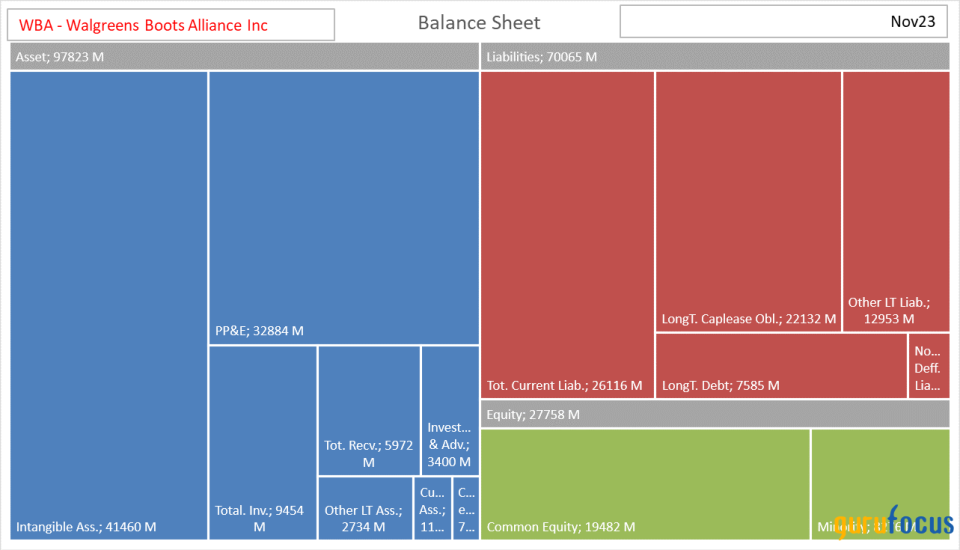

Walgreens' balance sheet is quite leveraged with total debt in the $33.5 billion range, though debt has been somewhat reduced in recent years. The chart below illustrates Walgreens recent balance sheet. As you can see, most of the debt is current liabilities, which is part of working capital. Long-term debt is reasonable at about $7.6 billion.

Walgreens owns a 15% equity stake in drug distributor Cencora (NYSE:COR), formerly AmerisourceBergen. The company sources branded and generic pharmaceutical products from Cencora.

The company had also settled its opioid legal liability, taking a $3.2 billion charge to its income in 2022.

Conclusion

Warren Buffett (Trades, Portfolio) has been known to avoid investing in retail businesses because of their high competition and low profit margins. According to the late Charlie Munger (Trades, Portfolio), Buffett's business partner, the retail industry has evolved and matured, making it more difficult to achieve high returns on investment. However, retail businesses with large brick and mortar operations, like Costco (NASDAQ:COST), Walmart, Best Buy (NYSE:BBY) and Home Depot (NYSE:HD) continue to thrive. Therefore, the question remains whether Walgreens will be able to find its groove and thrive or go the way of once great retail names like Sears, K-Mart and J.C. Penney, who could not evolve.Walgreens' stock is currently depressed, trading in significantly undervalued territory. The new CEO and his leadership team have their work cut out for them. The company's first priority should be to restore profitability to its operations. I think this is doable in spite of intense competition as the fundamentals of the company are quite healthy and it has a huge distribution network. The company, due to its size, has enormous operating leverage and network effect. It also has the secular trend of aging demographics working in its favor. It is a signficant player in the U.S. health care sector, which is about 18% of the U.S. gross domestic product. Some early "green shoots" are starting to appear, with the company posting growing Ebit per share numbers for two quarters in a row after a string of negative numbers. Let us see if this trend is sustained.

If the company can get back to the level of operating profits it had even five years ago, the stock can double from here. In fact, the stock was much more than that, at around $71, five years ago. However, investors need to see clear evidence of progress from the company to feel confident and get behind the stock. To me, recovery in operating margins is a key metric to watch. Walgreens is very much a "show me the money first" stock. Thus, I rate it as a hold for now.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance