Coronavirus: UK retail rebound 'masks a crisis' as high street job losses grow

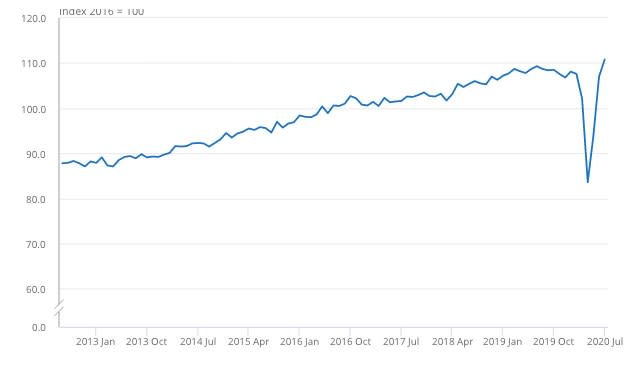

Total UK retail sales continued to rebound more strongly than expected in July, the first full month where the whole sector was allowed to re-open nationwide.

Retail leaders warned the data “masks a crisis” in parts of the industry, with town and city centre firms’ survival at stake as they struggle with lower footfall and rent bills. A wave of high street firms have announced lay-offs in recent months.

The latest figures from the Office for National Statistics (ONS) showed the volume of retail sales rose 2% between June and July, when analysts had expected a 0.2% boost. Some analysts had expected sales to go into reverse.

The quantity and value of total sales also smashed through levels seen before lockdown, with both up 4.4% on February. They were also higher than levels seen a year earlier, and up by a quarter on levels seen at the height of lockdown,

Kien Tan, senior retail adviser at PwC, said it continued an upward trend seen in June, the first full month when all non-essential shops were allowed to reopen. “Once again, consumers have shown a willingness to spend in stores, due to a combination of pent up demand and relatively resilient consumer confidence.”

The re-opening of leisure facilities at the start of July will have also boosted high street footfall, Tan added. Other analysts have highlighted the impact of good weather.

READ MORE: How COVID-19 will affect women's pensions in the long term

But business chiefs have previously warned the rebound has divided retail into “winners and losers,” and clothing retailers are among those continuing to suffer most. Many trackers of footfall in retail areas also show levels remain well below what they were pre-pandemic.

Demand has fallen significantly for clothes for work, formal and special occasions, Tan said. “While supermarkets, household goods stores and most speciality retail categories are now trading comfortably above pre-pandemic levels, fashion retailers are trading over 25% lower than before the lockdown.”

Helen Dickinson, chief executive of the British Retail Consortium (BRC), said many high streets were struggling without the normal “hustle and bustle of shoppers and workers.”

“Some retailers haven’t been able to pay their rent for the period where they were required to close for our national benefit and numbers of job losses and shop closures are rising,” she said. The BRC wants measures to protect shops from aggressive debt collection extended.

July also saw online retail stumbling, after a boom since the pandemic began with millions more households at home, many shops closed and long supermarket queues.

Online retail sales declined 7% month-on-month, with the proportion of all sales happening online falling below 30% for the first time since lockdown began. Tan said the “seismic shift” to online shopping showed few signs of reversing in the short term, however.

The revival in total sales also comes in spite of the continued economic turmoil facing the UK.

READ MORE: UK public sector debt hits £2tn for first time

Britain has seen a wave of mass job losses on high streets in recent months, and the country officially entered recession. Social distancing, uncertainty and wider economic upheaval continue to hammer firms in many sectors.

Tan said rising unemployment and the looming end of the UK government’s furlough scheme called into question whether the retail rebound could last for the rest of the year.

The figures come after official stats earlier this week also showed the UK inflation rate rose to 1% in July. Year-on-year growth in prices was up from 0.6% in June.

Rising fuel prices and an increase in the cost of haircuts and private dental appointments were among the factors that drove an unexpected increase in the inflation rate.

Yahoo Finance

Yahoo Finance