Unveiling UK's Top Growth Companies With High Insider Ownership In June 2024

As the United Kingdom's financial markets navigate through a period of cautious optimism, with the FTSE 100 showing mixed signals amid global economic uncertainties, investors are keenly watching for stable investment opportunities. In this context, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the company best—its insiders—especially in unpredictable times.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Getech Group (AIM:GTC) | 17.3% | 108.7% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Gulf Keystone Petroleum (LSE:GKP) | 10.8% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

B90 Holdings (AIM:B90) | 24.4% | 142.7% |

Afentra (AIM:AET) | 38.3% | 64.4% |

Mothercare (AIM:MTC) | 15.1% | 41.2% |

Let's dive into some prime choices out of from the screener.

Energean

Simply Wall St Growth Rating: ★★★★☆☆

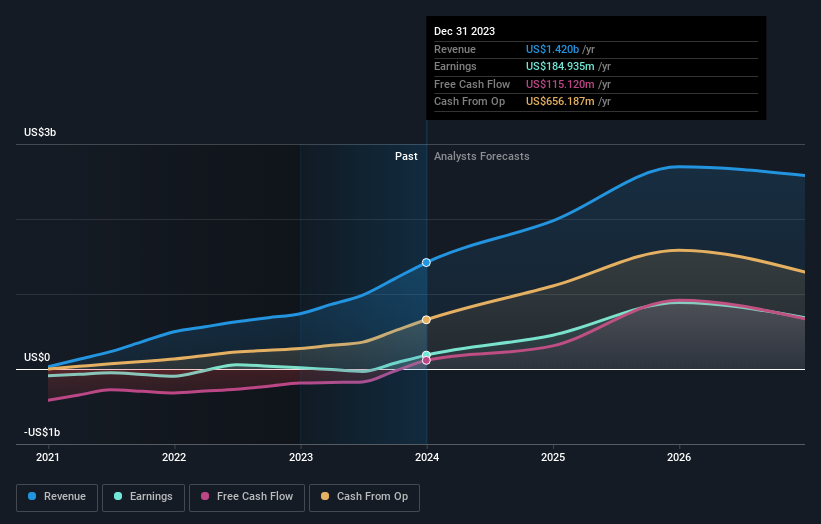

Overview: Energean plc is an oil and gas company focused on the exploration, development, and production of hydrocarbons, with a market capitalization of approximately £1.91 billion.

Operations: The company generates its revenue primarily from the exploration and production of hydrocarbons, totaling approximately $1.42 billion.

Insider Ownership: 10.7%

Energean, a UK-based growth company with high insider ownership, presents a mixed financial outlook. While its revenue and earnings are expected to grow at 11.7% and 18.34% per year respectively—outpacing the UK market—the company struggles with high debt levels and shareholder dilution over the past year. Despite trading 40.8% below estimated fair value and analysts predicting a significant price increase, its generous dividend of 9.13% is poorly covered by earnings, raising sustainability concerns.

Foresight Group Holdings

Simply Wall St Growth Rating: ★★★★★☆

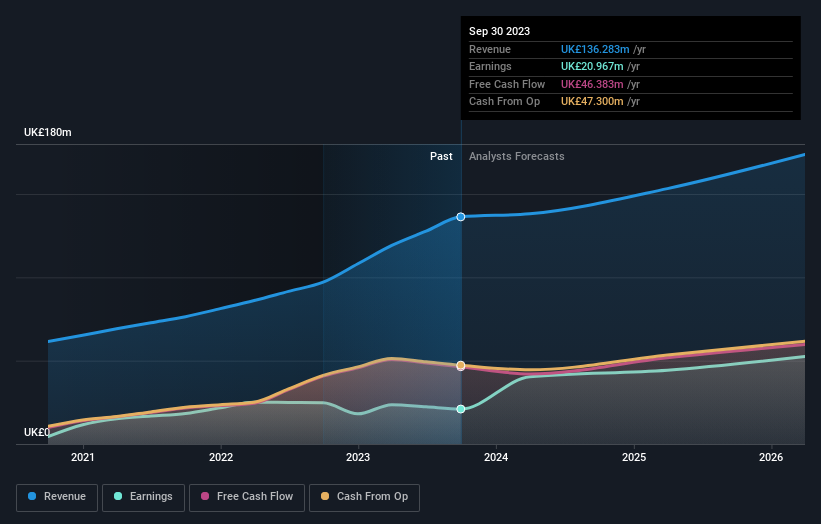

Overview: Foresight Group Holdings Limited is an infrastructure and private equity manager operating in the United Kingdom, Italy, Luxembourg, Ireland, Spain, and Australia with a market capitalization of approximately £576.47 million.

Operations: The company generates revenue through three primary segments: Infrastructure (£85.68 million), Private Equity (£39.28 million), and Foresight Capital Management (£11.33 million).

Insider Ownership: 31.7%

Foresight Group Holdings, a UK-based company with high insider ownership, is poised for notable growth. Its revenue is expected to increase by 10% annually, surpassing the UK market's average of 3.5%. Despite this, its dividend coverage is weak. Earnings are projected to surge by 30.9% per year, significantly outstripping the market forecast of 12.5%. However, profitability concerns linger as profit margins have declined from last year's 25.5% to 15.4%. The stock trades at a substantial discount—32.8% below its estimated fair value.

TBC Bank Group

Simply Wall St Growth Rating: ★★★★☆☆

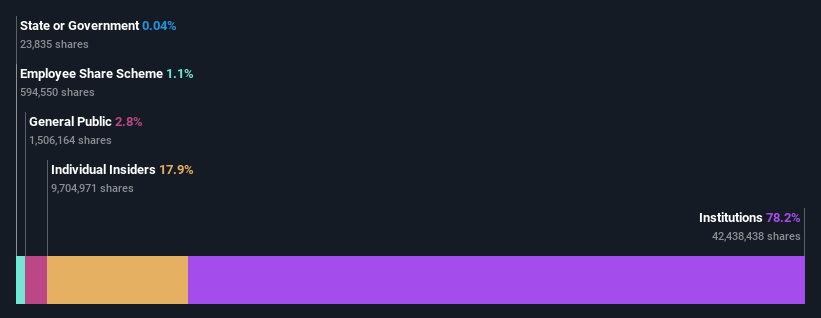

Overview: TBC Bank Group PLC operates primarily in Georgia, Azerbaijan, and Uzbekistan, offering a range of services including banking, leasing, insurance, brokerage, and card processing to both corporate and individual clients; the company has a market capitalization of approximately £1.38 billion.

Operations: The company generates revenue from banking, leasing, insurance, brokerage, and card processing services across Georgia, Azerbaijan, and Uzbekistan.

Insider Ownership: 18%

TBC Bank Group, a prominent UK growth company with high insider ownership, has demonstrated robust financial performance with a significant increase in net interest income and net income in Q1 2024. The bank's strategic share repurchase program aims to enhance shareholder value by reducing share capital and supporting employee benefits. Despite its volatile share price recently, TBC Bank is trading below its fair value and shows strong future revenue and earnings growth forecasts compared to the market.

Delve into the full analysis future growth report here for a deeper understanding of TBC Bank Group.

Our valuation report unveils the possibility TBC Bank Group's shares may be trading at a discount.

Make It Happen

Discover the full array of 67 Fast Growing UK Companies With High Insider Ownership right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include LSE:ENOG LSE:FSG and LSE:TBCG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance