Unveiling Three Premier Dividend Stocks With Yields Up To 3.9%

As the U.S. stock market shows resilience with the Nasdaq Composite and S&P 500 hitting record highs, investors are navigating through an environment marked by fluctuating economic indicators and interest rates. In such a landscape, dividend stocks remain a focal point for those seeking steady income streams amidst market uncertainties. In this context, understanding what constitutes a robust dividend stock is crucial—particularly ones that can offer reliable yields in conjunction with potential for stable performance regardless of broader economic fluctuations.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.36% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.31% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 4.97% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.15% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.87% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.83% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.75% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.21% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.19% | ★★★★★☆ |

East West Bancorp (NasdaqGS:EWBC) | 3.03% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

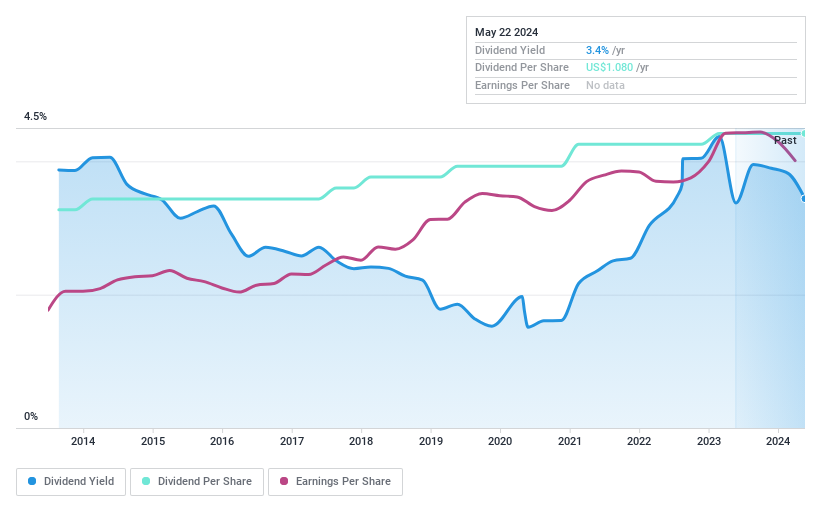

First Capital

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Capital, Inc., functioning as the bank holding company for First Harrison Bank, offers a range of banking services to individual and business customers with a market capitalization of approximately $102.31 million.

Operations: First Capital, Inc. generates its revenue primarily from banking services, totaling $40.31 million.

Dividend Yield: 3.5%

First Capital, Inc. recently affirmed a quarterly dividend of US$0.27 per share, reflecting its commitment to regular shareholder returns despite a slight decline in net income and interest income in Q1 2024 compared to the previous year. The company's dividends are supported by a modest payout ratio of 30.3%, indicating sustainability, although its yield of 3.6% trails behind the top quartile of U.S dividend stocks at 4.71%. Additionally, leadership changes with John Shireman's appointment could infuse new operational insights into the board, potentially impacting future performance and strategic direction.

Take a closer look at First Capital's potential here in our dividend report.

Our valuation report here indicates First Capital may be undervalued.

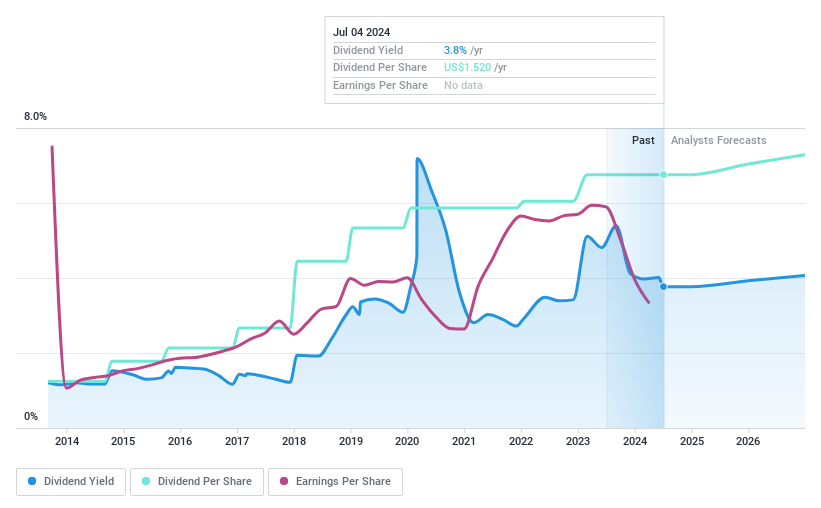

Synovus Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Synovus Financial Corp., a bank holding company for Synovus Bank, offers commercial and consumer banking products and services with a market capitalization of approximately $5.91 billion.

Operations: Synovus Financial Corp. generates revenue through various segments, including Consumer Banking ($675.42 million), Community Banking ($478.07 million), Wholesale Banking ($838.31 million), and Financial Management Services (FMS) ($269.43 million).

Dividend Yield: 3.8%

Synovus Financial Corp. recently declared dividends across its preferred and common stocks, maintaining a consistent payout with a quarterly dividend of US$0.38 per share for common stockholders. Despite a decline in net interest income and net income in Q1 2024, the company's dividend payments remain supported by a reasonable payout ratio of 51.9%. However, its current yield of 3.77% is lower than the top quartile of U.S market dividend payers at 4.74%, suggesting room for improvement in attractiveness despite stable long-term growth forecasts for earnings and dividends.

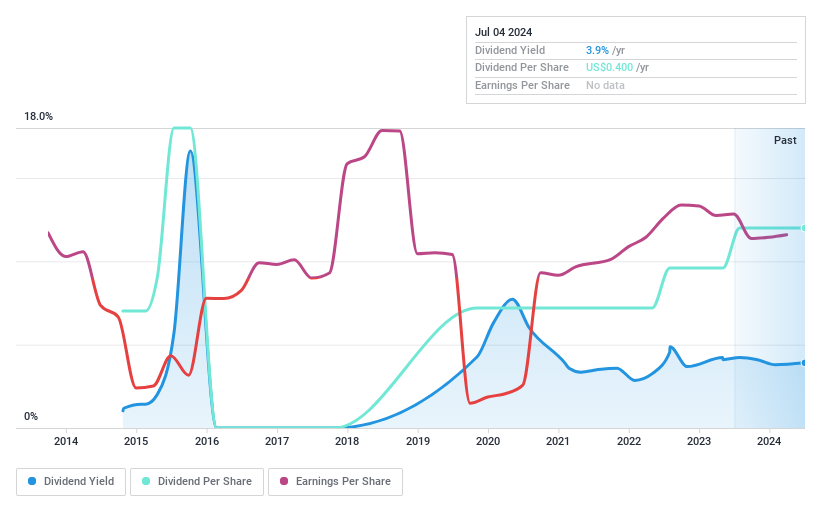

SunCoke Energy

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SunCoke Energy, Inc., an independent producer of coke operating in the Americas and Brazil, has a market capitalization of approximately $860.09 million.

Operations: SunCoke Energy, Inc. generates revenue through three primary segments: Logistics, which brought in $95.30 million, Brazil Coke at $35.60 million, and Domestic Coke contributing the most significantly with $1.95 billion in earnings.

Dividend Yield: 3.9%

SunCoke Energy, despite a track record of increasing dividends over the past decade, faces challenges with a volatile dividend history and high debt levels. The company's recent financials show modest growth, with Q1 2024 sales slightly up to US$488.4 million and net income rising to US$20 million. Dividends are well-covered by earnings and cash flows, with payout ratios of 52.7% and 26.5%, respectively. However, its dividend yield at 3.96% trails behind the top quartile of U.S market payers at 4.71%.

Navigate through the intricacies of SunCoke Energy with our comprehensive dividend report here.

Upon reviewing our latest valuation report, SunCoke Energy's share price might be too optimistic.

Summing It All Up

Take a closer look at our Top Dividend Stocks list of 205 companies by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:FCAP NYSE:SNV and NYSE:SXC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance