UK economy ‘must get more efficient’, says IMF

Britain must make sweeping reforms to pensions, the planning system, infrastructure, education and training, and research and development if it wants to boost economic growth in the years to come, the International Monetary Fund has warned.

Productivity and GDP growth have been relatively weak since the financial crisis, compared to historical levels and relative to other rich economies.

They will stay that way unless serious action is taken.

The IMF predicts annual GDP growth will stay at around 1.5pc in each year of its forecast, which runs to 2023, while productivity growth will grow by 1.1pc, around half its pre-crisis rate.

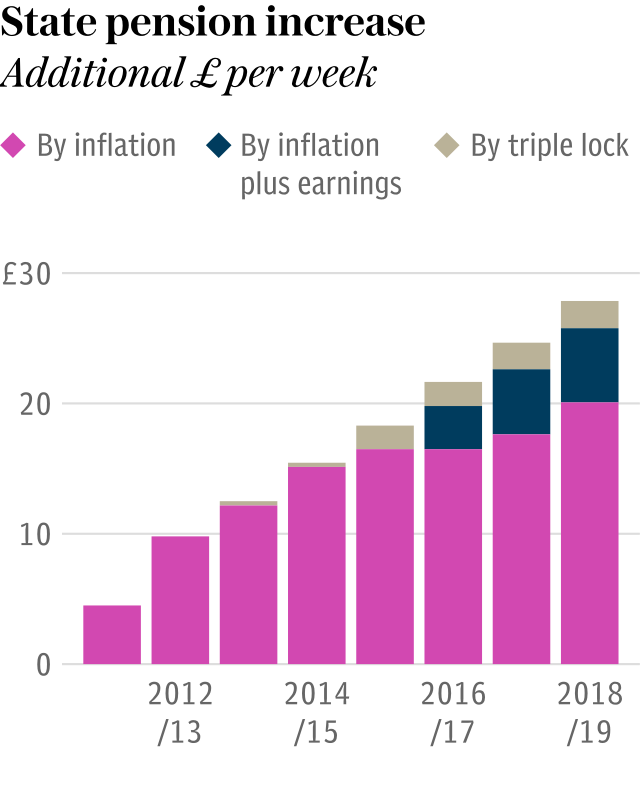

Vital but unpopular policies could include scrapping the pensions triple lock to limit the costs of an aging population.

Raising state pensions in line with prices would save as much as 0.5pc of GDP - £10bn - in a decade’s time, the IMF estimates.

However, proposals to reform the triple lock - which guarantees pensions rise in line with the highest of inflation, wages or 2.5pc - have so far been abandoned in the face of political opposition.

At the younger end of the population, the education system is also undermining the economy, the IMF said in its annual review of the country.

“UK students rank low on tests of basic numeracy and literacy despite relatively high average education spending in percent of GDP as well as per pupil,” it said.

“Low educational achievement hurts the labor market prospects of young people: unemployment rates are the lowest among those with higher education.”

The new T-levels may help close the skills shortage which blights sectors of the economy, but more also needs to be done on basic skills.

The IMF said that expensive housing and high taxes are also constricting the economy.

“Efforts should continue to boost housing supply, including by easing planning restrictions and reforming property taxes to encourage more efficient use of the housing stock,” the IMF said, indicating that lower stamp duty would enable owners to move more easily.

“Increasing supply would support near-term growth, facilitate labor mobility across regions, support financial stability by making homes more affordable, and promote social cohesion by reducing wealth inequality.”

Plans to reform the green belt have also proven tricky to put into action, however.

Greater regional prioritisation is particularly important, the IMF said, both to make sure the most relevant policies are targetted at the right areas now, and to make sure different parts of the country can react to shifts in the economy post-Brexit.

“Addressing congestion and housing restrictions are important for more successful regions; other regions should aim to increase human capital and improve transport connectivity to achieve agglomeration effect,” the review said.

The IMF said that some industries were more likely to be affected by higher trade barriers with the EU than others, which it said would result in "a reallocation of resources across sectors post-Brexit".

It said that "active labor market policies", such as training and job-search support, could help low-skilled or highly-specialized workers with the adjustment.

Yahoo Finance

Yahoo Finance