UK Growth Companies With High Insider Ownership And At Least 28% Earnings Growth

Amidst a backdrop of fluctuating global markets, with the FTSE 100 showing a continued disappointing performance, investors are keen on identifying resilient growth opportunities. High insider ownership coupled with strong earnings growth often signals robust confidence in a company's prospects, making such stocks potentially attractive in these uncertain times.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Petrofac (LSE:PFC) | 16.6% | 102.2% |

Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

Foresight Group Holdings (LSE:FSG) | 31.7% | 30.9% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 27.9% |

Plant Health Care (AIM:PHC) | 26.4% | 94.4% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

Afentra (AIM:AET) | 38.3% | 99.2% |

We'll examine a selection from our screener results.

Craneware

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Craneware plc operates in the healthcare industry, primarily in the United States, where it develops, licenses, and supports computer software; the company has a market capitalization of approximately £863.35 million.

Operations: The company generates its revenue primarily from the healthcare software segment, totaling $180.56 million.

Insider Ownership: 17%

Earnings Growth Forecast: 28.5% p.a.

Craneware, a UK-based company, exhibits strong growth potential with its earnings forecast to increase significantly by 28.5% annually, outpacing the UK market's 13.2% average. Despite slower revenue growth at 7.3% per year compared to the broader market's 3.7%, its substantial insider ownership aligns interests with shareholders, fostering robust governance and potential resilience in strategy execution. Recent activities, including dividend increases and extended buyback plans, underscore management's confidence in sustained financial health and commitment to shareholder value.

Foresight Group Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Foresight Group Holdings Limited is a company that manages infrastructure and private equity in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £556.15 million.

Operations: The company's revenue is primarily derived from its infrastructure and private equity management activities, generating £85.68 million and £39.28 million respectively, along with £11.33 million from Foresight Capital Management.

Insider Ownership: 31.7%

Earnings Growth Forecast: 30.9% p.a.

Foresight Group Holdings, a UK-based firm, is poised for robust growth with earnings expected to rise by 30.9% annually, surpassing the UK market average. Despite a dip in profit margins from 25.5% to 15.4%, the company's revenue is also set to outpace the market with a 10% annual increase. High insider ownership may bolster confidence in governance, though its dividend coverage remains weak. Analysts predict a significant stock price increase of 23.9%.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company specializing in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market capitalization of approximately £0.97 billion.

Operations: The primary revenue sources for the company include $396.64 million from Inmaculada, $242.46 million from San Jose, and $54.05 million from Pallancata.

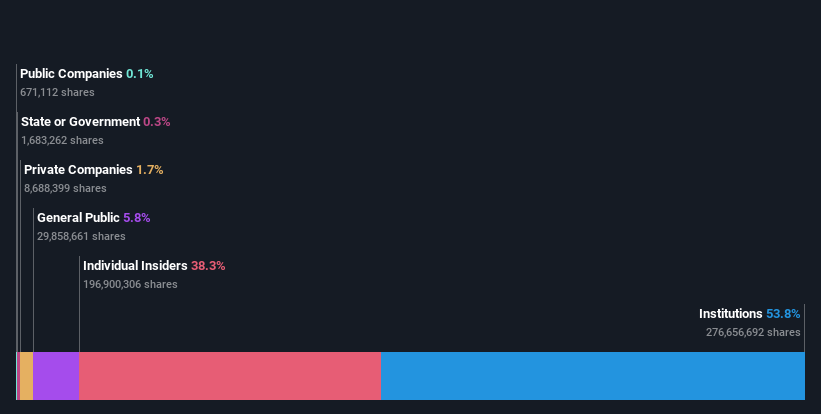

Insider Ownership: 38.4%

Earnings Growth Forecast: 58.2% p.a.

Hochschild Mining, with substantial insider buying in the past three months and no significant selling, is on a path to profitability within three years. The company's revenue growth at 8.4% per year outpaces the UK market's 3.7%, although this growth rate is below the high-growth benchmark of 20%. Recent production guidance and quarterly results show increased gold output, supporting its operational momentum amidst plans for strategic acquisitions aimed at enhancing value.

Seize The Opportunity

Reveal the 67 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:CRW LSE:FSG and LSE:HOC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance