UK stocks could shine in 2021 after years of underperformance

For years UK stocks have been underperforming, under-owned, and unloved.

But now, as the Brexit end game looms and a possible global COVID recovery beckons, analysts think that could be about to change.

“If people get more confident on the prospect of normalisation, if we get some more hopefully positive news on Brexit, then you should see the UK market going well,” Themis Themistocleous, UBS Wealth Management’s chief investment officer, told journalists on an outlook call on Tuesday.

Analysts at UBS, Morgan Stanley, and Citi have all recently advised clients to buy into UK equities, arguing that the market could be a surprise performer in 2021.

Morgan Stanley said in a note sent to clients on Sunday that the FTSE 100 (^FTSE) could rally by 17% next year. Citi this week told investors to consider an “aggressive” short-term bet on UK equities, Bloomberg reported. Analysts at the US bank said Britain’s stock market was likely to outperform the US over the next few months.

READ MORE: UK secures 5 million doses of Moderna’s COVID-19 vaccine

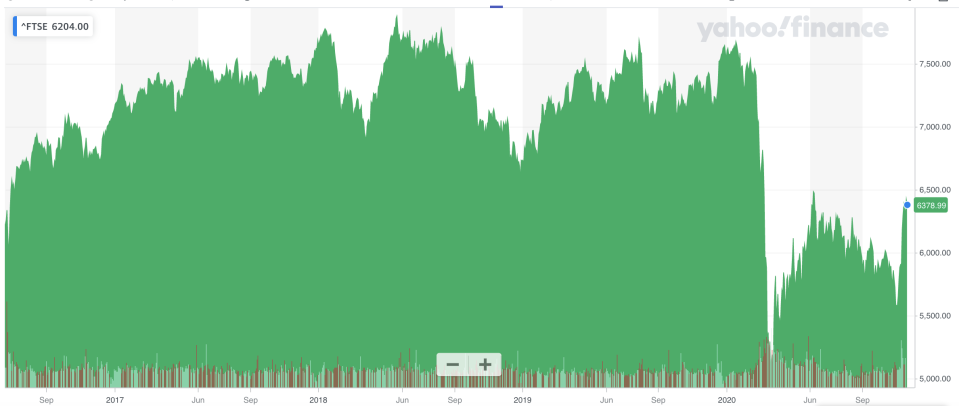

The bullish bets are notable given the poor run British equities have been on since the Brexit referendum. The FTSE 100 is more or less at the same level it was on the day of the 2016 vote. Meanwhile, the S&P 500 (^GSPC) has risen 66% over the last four years and the MSCI World (MWS=F) has rallied over 45%.

“If we look at the UK market, it is trading at about a 25% discount to global markets,” Themistocleous said. “The historical average has been about 10%, obviously for good reasons.

“If you look at the hit to the economy from COVID, it’s been more severe than some of the other countries. We had the uncertainty about Brexit. There’s been a number of things overhanging the UK economy.”

London-listed stocks have also suffered due to a comparative lack of tech on the market. Technology has been the stand out sector globally over the last decade. The FTSE 100 is dominated by oil and materials companies, financials, and domestic retail, none of which have performed well in recent years.

Moving forward, this equity imbalance may actually work in the UK’s favour. Recent positive COVID-19 vaccine news has prompted a historic global rotation away from growth stocks — like tech — towards value stocks — solid companies trading below their book value, typically in industries like banking or insurance.

The years-long underperformance of UK stocks and the proliferation of steady, mature businesses that value investors love means the FTSE 100 looks well placed to benefit from the rotation.

“UK equities look extremely cheap versus peers and are very positively correlated to global value trends,” a team of Morgan Stanley analysts wrote in a 2021 outlook note.

Watch: What is inflation and why is it important?

READ MORE: COVID-19 vaccine: BioNTech and Pfizer report 90% effectiveness in trials

This dynamic was already on show last week. The FTSE 100 had fallen 20% so far this year prior to Pfizer and BioNTech’s positive vaccine news. However, the index rallied 7% last week after the pair said their vaccine candidate had a 90% effectiveness rate. Rupert Thompson, chief investment officer at Kingswood, said the UK was a “notable outperformer” globally.

The fundamental outlook for many UK-listed businesses also looks strong. While tech businesses have benefited from the world being stuck indoors during the pandemic, a possible global recovery next year should benefit industrial companies and sectors like banking and energy that largely mirror the health of the economy.

“As we’re coming out and the economy is starting to normalise, you would expect those sectors to lead the recovery,” Themistocleous said. “If you look at earnings expectations for those sectors, they’re likely to be a lot stronger than technology or the more defensive parts of the economy. You have earnings momentum in your favour.”

Morgan Stanley believes earnings per share on the FTSE 100 could grow by 35% next year, outpacing the 30% expected from the MSCI Europe index.

“If you look at the expected dividend yield from the UK, it is still very attractive,” Themistocleous added. “The market is around 4% in an environment where it’s very, very difficult to get yield, which is another aspect I think of with the UK equity market.”

The one hiccup for share prices could be the pound. FTSE 100 companies make around 70% of their earnings overseas, meaning any rally for the pound hurts bottom lines. A positive resolution to Brexit trade talks could spark such a rally but Themistocleous thinks UK stocks are still worth a punt.

“Net-net we still think the UK can still perform well in combination of earnings recovery, more confidence, multiple expansion, and closing the gap in terms of valuation relative to the other markets,” he said.

Watch: What does a Biden presidency in the US mean for the global economy?

Yahoo Finance

Yahoo Finance