U.S. Services PMI Returns to Expansion Path in May: 5 Picks

The Institute of Supply Management (ISM) reported that the U.S. services sector PMI (purchasing managers’ index) came in at 53.8% in May, surpassing the consensus estimate of 50.7%. Any reading above 50% indicates an expansion of services activities.

Notably, the metric for April was 49.4%, marking the first month of contraction since December 2022. The data for May was a major relief as the U.S. economy has shown signs of cooling with respect to several key economic data.

In May, the business activity index came in at 61.25 compared with 50.9% in April. The new orders index increased to 54.1% from 52.2% in the previous month. The backlog of orders index fell to 50.8% from 51.1% in April.

Anthony Nieves, Chairman of the ISM Services Business Survey Committee said, “The increase in the composite index in May is a result of notably higher business activity, faster new orders growth, slower supplier deliveries and despite the continued contraction in employment.”

Nieves also said, “Survey respondents indicated that overall business is increasing, with growth rates continuing to vary by company and industry. Employment challenges remain, primarily attributed to difficulties in backfilling positions and controlling labor expenses. The majority of respondents indicate that inflation and the current interest rates are an impediment to improving business conditions.”

Other Positives

Corporate earnings for the first quarter of 2024 continued to be solid. Total earnings of the S&P 500 companies were up 6.8% year over year on 4.3% higher revenues. Notably, in fourth-quarter 2023, total earnings of the S&P 500 companies were up 6.9% year over year on 3.9% higher revenues.

The CME FedWatch tool currently shows a 68.2% probability that the Fed will reduce the benchmark lending rate by 25 basis points. This probability was around 54% just a couple of weeks ago.

Moreover, 66% of respondents are currently anticipating 66% chances of two rate cut of 25 basis points each by the end of this year. Notably, the Fed fund rate currently remains static in the range of 5.25-5.5% since July 2023. However, this range indicates its 23-year high level.

Our Top Picks

We have selected five services-oriented stocks that have strong potential for the rest of 2024. These stocks have seen positive earnings estimate revisions in the last 60 days E.ach of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

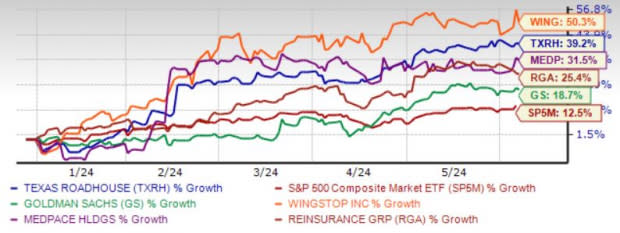

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Medpace Holdings Inc. MEDP provides clinical research-based drug and medical device development services in North America, Europe, and Asia. MEDP offers a suite of services supporting the clinical development process from Phase I to IV in various therapeutic areas. Medpace Holdings also provides clinical development services to the pharmaceutical, biotechnology, and medical device industries.

Medpace Holdings has an expected revenue and earnings growth rate of 14.9% and 27.1%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.5% over the last 30 days.

Texas Roadhouse Inc. TXRH is a full-service, casual dining restaurant chain offering assorted seasoned and aged steaks hand-cut daily on the premises and cooked to order over open gas-fired grills. TXRH operates restaurants under the Texas Roadhouse and Aspen Creek names.

TXRH offers its guests a selection of ribs, fish, seafood, chicken, pork chops, pulled pork and vegetable plates, an assortment of hamburgers, salads and sandwiches. TXRH also provides supervisory and administrative services for other licensed and franchise restaurants.

Texas Roadhouse has an expected revenue and earnings growth rate of 15.2% and 32.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1% over the last 30 days.

Wingstop Inc. WING franchises and operates restaurants. WING’s operating segment consists of the Franchise and Company segments. WING offers classic wings, boneless wings, and tenders that are cooked-to-order, and hand-sauced-and-tossed in various flavors.

Wingstop has an expected revenue and earnings growth rate of 27.5% and 36.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 13% over the last 60 days.

The Goldman Sachs Group Inc. GS intends to refocus on the core strengths of investment banking (IB) and trading businesses. Improvement in global deal-making and underwriting activities and GS’ leading position are likely to offer leverage and drive IB fees. We expect the metric to grow 8.8% in 2024. Also, the decent liquidity of GS aids sustainable capital distribution.

The Goldman Sachs Group has an expected revenue and earnings growth rate of 11.8% and 59.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 11.5% over the last 60 days.

Reinsurance Group of America Inc. RGA steadily benefits from a mix of organic and transactional opportunities. RGA’s niche position in reinsurance markets and expansion of international footprint are positives.

RGA’s individual mortality has matured and provides a base for stable earnings. Significant value embedded in in-force business should generate predictable long-term earnings. RGA is poised to benefit from improving life reinsurance pricing environment and higher investment income.

Reinsurance Group of America has an expected revenue and earnings growth rate of 7.2% and 3.9%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS) : Free Stock Analysis Report

Texas Roadhouse, Inc. (TXRH) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance