UK borrowing falls leaving Hammond wriggle room for Budget

The UK Government borrowed less than expected in August, raising expectation that it may beat its forecasts for the year and give the Chancellor space to ease austerity measures in his November Budget.

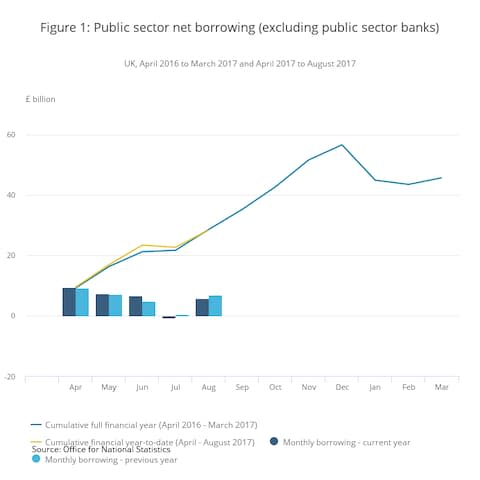

Public sector borrowing in August was £5.7bn, far better than economists' more gloomy forecast of £7.1bn.

For the financial year to date, from April to August, borrowing was £200m lower than the year before, at £28.3bn. This was the lowest amount for the five-month period since 2007.

Spending watchdog the Office for Budget Responsibility has forecast that Government borrowing will reach £58.3bn for the year ending March 2018, but these latest figures from the Office for National Statistics suggest the UK may actually spend less.

Paul Hollingsworth, UK economist at Captial Economics, said that August's figures offered the Chancellor Philip Hammond scope to "ease back on austerity a touch".

"Borrowing on the headline measure of £5.1bn was lower than last year’s outturn of £6.3bn and considerably below the consensus expectation of £7.1bn," he said.

Mr Hollingsworth warned that the unwinding of temporary factors such as self-assessment receipts - thought to have caused a surprising £200m surplus in July - are factored into the OBR's expected deterioration in public sector finances.

"Nonetheless, if the trend in the public finances seen so far this fiscal year continues, then borrowing would undershoot the OBR’s forecast by £13bn. As a result, some easing back on austerity, to help households struggling in the face of the squeeze on real incomes, looks likely," he said.

Samuel Tombs, chief UK economist at Pantheon Economics, argued that the better than expected August borrowing level "reflects punitive austerity, not a rebounding economy".

Mr Tombs also warned against assuming the trend in cumulative borrowing will continue as the year progresses, arguing that the bumper batch of self assessment tax receipts was a one-off that had distorted overall borrowing.

However he acknowledged that the headline figure could come in at about £50bn, well below the OBR's £58.3bn March forecast.

"We doubt, however, that the Chancellor will ease the fiscal consolidation significantly in the Budget on November 22. In addition, the Chancellor likely will retain scope to ease the fiscal consolidation in the event of a damaging hard Brexit, rather than ease policy now," Mr Tombs added.

The Prime Minister Theresa May has already given ground on the public sector pay cap, agreeing to raise it for police officers and prison staff. But this concession is relatively minor, as these roles constitute only a small part of the state workforce. Expanding this to other public workers would be far more costly.

For the financial year to the end of March 2017, the deficit was £52bn, or 2.6pc of GDP.

Mr Hammond has not set a hard deadline for when the deficit will be wiped out.

Yahoo Finance

Yahoo Finance