United States Dialysis Services Market Insights, 2023-2029: Dominated by B. Braun Melsungen, Baxter Renal Care Services, Davita, Dialysis Clinic, Fresenius Medical Care, Innovative Renal Care, and NephroPlus

U.S. Dialysis Services Market

Dublin, July 10, 2024 (GLOBE NEWSWIRE) -- The "U.S. Dialysis Services Market - Focused Insights 2024-2029" report has been added to ResearchAndMarkets.com's offering.

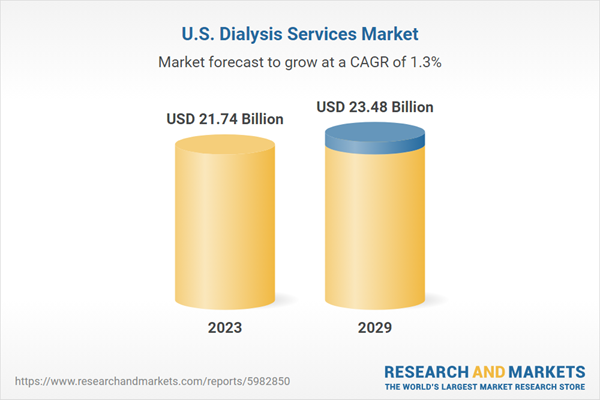

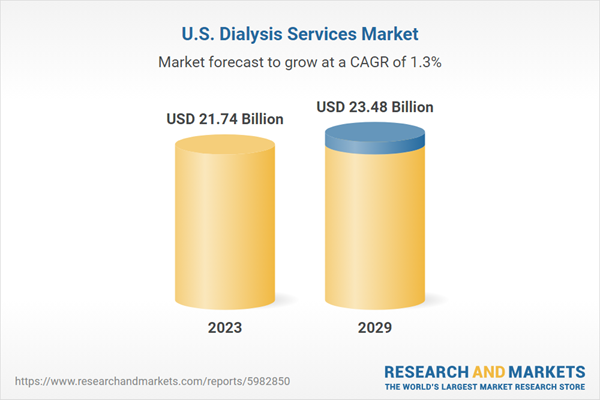

The U.S. dialysis services market is expected to grow at a CAGR of 1.29% from 2023 to 2029.

Increasing Mobile Dialysis Service

The shift toward mobile and ambulatory care has increased significantly in recent years due to the increasing burden on healthcare services. Nowadays, dialysis services are available outside their homes. Mobile dialysis providers are rapidly increasing in developed countries. Increasing expenditure for dialysis services and the availability of mobile dialysis services show significant market growth opportunities. Mobile dialysis service providers give cost-effective solutions to patients as dialysis facilities.

In the US, Odulair LLC is a well-known mobile dialysis service provider organization that delivers several dialysis services annually in the U.S. It is a mobile medical manufacturer pioneer in building commercial mobile dialysis units in the U.S. and international markets. Mobile dialysis facilities are available in three forms: mobile dialysis clinic, mobile dialysis unit, and mobile dialysis facility.

These services provide short-term dialysis, hemodialysis, and peritoneal dialysis facilities. It is one of the cost-effective services available at off-site locations. It allows dialysis and other required solutions to be brought to care homes, low-income communities, and other healthcare services.

Increasing kidney care facilities and a significantly rising patient population drive the high demand for these services. Moreover, mobile dialysis services are used in a state or federal disaster response.

Other market insights covered:

Increasing Government Initiatives for Kidney Health

Increasing Mergers & Acquisitions in Dialysis Service Sector

Complications Associated with Dialysis Services

Insight by Service Type

The U.S. dialysis services market by service type is segmented into hemodialysis and peritoneal dialysis. The hemodialysis segment dominates with the largest market share in 2023. The dominance of this segment is attributed to the larger acceptance of hemodialysis and the presence of many dialysis centers that offer these services. In addition, factors such as the rising prevalence of diabetes and hypertension and the shortage of kidneys for transplantation in the U.S. are likely to augment market growth.

Insight by End-user Type

The U.S. dialysis services market by end-user type is categorized into in-center dialysis, home dialysis, and hospital dialysis. The home dialysis segment shows significant growth, with the highest growth during the forecast period. Several factors positively impact the shift toward home dialysis. In the U.S., the trend toward home dialysis has grown significantly in recent years. Popular Medicare and public-to-private insurance policies offered by the government or individuals provide plenty of opportunities for market growth. One of the major factors that significantly drove the high market growth in the home healthcare setting was the COVID-19 pandemic, and several government and private entities came forward to deliver dialysis services at the patient's home.

Insight by Disease Type

The chronic kidney segment by disease type shows major growth, with the fastest-growing CAGR during the forecast period. The rising prevalence of chronic kidney diseases, increasing initiatives for kidney health improvement, and dialysis access for prevalent CKD patients contribute to market growth. By 2040, it is estimated that CKD will be among the top five leading causes of death. It shows the significant opportunities for market growth in the future. Moreover, during the COVID-19 pandemic, both chronic kidney disease (CKD) and end-stage kidney disease (ESKD) conditions significantly increased, which will deliver plenty of opportunities for dialysis services.

Insight by Age Group Type

The above-60 age group segment dominated with the largest U.S. dialysis services market share in 2023. The increasing elderly/geriatric population with various kidney disorders is one of the major factors driving the market growth. Globally, the increasing geriatric population is driving up the high cost of dialysis services. Several factors are positively influencing the adoption of dialysis services, such as the higher prevalence of chronic kidney disease (CKD), end-stage kidney disease (ESKD), acute kidney injury (AKI), and rising infections of various viral and chronic diseases.

Competitive Landscape

The U.S. dialysis services market report consists of exclusive data on 28 vendors. The U.S. dialysis service market is highly competitive due to domestic, regional, and international players. Moreover, key market players' geographical presence and broad distribution channels increase market competitiveness through their primary dialysis service delivery strategies. The outbreak of the COVID-19 pandemic significantly increased the demand for home dialysis services, driving high competitiveness among market players and shifting them to look for various options to deliver the services during the pandemic.

Key Vendors

B. Braun Melsungen

Baxter Renal Care Services

Davita

Dialysis Clinic Inc.

Fresenius Medical Care

Innovative Renal Care

NephroPlus

Other Prominent Vendors

ARC Dialysis

Atlantic Dialysis Management Services

Centers for Dialysis Care

Dialife

Northwest Kidney Centers

Rogosin Institutes

Premier Dialysis

Satellite Healthcare

Sanderling Healthcare

Terumo

US Renal Care

Concerto Renal Services

American Dialysis Centers

Mayo Clinic

Quik Travel Staffing

Hattiesburg Clinic

Allmed Medical Care

Key questions answered in the report:

1. What is the growth rate of the U.S. dialysis services market?

2. What are the key drivers of the U.S. dialysis services market?

3. How big is the U.S. dialysis services market?

4. Who are the major players in the U.S. dialysis services market?

Key Attributes

Report Attribute | Details |

No. of Pages | 80 |

Forecast Period | 2023-2029 |

Estimated Market Value (USD) in 2023 | $21.74 Billion |

Forecasted Market Value (USD) by 2029 | $23.48 Billion |

Compound Annual Growth Rate | 1.2% |

Regions Covered | United States |

For more information about this report visit https://www.researchandmarkets.com/r/y1v51i

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

Yahoo Finance

Yahoo Finance