Union Square Park Capital Management's Strategic Acquisition of Reed's Inc Shares

Overview of the Recent Transaction

On September 10, 2024, Union Square Park Capital Management, LLC (Trades, Portfolio) made a significant move in the stock market by acquiring 1,230,699 shares of Reed's Inc (REED). This transaction marked a new holding for the firm, purchased at a price of $1.50 per share. The total investment impacted the firm's portfolio by 1.61%, establishing a 16.50% ownership stake in Reed's Inc.

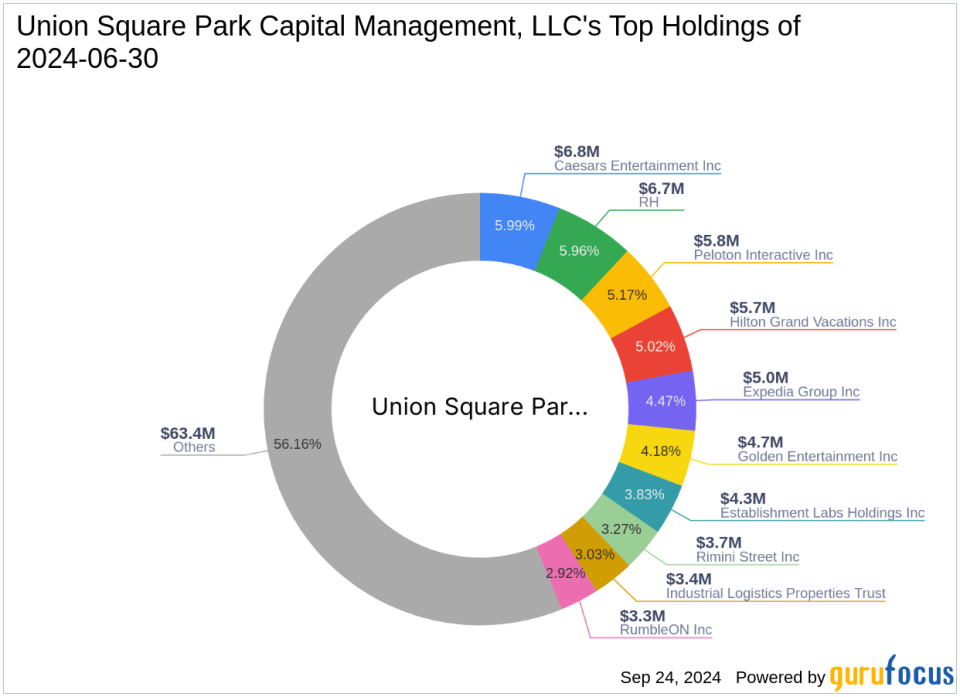

Union Square Park Capital Management, LLC (Trades, Portfolio) Profile

Located at 1251 Avenue of the Americas, New York, NY, Union Square Park Capital Management, LLC (Trades, Portfolio) is a prominent investment firm. The firm manages a diverse portfolio with a strong emphasis on sectors like Consumer Cyclical and Real Estate. With top holdings including companies like Caesars Entertainment Inc (NASDAQ:CZR) and Expedia Group Inc (NASDAQ:EXPE), the firm's investment philosophy focuses on leveraging market dynamics to optimize returns. Currently, the firm oversees assets totaling approximately $113 million across 31 stocks.

Introduction to Reed's Inc

Reed's Inc, based in the USA, operates within the Beverages - Non-Alcoholic sector. Since its IPO on December 29, 2006, the company has been known for its Ginger Beer brand and a variety of handcrafted, all-natural beverages. Despite a challenging market, Reed's continues to distribute its products across a broad network of over 45,000 outlets nationwide. As of the latest data, the company's market capitalization stands at approximately $9.917 million, with a current stock price of $1.33.

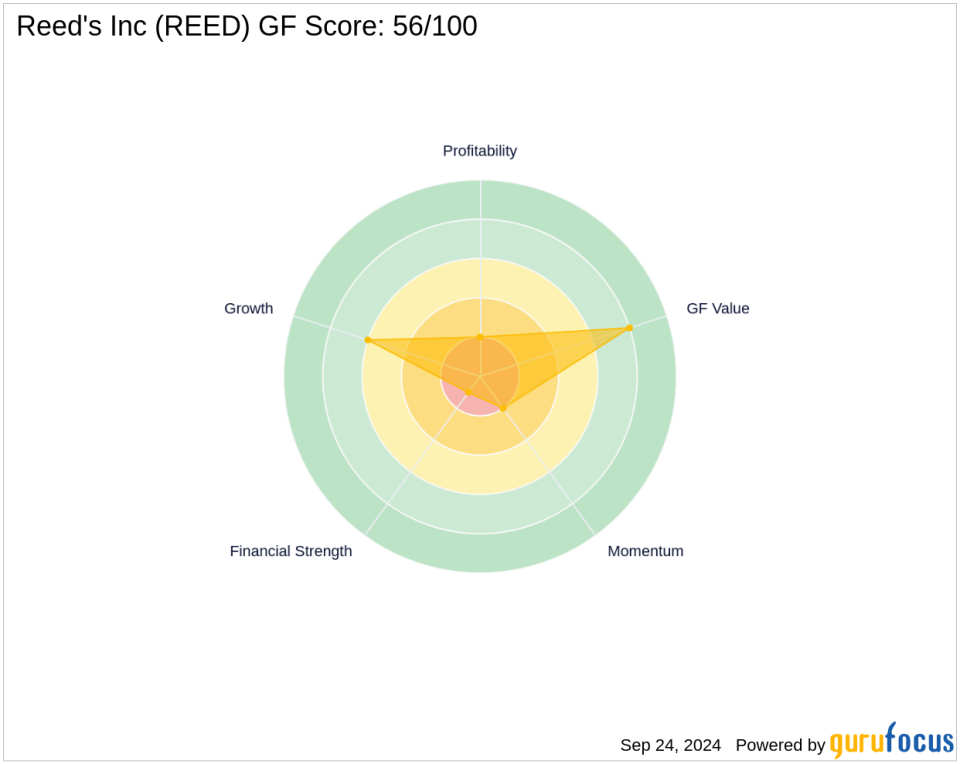

Financial Health and Market Position

Reed's Inc's financial health appears strained, with a Financial Strength ranking of 1/10 and a Profitability Rank of 2/10. The company's GF Score of 56/100 indicates poor future performance potential. Additionally, its GF Value of $1.90 suggests the stock might be a value trap, as its current price to GF Value ratio stands at 0.70.

Strategic Implications of the Trade

The decision by Union Square Park Capital Management to invest in Reed's Inc could be driven by potential turnaround prospects or undervalued stock conditions. This acquisition significantly increases the firm's influence in Reed's Inc, holding a substantial 16.50% of the company's shares. The move could signal a strategic interest in the Beverages - Non-Alcoholic sector or a specific investment thesis by the firm regarding Reed's future.

Market and Sector Overview

The Beverages - Non-Alcoholic sector has been facing various challenges, reflected in the overall performance of companies like Reed's Inc. However, this sector also presents opportunities for growth and innovation, particularly in natural and specialty beverage products that align with increasing consumer health consciousness.

Investment Risks and Opportunities

Investing in Reed's Inc carries potential risks, notably its designation as a possible value trap and its low rankings in profitability and financial health. However, opportunities may arise from market trends favoring healthier beverage options and Reed's established brand presence in the natural beverage market.

Conclusion

Union Square Park Capital Management's recent acquisition of Reed's Inc shares is a notable development, reflecting a strategic investment decision that could influence both the firm's portfolio and the broader market dynamics within the Beverages - Non-Alcoholic sector. Investors and market watchers will undoubtedly keep a close eye on how this investment unfolds in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.