UK's Rolls-Royce says confident on 2024 forecasts

LONDON (Reuters) - Britain's Rolls-Royce said it was confident on meeting its 2024 forecasts as air travel continues to grow, demand for power for data centres picks up and the engineering group focuses on finding efficiencies and contractural improvements.

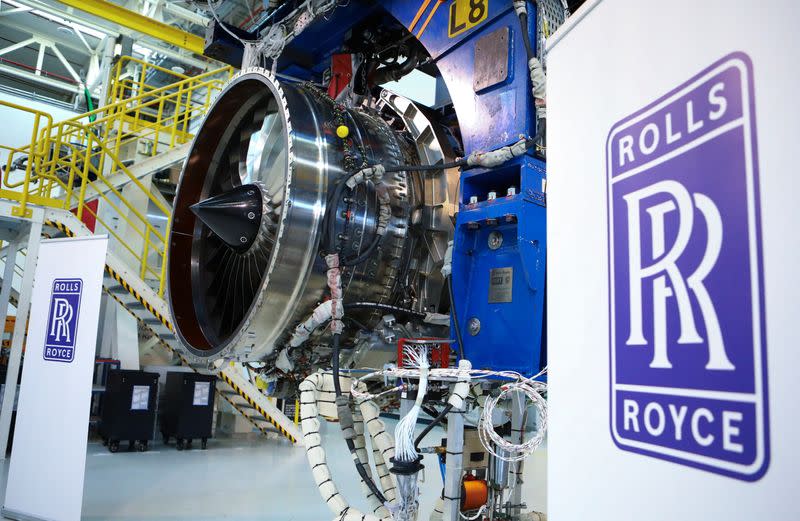

CEO Tufan Erginbilgic, the former BP executive who took over 18 months ago, has said he will transform Rolls-Royce, which makes engines for Airbus and Boeing's wide-body jets, into a more competitive company.

The group on Thursday stuck to its guidance for underlying operating profit to come in between 1.7 billion pounds and 2 billion pounds this year, up as much as 25%.

"We have had a strong start to the year, despite continued industry-wide supply chain challenges. This builds on our record performance in 2023 and provides further confidence in our guidance for 2024," Erginbilgic said in the statement.

Strengthening Rolls-Royce's balance sheet, which was battered during the pandemic when planes stopped flying, has been part of Erginbilgic's plan.

In Rolls's civil aerospace unit, its biggest, the company said flying hours, a measure of how much airlines use its engines, returned to 100% of 2019 levels in the first four months of the year and could finish the year at up to 110% of 2019 levels.

The company said it had recently been upgraded by credit rating agencies and had reduced its debt by repaying a 550 million euro bond from its cash.

(Reporting by Sarah Young; Editing by Kate Holton and Paul Sandle)

Yahoo Finance

Yahoo Finance