Unveiling 3 Chinese Growth Companies With Insider Ownership Up To 36%

As global markets experience varied trends, China's mixed economic signals—with a notable decline in home prices but a rise in retail sales—paint a complex backdrop for investors. In such an environment, understanding the nuances of growth companies with high insider ownership can offer valuable insights into potential resilience and long-term value creation.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Ningbo Deye Technology Group (SHSE:605117) | 24.8% | 28.5% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

Eoptolink Technology (SZSE:300502) | 26.7% | 39.1% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 24% | 33.1% |

We're going to check out a few of the best picks from our screener tool.

Nanjing Vazyme BiotechLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nanjing Vazyme Biotech Ltd (ticker: SHSE:688105) specializes in technology solutions for life science, biomedicine, and in vitro diagnostics with a market capitalization of CN¥7.79 billion.

Operations: The company generates revenue primarily from technology solutions in life science, biomedicine, and in vitro diagnostics.

Insider Ownership: 14.9%

Nanjing Vazyme Biotech Ltd, a player in the oligonucleotide therapeutics space, demonstrates robust potential with its high forecasted revenue growth of 25.6% per year, significantly outpacing the Chinese market average. Recently rebounding to profitability with a net income of CNY 5.22 million from a previous loss and maintaining consistent revenue around CNY 301.57 million, the company shows promising financial recovery. However, its recent exclusion from the Shanghai Stock Exchange Health Care Sector Index could impact investor perception negatively.

SWS Hemodialysis Care

Simply Wall St Growth Rating: ★★★★★☆

Overview: SWS Hemodialysis Care Co., Ltd. operates globally, offering integrated blood purification solutions for renal failure and critically ill patients, with a market capitalization of approximately CN¥4.41 billion.

Operations: The company generates its revenue from providing integrated blood purification solutions for renal failure and critically ill patients globally.

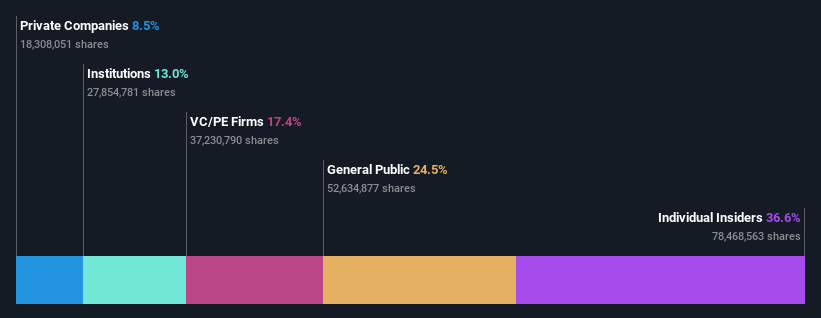

Insider Ownership: 36.6%

SWS Hemodialysis Care, a growth-oriented firm in China with high insider ownership, recently reported a decline in Q1 earnings and revenue compared to the previous year, marking significant challenges. However, the company's forecasted annual earnings growth of 35.6% and revenue increase of 37.2% per year outpace market expectations significantly. Despite recent setbacks including a substantial drop in net income and basic earnings per share, SWS Hemodialysis Care is actively managing its capital through strategic share buybacks totaling CNY 30.1 million.

Guangzhou Jinzhong Auto Parts Manufacturing

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Jinzhong Auto Parts Manufacturing Co., Ltd. is a company that specializes in the production of automotive parts, with a market capitalization of approximately CN¥2.18 billion.

Operations: The company generates approximately CN¥995.99 million in revenue, primarily from the automotive interior and exterior trim segment.

Insider Ownership: 16%

Guangzhou Jinzhong Auto Parts Manufacturing, a Chinese growth company with high insider ownership, has shown impressive financial performance with earnings and revenue growing by 86.4% over the past year. The company's future looks promising with forecasted annual earnings and revenue growth rates of 27% and 27.2%, respectively, both exceeding market averages. Despite this strong growth trajectory and a recent dividend increase, the stock is trading at 52.7% below its estimated fair value, which may raise concerns about its market valuation accuracy or investor perceptions.

Next Steps

Delve into our full catalog of 366 Fast Growing Chinese Companies With High Insider Ownership here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688105 SHSE:688410SZSE:301133 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance