United Insurance (UIHC) Q1 Earnings & Revenues Top, Up Y/Y

United Insurance Holdings Corp. UIHC reported first-quarter 2018 operating income of 40 cents per share, beating the Zacks Consensus Estimate by 5.3%. The bottom line also soared 73.9% year over year.

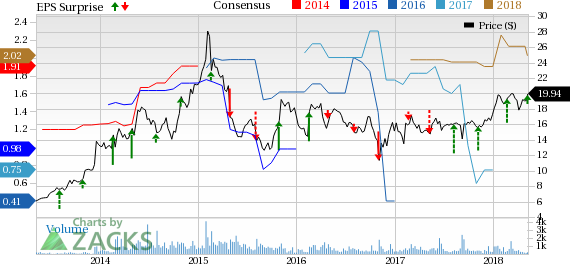

United Insurance Holdings Corp. Price, Consensus and EPS Surprise

United Insurance Holdings Corp. Price, Consensus and EPS Surprise | United Insurance Holdings Corp. Quote

Though in the reported quarter, the company witnessed catastrophe activities at places where it operates from, its premium-in-force however, increased 3% to $1.1 billion.

Quarter in Detail

Operating revenues totaled $182 million, surpassing the Zacks Consensus Estimate by 2.3%. The top line also surged nearly 48% year over year.

Gross premiums written increased 65.6% year over year to $279.6 million in the quarter under review, driven by a merger with AmCo last year and organic growth in new plus renewed business generated across all regions.

Net premiums earned improved 51.8% to $162.7 million. This improvement was owing to a better performance at Personal Property and Commercial Property lines of business.

Investment income skyrocketed nearly 93% to $5.7 million.

Loss and loss adjustment (LAE) expense jumped 22% to $77.2 million while LAE expense as a percentage of net earned premiums decreased 1160 basis points to 47.5% in the first quarter.

Operating and underwriting expenses rose 41.7% to $8.3 million, attributable to escalated costs related to expenses for software tools, agent incentive costs and the same incurred for underwriting services and assessments.

Underlying combined ratio of 92.4% deteriorated150 basis points in the period under discussion.

Financial Update

Cash and cash equivalents of $216.7 million as of Mar 31, 2018 were down 21.6% from the level at year-end 2017. Total shareholders’ equity of $535.1 million as of Mar 31, 2018 slid 0.4% from the level as of Dec 31, 2017.

Book value per share was $12.52 as of Mar 31, 2018, up 10.1% from the figure at year-end 2017.

Core return on equity of 13.2% expanded 500 basis points year over year, reflecting the company’s effective utilization of shareholders’ funds.

Dividend Update

The board of directors approved a quarterly cash dividend of 6 cents per share to shareholders of record on May 22, 2018, payable May 29, 2018.

Zacks Rank

United Insurance carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1Rank (Strong Buy) stocks here.

Performance of Other Insurers

Among other insurers, which have already reported first-quarter earnings, the bottom line of The Progressive Corporation PGR and RLI Corp. RLI outpaced the respective Zacks Consensus Estimate while that of The Travelers Companies, Inc. TRV missed the same.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

United Insurance Holdings Corp. (UIHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance