Unpacking Q1 Earnings: Floor And Decor (NYSE:FND) In The Context Of Other Home Furnishing and Improvement Retail Stocks

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the home furnishing and improvement retail stocks, including Floor And Decor (NYSE:FND) and its peers.

Home furnishing and improvement retailers understand that ‘home is where the heart is’ but that a home is only right when it’s in livable condition and furnished just right. These stores therefore focus on providing what is needed for both the upkeep of a house as well as what is desired for the aesthetics of a home. Decades ago, it was thought that furniture and home improvement would resist e-commerce because of the logistical challenges of shipping a sofa or lawn mower, but now you can buy both online; so just like other retailers, these stores need to adapt to new realities and consumer behaviors.

The 7 home furnishing and improvement retail stocks we track reported an ok Q1; on average, revenues beat analyst consensus estimates by 1.5%. while next quarter's revenue guidance was 4.7% below consensus. Stocks--especially those trading at higher multiples--had a strong end of 2023, but 2024 has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and home furnishing and improvement retail stocks have had a rough stretch, with share prices down 9.3% on average since the previous earnings results.

Floor And Decor (NYSE:FND)

Operating large, warehouse-style stores, Floor & Decor (NYSE:FND) is a specialty retailer that specializes in hard flooring surfaces for the home such as tiles, hardwood, stone, and laminates.

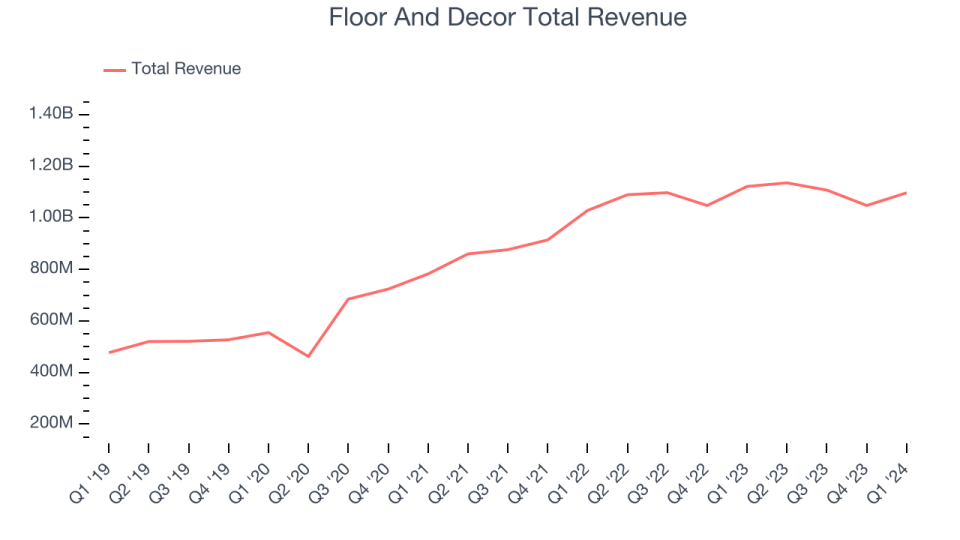

Floor And Decor reported revenues of $1.10 billion, down 2.2% year on year, falling short of analysts' expectations by 1.5%. It was a mixed quarter for the company, with a decent beat of analysts' earnings estimates but underwhelming earnings guidance for the full year.

Tom Taylor, Chief Executive Officer, stated, “We are pleased to report better-than-expected fiscal 2024 first quarter diluted earnings per share of $0.46. We take pride in these first quarter results as they demonstrate how our teams continue to work to strategically grow our gross margin rate and prudently manage expenses without sacrificing customer service amid the near-term uncertain macroeconomic challenges. We are focused on continuing to grow our market share by opening new warehouse-format stores, capitalizing on our everyday low prices and value-driven options, trend-right product assortments, in-stock job lot quantities, and exceptional customer service.”

Floor And Decor pulled off the highest full-year guidance raise but had the weakest performance against analyst estimates of the whole group. The stock is down 15.6% since the results and currently trades at $95.27.

Read our full report on Floor And Decor here, it's free.

Best Q1: Williams-Sonoma (NYSE:WSM)

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

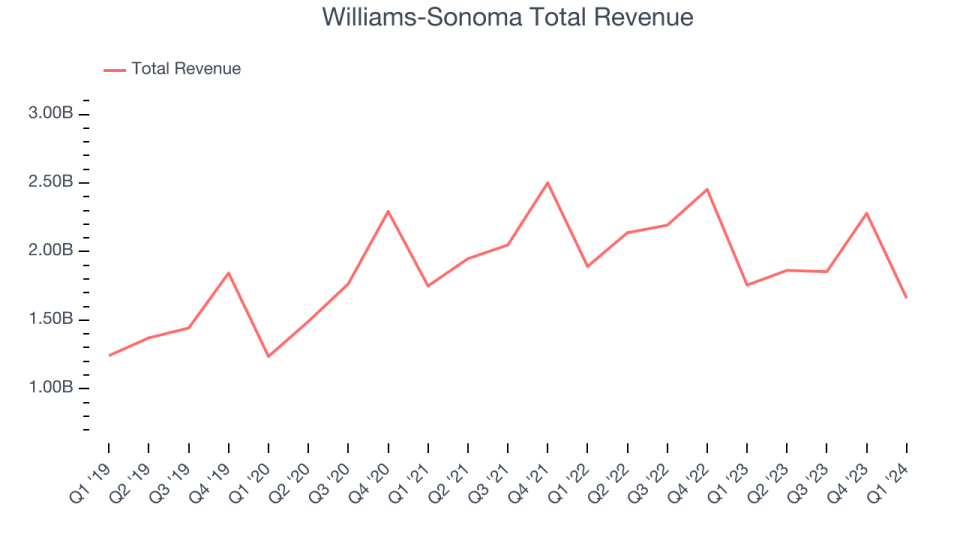

Williams-Sonoma reported revenues of $1.66 billion, down 5.4% year on year, in line with analysts' expectations. It was a very good quarter for the company, with an impressive beat of analysts' gross margin and earnings estimates.

The stock is down 11.9% since the results and currently trades at $276.86.

Is now the time to buy Williams-Sonoma? Access our full analysis of the earnings results here, it's free.

Weakest Q1: RH (NYSE:RH)

Formerly known as Restoration Hardware, RH (NYSE:RH) is a specialty retailer that exclusively sells its own brand of of high-end furniture and home decor.

RH reported revenues of $727 million, down 1.7% year on year, in line with analysts' expectations. It was a weak quarter for the company, with a miss of analysts' earnings.

RH pulled off the fastest revenue growth in the group. The stock is down 13.9% since the results and currently trades at $238.36.

Read our full analysis of RH's results here.

Lowe's (NYSE:LOW)

Founded in North Carolina as Lowe's North Wilkesboro Hardware, the company is a home improvement retailer that sells everything from paint to tools to building materials.

Lowe's reported revenues of $21.36 billion, down 4.4% year on year, surpassing analysts' expectations by 1.2%. It was an ok quarter for the company, with a narrow beat of analysts' earnings estimates.

The stock is down 6.9% since the results and currently trades at $213.51.

Read our full, actionable report on Lowe's here, it's free.

Home Depot (NYSE:HD)

Founded and headquartered in Atlanta, Georgia, Home Depot (NYSE:HD) is a home improvement retailer that sells everything from tools to building materials to appliances.

Home Depot reported revenues of $36.42 billion, down 2.3% year on year, falling short of analysts' expectations by 0.6%. It was a mixed quarter for the company, with some shareholders hoping for a better result.

The stock is down 1.4% since the results and currently trades at $336.17.

Read our full, actionable report on Home Depot here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance