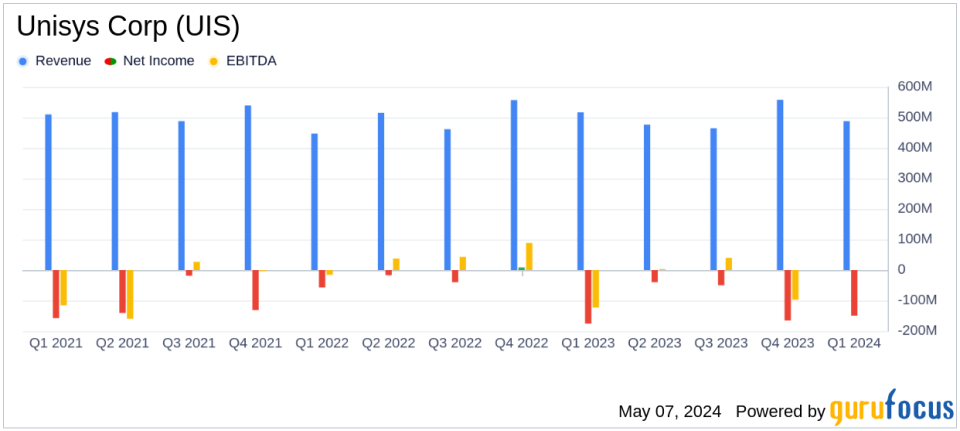

Unisys Corp (UIS) Q1 2024 Earnings: Challenges Persist Amidst Revenue Decline

Revenue: Reported at $487.8 million, down 5.5% year-over-year, surpassing estimates of $482.90 million.

Net Loss: Increased to $149.5 million from $175.4 million year-over-year, below the estimated net loss of $3.37 million.

Gross Profit Margin: Decreased to 27.9% from 30.8% year-over-year, indicating a decline of 290 basis points.

Operating Cash Flow: Improved to $23.8 million from $12.8 million in the previous year, showing a positive shift in cash management.

Free Cash Flow: Turned positive at $3.9 million, compared to a negative $7.5 million in the prior year, reflecting better operational efficiency.

Excluding License and Support (Ex-L&S) Revenue: Grew by 4.0% year-over-year to $394.6 million, showing resilience in core operations.

Full-Year Guidance: Reiterated, anticipating strong performance in the second half of the year based on new logo momentum and pipeline mix.

On May 7, 2024, Unisys Corp (NYSE:UIS) released its 8-K filing, revealing the financial outcomes for the first quarter of 2024. The technology solutions provider, known for its services across government, financial services, and commercial markets, reported a revenue decline but demonstrated strategic growth in certain areas and an improved cash flow position.

Company Overview

Unisys operates through three segments: Digital Workplace Solutions (DWS), Cloud, Applications & Infrastructure Solutions (CA&I), and Enterprise Computing Solutions (ECS). These segments cater to transforming digital workplaces, providing digital platform solutions, and harnessing secure computing environments, respectively.

Financial Performance Analysis

The first quarter saw Unisys generating $487.8 million in revenue, marking a 5.5% decrease year-over-year (YoY), and a 7.1% decline in constant currency terms. This downturn was primarily due to the timing of License and Support (L&S) renewals. However, excluding L&S, revenue grew by 4.0% YoY, indicating resilience in core business areas.

The gross profit margin declined to 27.9% from 30.8% in the previous year, impacted by the same L&S timing. Yet, the Ex-L&S gross profit margin saw a significant increase, up 420 basis points to 18.0%, reflecting cost reduction efficiencies and a one-time benefit from a resolved contractual dispute.

Operating profit stood at $17.7 million, down from $49.9 million YoY, with the operating profit margin at 3.6%. The non-GAAP operating profit was $34.4 million, resulting in a 7.1% margin, compared to 11.6% the previous year. This decrease highlights ongoing challenges but also points to underlying operational improvements.

Segment Performance

Among the segments, the Digital Workplace Solutions (DWS) and Cloud, Applications & Infrastructure Solutions (CA&I) segments showed modest growth. DWS revenue increased by 1.0% YoY to $132.3 million, with a gross profit margin improvement of 250 basis points to 14.4%. CA&I revenue rose by 2.4% YoY to $129.0 million, with a gross profit margin of 16.6%, up 360 basis points. In contrast, the Enterprise Computing Solutions (ECS) segment faced a significant revenue decline of 21.9% YoY to $147.0 million, with a decrease in gross profit margin by 890 basis points to 57.8%.

Cash Flow and Financial Health

Unisys showed a stronger cash flow in the quarter, with operating cash flow at $23.8 million, up from $12.8 million in Q1 2023. Free cash flow also improved significantly to $3.9 million from a negative $7.5 million last year. This improvement is primarily attributed to better working capital management and reduced pension contributions.

Strategic Developments and Outlook

Unisys reiterated its full-year 2024 guidance, expecting a slight revenue growth in constant currency terms. The company's strategic focus remains on enhancing its service offerings and capitalizing on new logo signings, which more than doubled YoY, showcasing potential for future revenue streams.

Despite the challenges posed by timing in license renewals and a competitive market environment, Unisys is strategically positioning itself for sustainable growth. The company's ability to improve operational efficiencies and cash flow amidst revenue pressures highlights its resilience and adaptability in a dynamic industry landscape.

Explore the complete 8-K earnings release (here) from Unisys Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance