Coronavirus: UK house prices at record high after biggest monthly leap in 16 years

UK house prices hit a new all-time high in August after the biggest monthly rise since 2004, according to new figures from Nationwide.

The average home sold for £224,123 ($299,828) in August, up 2% from £220,935 in July.

It provides the latest sign of the mini-boom in Britain’s property market in recent months, with pent-up demand after lockdown and a temporary stamp duty holiday fuelling growth in sales and prices.

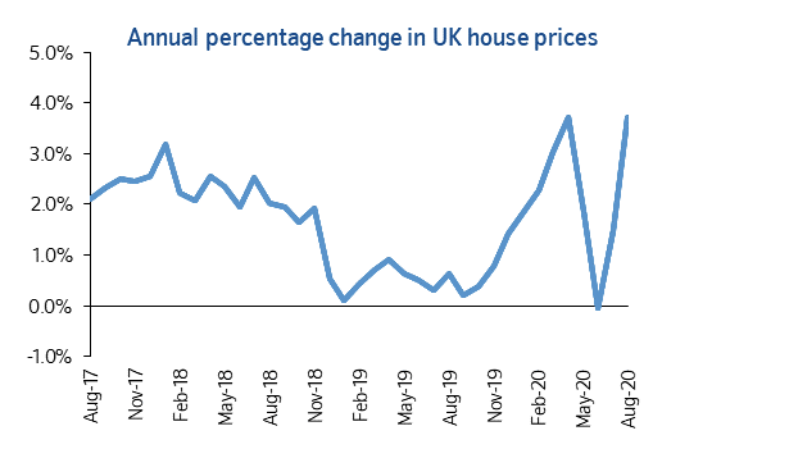

The data from the building society, one of Britain’s biggest mortgage lenders, showed a 3.7% increase year-on-year. Analysts had expected just a 0.5% rise on July, and a 2% annual increase.

The market has now erased all the losses seen in May and June. Robert Gardner, Nationwide's chief economist, said it reflected the "unexpectedly rapid" recovery in activity since lockdown curbs eased.

Gardner highlighted not only pent-up demand, but also people reasesssing their "housing needs and preferences" as a result of life under lockdown. "Social distancing does not appear to be having as much of a chilling effect as we might have feared, at least at this point," he added.

The news sent housebuilding stocks soaring, with four building firms among the top 10 biggest daily risers in morning trading on London’s FTSE 100 (^FTSE).

Barratt Developments (BDEV.L) leapt 7.7%, Taylor Wimpey y (TW.L) rose 5.9%, Persimmon (PSN.L) rose 4.8% and Berkeley (BKG.L) rose 4.3%.

It comes a day after official figures showed lending for new mortgages soared by 66.2% between June and July. Lenders approved 66,300 mortgages for residential property purchases in July, according to a comprehensive survey by the Bank of England (BoE) published on Tuesday.

READ MORE: UK mortgage approvals soar 66% as stamp duty slashed

Approvals were only 10% below February levels, and more than seven times higher than the 9,300 mortgages signed off in May in the wake of national lockdown and lenders prioritising efforts to help existing mortgage customers.

UK chancellor Rishi Sunak announced a temporary stamp duty holiday on purchases under £500,000 ($671,000) in England and Northern Ireland in early July. The threshold had previously been £125,000, albeit with higher thresholds for first-time buyers.

The finance minister said at the time the measures would “catalyse the housing market and boost confidence,” as the government battles to drag the country out of a deep recession.

Hugh Wade-Jones, managing director of brokers Enness Global Mortgages, said this week the tax cuts had “turbo-charged” the market.

Lettings have lagged behind the sales boom, but separate figures from property firm Knight Frank on Tuesday also showed viewings for lettings had hit a ten-year high in London and the Home Counties at the end of August.

READ MORE: Zoopla predicts UK house prices will hold firm throughout 2020

The company said students had driven the surge in demand, as uncertainty over starting university mid-pandemic and the recent controversial release of exam results delayed accommodation decisions.

The rebound in the residential property sector comes in spite of the dire state of the wider UK economy and a wave of job losses. Government and central bank crisis measures including low interest rates, mortgage re-payment holidays, and the furlough scheme are seen to have buttressed the market.

Gardner said the stamp duty cuts would boost "near-term" demand for purchases by bringing some transactions forward, but suggested the rebound may eventually fade.

"Most forecasters expect labour market conditions to weaken significantly in the quarters ahead as a result of the aftereffects of the pandemic and as government support schemes wind down. If this comes to pass, it would likely dampen housing activity once again in the quarters ahead.”

Yahoo Finance

Yahoo Finance