TV presenter Adrian Chiles faces £1.7m tax bill after losing appeal

TV presenter Adrian Chiles is facing a £1.7m bill after losing an appeal with HM revenue & Customs over his tax status at ITV and the BBC.

Mr Chiles, who is married to Guardian editor Katharine Viner, has been locked in a 10-year legal battle with the tax authority over whether he should have been classed as an employee or freelancer during his time at the broadcaster.

Mr Chiles won the case in February 2022. However HMRC then appealed the decision to the Upper-Tier Tribunal, who ruled on 7 June 2024 that “errors of law” had informed the judgement. This means the case will now return to the First-Tier tribunal.

HMRC argues Mr Chiles was not a freelancer when working for the BBC and ITV between 2012 and 2017 and should therefore have paid tax as an “employee”, despite having worked as a contractor through his own limited company Basic Broadcasting Ltd (BBL) since 1996.

The Radio 5 Live host will owe £1.2m in income taxes and almost £500,000 in National Insurance Contributions (NICs) if he loses.

It comes amid a wider HMRC crackdown on taxpayers believed to be “disguised employees” who HMRC argues are reducing their tax bills by funnelling their income through personal service companies.

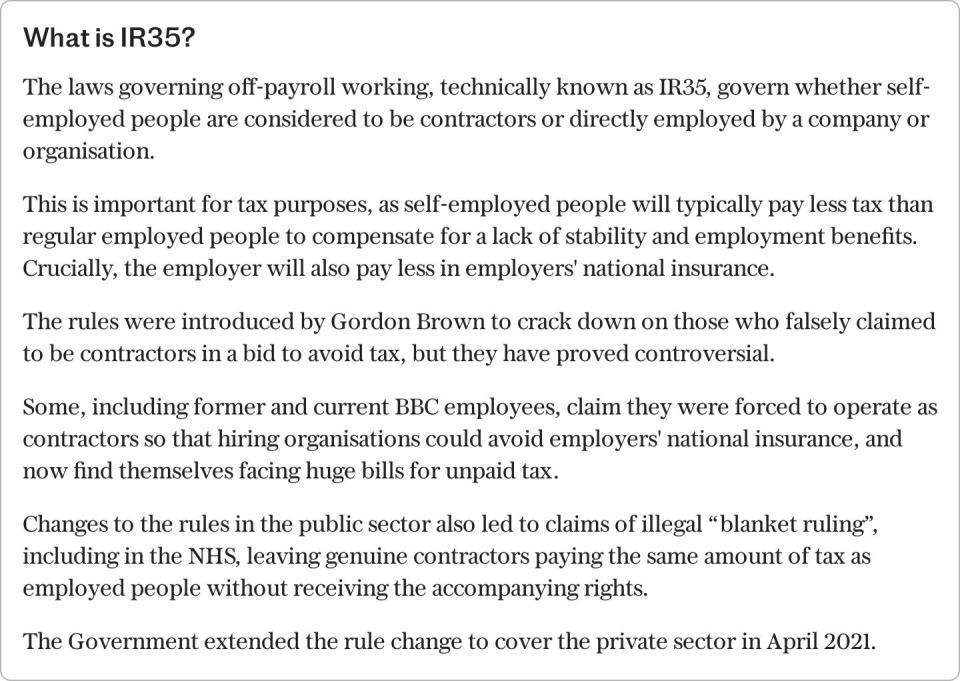

Presenters such as Kaye Adams and Gary Lineker have previously become embroiled in court battles with HMRC over disputed bills, under the same controversial “IR35” rules at the centre of Mr Chiles’ case.

The rules determine whether a worker is employed or self-employed for tax purposes. Contractors “outside” of the IR35 rules pay lower rates of National Insurance.

Mr Lineker won his tax battle with HMRC last year after he was pursued for nearly £5m under IR35 legislation.

Ms Adams, who presents ITV daytime show Loose Women, won a nine-year dispute over her earnings as a BBC presenter last year. She was chased by HMRC for £124,000 in income tax and NICs.

Ms Adams said: “I am appalled that HMRC has once again decided to twist the knife into a fellow freelancer.

“Over ten long years, Adrian has done everything and more that has been required of him by presenting the facts of his case to the tribunal system.

“Despite two rulings in my favour, HMRC took me to the Court of Appeal, apparently to ‘get clarification’ on the law, and the upshot was that I won my case again.

“How many times and how many of us have to go through this for HMRC and the tribunal system to get their heads around fair and consistent application of IR35 legislation?”

Susan Ball, of accounting firm RSM, said the employment tax rules at the centre of the case were “complex” and often “catch people out”.

She added: “The key question is whether the relationship is one that looks like an employment relationship, and if so then tax must be deducted under these rules.

“But you’re asking individuals to do this sort of thing themselves and getting it right when judges aren’t sure themselves.

“In Mr Chiles’ case, it’s been 10 years of going through several layers of the court system. But we still don’t have a definitive answer on whether tax is due or not.”

The tax office has faced heavy criticism over its treatment of taxpayers who fall foul of its complicated rules.

Dave Chaplin, of tax advisory firm IR35 Shield, said taxpayers were at a “severe disadvantage” in legal disputes with HMRC.

He added: “The power imbalance between taxpayers and HMRC in these cases is staggering.

“While Mr Chiles must bear the financial and emotional burden of this prolonged dispute, HMRC has the luxury of dipping into the public purse to fund their legal battles.

“It’s like playing a game of poker where your opponent has an unlimited supply of chips and can go all-in on every hand.

“Taxpayers are at a severe disadvantage when taking on HMRC in these cases, and the system desperately needs reform. Cases like Mr. Chiles’ serve as a stark reminder of the human cost of this broken system.”

A HMRC spokesman said: “We appreciate there’s a real person behind every case and are committed to treating all taxpayers with respect. We always seek to resolve disputes out of court and only take action to litigate where this isn’t possible.

“We carefully consider various factors when deciding whether to appeal litigation cases, including the tax we think is due under the law, whether clarification of that law would be helpful and whether we can achieve that clarification in other ways.”

Adrian Chiles was approached for comment.

Yahoo Finance

Yahoo Finance