UK Exchange Highlights Three Growth Companies With High Insider Ownership

The United Kingdom market has shown robust performance, rising 1.2% over the past week and achieving a 7.8% increase over the last year, with earnings expected to grow by 13% annually. In such an optimistic climate, stocks with high insider ownership can be particularly appealing as they often indicate that company leaders have a vested interest in the business's success.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Getech Group (AIM:GTC) | 17.3% | 86.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Judges Scientific (AIM:JDG) | 11.5% | 25.3% |

Afentra (AIM:AET) | 38.3% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's uncover some gems from our specialized screener.

Energean

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Energean plc is an oil and gas company focused on the exploration, development, and production of hydrocarbons, with a market capitalization of approximately £1.97 billion.

Operations: The company generates its revenue primarily from the exploration and production of oil and gas, totaling approximately $1.42 billion.

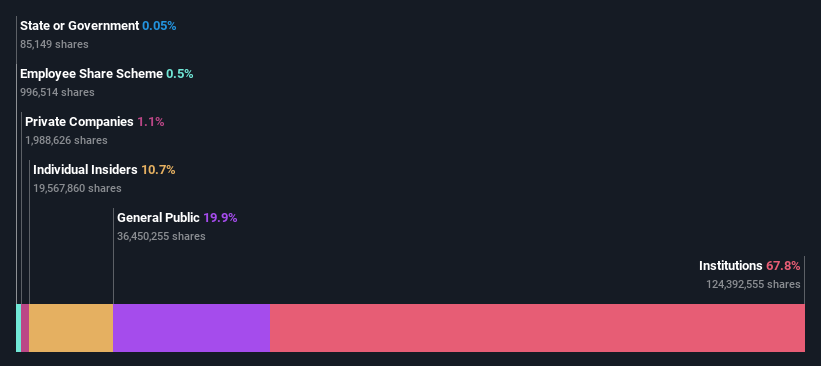

Insider Ownership: 10.7%

Earnings Growth Forecast: 19.4% p.a.

Energean, a UK-based growth company with significant insider ownership, has demonstrated robust performance with a 49% increase in production in early 2024 compared to the previous year. Despite this growth and positive earnings results, the company's dividend coverage remains weak due to insufficient earnings and cash flows. Additionally, while Energean's revenue is expected to grow faster than the UK market average at 12.4% per year, its high level of debt poses financial risks. Analysts predict potential stock price increases based on current valuations suggesting it trades below fair value.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market capitalization of approximately £950.72 million.

Operations: The company generates revenue primarily from three segments: San Jose at $242.46 million, Inmaculada at $396.64 million, and Pallancata at $54.05 million.

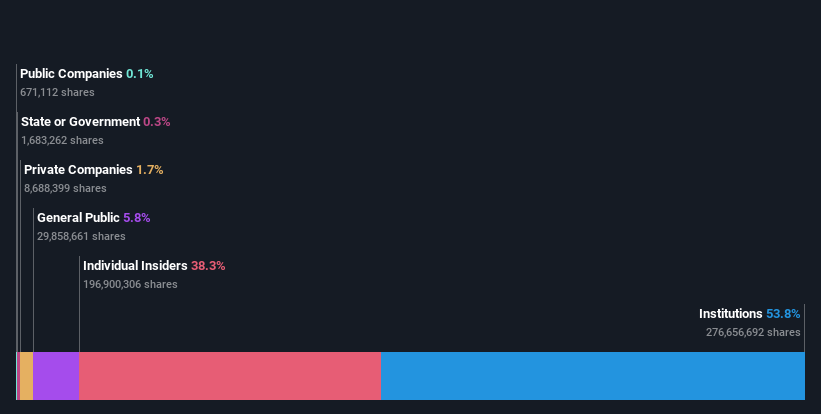

Insider Ownership: 38.4%

Earnings Growth Forecast: 59.8% p.a.

Hochschild Mining, poised for profitability within three years, is expected to see earnings grow significantly at a rate of 59.83% annually. Revenue growth is also strong, outpacing the UK market with an annual increase of 9.4%. Recent insider activities show more buying than selling, highlighting confidence from within. Despite trading at a substantial discount to its estimated fair value, the company's projected return on equity remains modest at 15.9%. Recent production guidance confirms a stable output forecast for 2024.

TBC Bank Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TBC Bank Group PLC operates as a financial entity offering banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan with a market capitalization of approximately £1.35 billion.

Operations: The company generates its revenue from banking, leasing, insurance, brokerage, and card processing services across three countries.

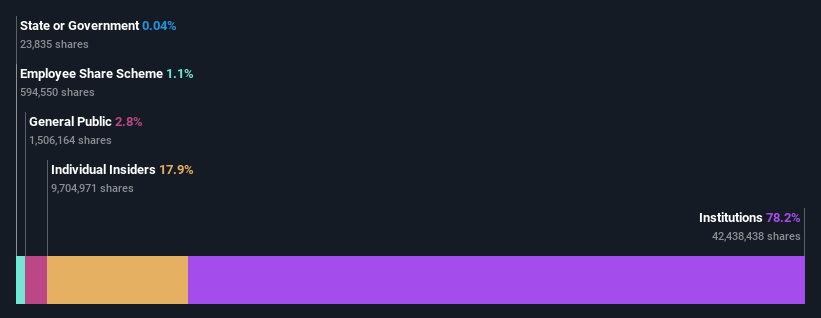

Insider Ownership: 18%

Earnings Growth Forecast: 15.2% p.a.

TBC Bank Group is trading significantly below its estimated fair value, presenting a potential opportunity. The company's earnings have grown robustly by 23.6% annually over the past five years and are expected to continue growing at 15.22% per year. Revenue growth projections also outpace the UK market average, although they fall short of very high growth thresholds. Recent strategic moves include a GEL 75 million share buyback program aimed at capital reduction and employee benefits, alongside strong quarterly earnings growth reported in May 2024. However, concerns exist around a high bad loans ratio (2.1%) with insufficient allowance coverage (74%), potentially impacting financial stability.

Next Steps

Embark on your investment journey to our 67 Fast Growing UK Companies With High Insider Ownership selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:ENOG LSE:HOC and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance