Uni-Trend Technology China Leads Trio Of Stocks Possibly Priced Below Estimated True Value On Chinese Exchange

Amidst a backdrop of fluctuating global markets, Chinese stocks have shown mixed responses to recent economic data, with sectors like real estate continuing to face challenges. As investors navigate this complex environment, identifying stocks that are potentially undervalued could offer opportunities for those looking for value in less obvious places.

Top 10 Undervalued Stocks Based On Cash Flows In China

Name | Current Price | Fair Value (Est) | Discount (Est) |

Xiamen Amoytop Biotech (SHSE:688278) | CN¥57.61 | CN¥110.65 | 47.9% |

Xi'an Manareco New MaterialsLtd (SHSE:688550) | CN¥24.83 | CN¥47.34 | 47.6% |

DaShenLin Pharmaceutical Group (SHSE:603233) | CN¥15.41 | CN¥30.33 | 49.2% |

ShenZhen Click TechnologyLTD (SZSE:002782) | CN¥11.14 | CN¥22.01 | 49.4% |

Zhejiang Taihua New Material Group (SHSE:603055) | CN¥10.46 | CN¥20.03 | 47.8% |

TianJin 712 Communication & Broadcasting (SHSE:603712) | CN¥19.70 | CN¥38.36 | 48.6% |

China Film (SHSE:600977) | CN¥11.05 | CN¥20.15 | 45.2% |

Shandong Weigao Orthopaedic Device (SHSE:688161) | CN¥21.21 | CN¥40.72 | 47.9% |

Quectel Wireless Solutions (SHSE:603236) | CN¥50.06 | CN¥90.62 | 44.8% |

Levima Advanced Materials (SZSE:003022) | CN¥14.39 | CN¥25.76 | 44.1% |

We'll examine a selection from our screener results

Uni-Trend Technology (China)

Overview: Uni-Trend Technology (China) Co., Ltd. is a global company that designs and manufactures test and measurement products, with a market capitalization of approximately CN¥3.94 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Estimated Discount To Fair Value: 40.4%

Uni-Trend Technology (China) is currently undervalued based on DCF, trading at CN¥35.38 against a fair value of CN¥59.39, which reflects a significant discount of 40.4%. The company's earnings are projected to increase by 24.1% annually, outpacing the Chinese market forecast of 22.5%. Despite robust profit growth and a positive outlook in earnings, its dividend coverage by cash flows remains weak. Recent financials show strong year-over-year growth with Q1 revenue rising to CN¥283.86 million from CN¥237.74 million and net income increasing to CN¥54.61 million from CN¥40.87 million last year.

Jiangsu Chuanzhiboke Education Technology

Overview: Jiangsu Chuanzhiboke Education Technology Co., Ltd. is a company that specializes in educational technology, with a market capitalization of approximately CN¥3.87 billion.

Operations: The company generates revenue primarily through training services, totaling CN¥445.44 million.

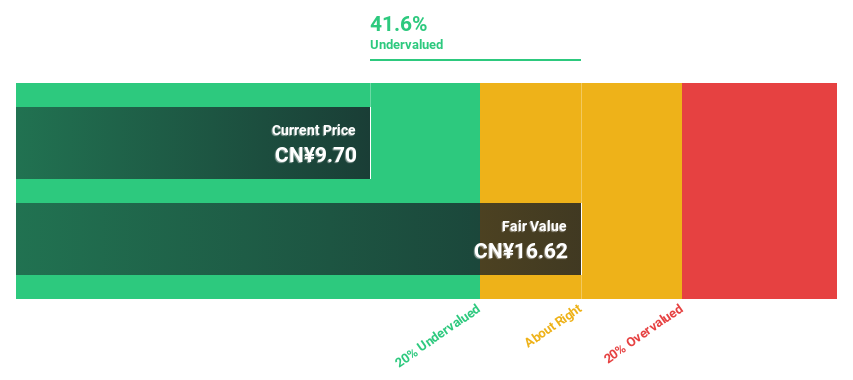

Estimated Discount To Fair Value: 41.6%

Jiangsu Chuanzhiboke Education Technology has experienced a significant downturn, with recent quarterly sales dropping to CN¥50.92 million from CN¥139.95 million year-over-year and shifting from a net profit to a loss of CN¥16.01 million. Despite this, the company is forecasted to become profitable within three years and is currently trading at 41.6% below its estimated fair value of CN¥16.62, indicating potential undervaluation based on discounted cash flows. Analysts expect an average price increase of 23.8%, suggesting recovery prospects despite slower revenue growth projections of 19.9% annually.

Chengdu Guibao Science & TechnologyLtd

Overview: Chengdu Guibao Science & Technology Co., Ltd. is a company engaged in the research, development, and manufacturing of silicone materials, with a market capitalization of approximately CN¥5.38 billion.

Operations: The revenue segments for the company are not specified in the provided text.

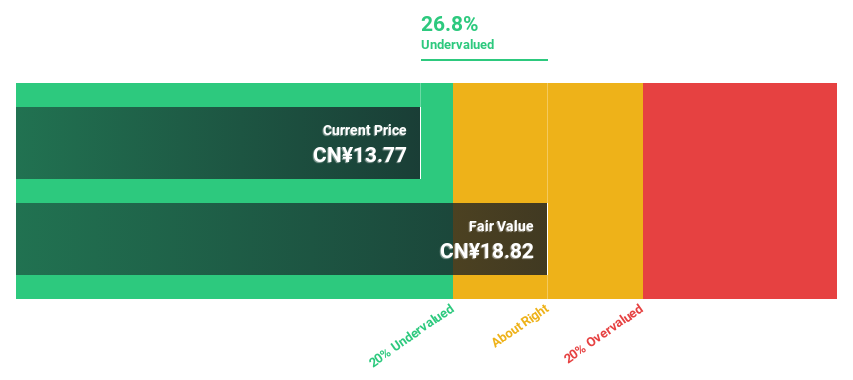

Estimated Discount To Fair Value: 26.8%

Chengdu Guibao Science & Technology Ltd., trading at CN¥13.77, is perceived as undervalued with a fair value estimate of CN¥18.82, reflecting a significant discount. The company's earnings and revenue are forecasted to grow by 26.2% and 22.8% per year respectively, outpacing the Chinese market averages of 22.5% for earnings and 13.9% for revenue growth. Despite this growth potential, its return on equity is expected to remain modest at 15.2%, and it has a history of unstable dividends, recently declaring a cash dividend of CNY3 per share with payment due on April 30, 2024 following declining quarterly profits from CNY54.99 million to CNY40.12 million year-over-year.

Where To Now?

Navigate through the entire inventory of 94 Undervalued Chinese Stocks Based On Cash Flows here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SHSE:688628 SZSE:003032 and SZSE:300019.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance