UK Exchange Highlights: 3 Growth Companies With High Insider Ownership

As the global rally cools and London markets stabilize, investors are closely monitoring shifts in the United Kingdom's economic landscape. Amid these conditions, companies with high insider ownership can be particularly noteworthy as they often indicate a strong commitment from those most familiar with the company’s potential and challenges.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.6% | 54.6% |

Petrofac (LSE:PFC) | 16.6% | 115.4% |

Spectra Systems (AIM:SPSY) | 23.3% | 26.3% |

Energean (LSE:ENOG) | 10.7% | 23.8% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 19.7% | 94.4% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 198.2% |

We'll examine a selection from our screener results.

Gulf Keystone Petroleum

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited is focused on the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market capitalization of approximately £290.43 million.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling $123.51 million.

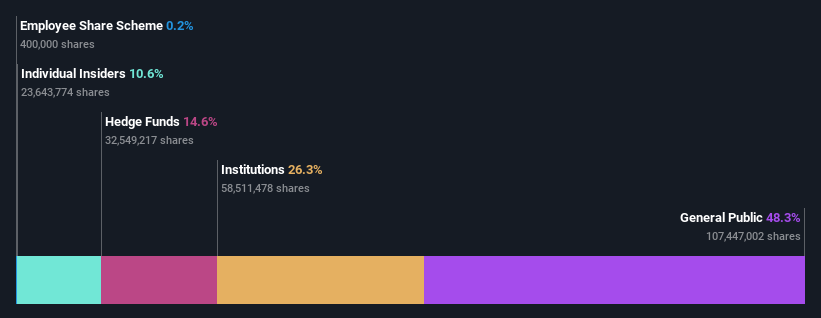

Insider Ownership: 10.6%

Earnings Growth Forecast: 54.6% p.a.

Gulf Keystone Petroleum (GKP) is trading at 70.2% below its estimated fair value, signaling potential undervaluation. Despite recent challenges, including a significant revenue drop to US$123.51 million in 2023 from US$460.11 million the previous year and shifting from a net income to a loss of US$11.5 million, GKP is forecasted to grow its revenue by 24.1% annually and become profitable within three years. The expected high return on equity of 31.8% further underscores its growth prospects amidst recovery efforts.

IWG

Simply Wall St Growth Rating: ★★★★☆☆

Overview: IWG plc operates globally, offering workspace solutions across the Americas, Europe, the Middle East, Africa, and Asia Pacific, with a market capitalization of approximately £2.08 billion.

Operations: IWG's revenue is primarily generated from its operations in the Americas (£1.05 billion), Europe, the Middle East, and Africa (£1.32 billion), with additional contributions from Asia Pacific (£273 million) and Worka (£319 million).

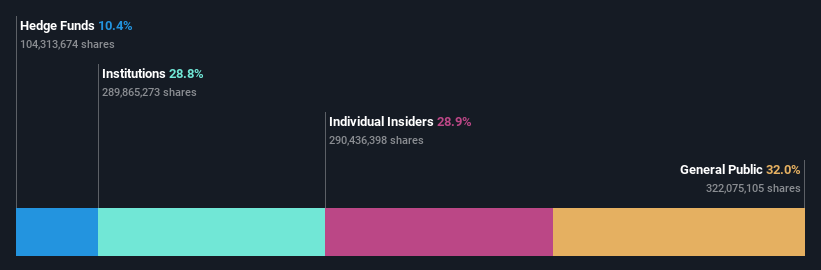

Insider Ownership: 28.9%

Earnings Growth Forecast: 101.7% p.a.

IWG is poised for significant earnings growth, with forecasts suggesting a 101.7% annual increase. Although its Return on Equity might remain modest at 11.6%, the company's revenue growth at 7.8% annually is expected to outpace the UK market average of 3.8%. Recent financials show a slight year-over-year revenue increase to US$912 million in Q1 2024, despite a challenging previous fiscal year marked by substantial losses. Trading at good value relative to peers, IWG's profitability outlook and strategic pricing position it as an attractive prospect within high insider ownership sectors in the UK.

Kainos Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc is a provider of digital technology services across the UK, Ireland, North America, Central Europe, and other international markets, with a market capitalization of approximately £1.36 billion.

Operations: The company generates revenue through three primary segments: Digital Services (£223.12 million), Workday Products (£50.49 million), and Workday Services (£114.67 million).

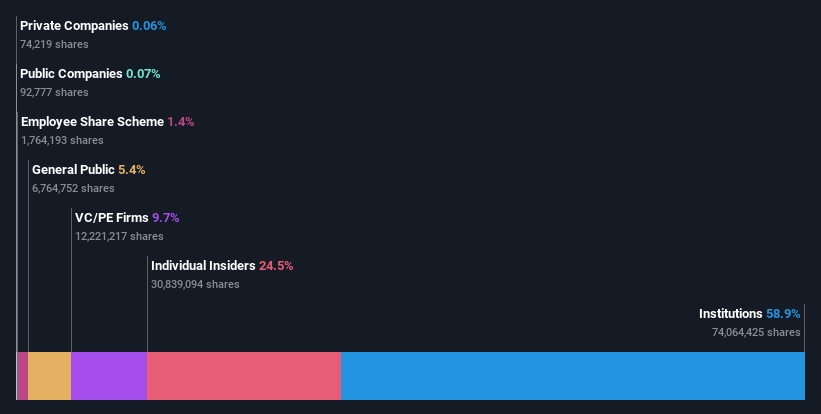

Insider Ownership: 24.5%

Earnings Growth Forecast: 16.7% p.a.

Kainos Group, trading at a 39.7% discount to its estimated fair value, showcases promising financial trends with forecasted revenue growth of 8.7% per year, outpacing the UK market's 3.8%. While its earnings growth is expected at 16.7% annually, slightly below significant levels, it still exceeds the UK market forecast of 13.3%. The company's Return on Equity is projected to reach a high of 37.2% in three years, indicating robust potential for efficiency and profitability.

Next Steps

Delve into our full catalog of 62 Fast Growing UK Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:GKP LSE:IWG and LSE:KNOS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance