UK dividends leap to a first-quarter record of £19.7bn

UK dividends jumped 15.7% to a first-quarter record of £19.7bn ($25.8bn) between the beginning of January and the end of March, according to the latest UK Dividend Monitor by Link Asset Services.

The dramatic increase in dividends — the money paid by a company to its shareholders out of profits — was mainly influenced by very large special dividends. Underlying growth was actually slightly slower than expected, the report shows.

The biggest impact came from BHP. The global mining group paid a huge £1.7bn special dividend from the proceeds of the disposal of its US shale oil interests, on top of a healthy increase in its final dividend. This made BHP the second-largest dividend payer in the first quarter of the year.

READ MORE: Top 20 FTSE 100 dividend-paying stocks

Rio Tinto will follow suit in the second quarter, distributing cash from the sale of its Australian coal assets, according to the Link report.

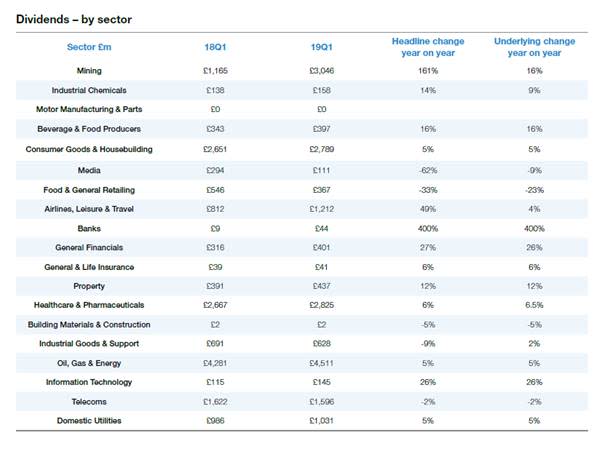

The report also shows that the two largest-paying sectors — oil and pharmaceuticals — accounted for almost two fifths of the first-quarter total. Growth in these industries was almost entirely due to positive exchange-rate effects.

With the exception of a small increase from BP, the biggest companies all held their dividends flat on a constant-currency basis. Conversely, tobacco stocks raised their payouts substantially.

Telecoms was a particularly weak sector, with BT cutting payouts and Vodafone’s payouts remaining flat. Retail was also disappointing, as most companies held dividends flat, while there were notable cuts from Dixons and, unsurprisingly, Debenhams.

The monitor shows the top 100 payouts outperformed those by mid-caps — companies with a market capitalisation between $2bn (£1.5bn) and $10bn (£7.6bn) — even after special dividends and exchange rates were taken into account. This reflects a slowdown in earnings growth for companies outside the “multinational super league,” according to the Link report. After stripping out exchange rates and special dividends, top 100 payouts rose 2.6%, while mid-cap payouts fell 2.5%.

“The first quarter is usually just the warm-up act for dividends, but this year it has put in a stellar performance,” Michael Kempe, chief operating officer of Link Market Services, said.

READ MORE: 3 FTSE 100 stocks that just increased their dividends

“Miners are taking centre stage with large special dividends, but these reflect restructuring and asset sales rather than trading profits. Underlying growth from this sector is now much more normal after grabbing the headlines over the past couple of years.”

Despite share prices rebounding by around a tenth since January, the yield — the expected value of dividends divided by share prices — on UK shares has only dropped slightly from a 10-year high in January. It now stands at an “extremely attractive” 4.6% excluding special dividends, which far exceeds the yield available on other asset classes like government bonds, property, and cash.

Kempe said this “suggests equities are still extremely cheap, both in comparison to other countries and to other asset classes.”

READ MORE: Dividends in 2018 broke new records reaching nearly £100 billion

“Payouts would need to fall far more than they did even during the financial crisis to bring the UK equity yield back into line with the long-run average, and we just don’t see that happening,” he added.

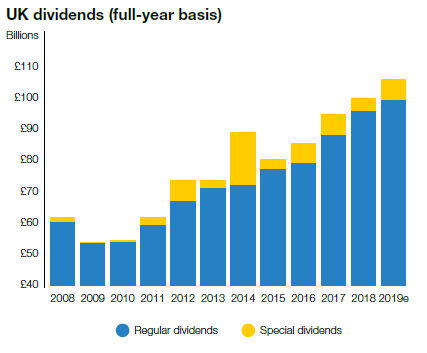

Based on the slightly weaker-than-expected start to 2019, and slower growth in company earnings, the Link report predicted underlying growth of 3.9% this year, down from 5.3% in January. That will take underlying dividends (excluding specials) to £99.7bn — a comfortable record.

The big boost from specials takes the potential headline dividends to a record £106.1bn this year, smashing through the £100bn mark for the first time, an increase of 6.3% year-on-year.

However, one big unknown for UK dividends in 2019 is the outlook for sterling. A fall in the pound due to a no-deal Brexit will increase the value of dividends from the UK’s biggest multinational firms, whereas a rise in the pound would reduce the total in sterling terms.

“Over the long-term, exchange rates are just noise, as losses one year are later compensated with gains. Investors focused on the fundamentals can see UK equities provide solid income with steady growth,” Kempe said.

“Uncertainty abounds in markets, about the world economy, and about the outlook for the UK in the light of the turmoil surrounding Brexit. For dividends, however, we are confident 2019 will show good growth, even if [the first quarter] was, in truth, a touch weaker than we expected on an underlying basis.

Yahoo Finance

Yahoo Finance