Unveiling US Growth Companies With High Insider Ownership In May 2024

As of May 2024, the U.S. market is experiencing a notable uplift, buoyed by strong earnings from tech giants like Nvidia, which has sparked optimism and driven gains across various sectors. This positive momentum underscores the importance of robust corporate governance and strategic insider investments, particularly in growth-oriented companies with high insider ownership. In the current climate where technological advancements and economic policies play pivotal roles in shaping market dynamics, companies with substantial insider ownership can offer unique advantages. These insiders often have a deep commitment to the company's long-term success and are likely to align their strategies closely with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 26% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 21.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 27.2% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.2% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 98.2% |

BBB Foods (NYSE:TBBB) | 23.6% | 77.5% |

Establishment Labs Holdings (NasdaqCM:ESTA) | 11.2% | 68.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

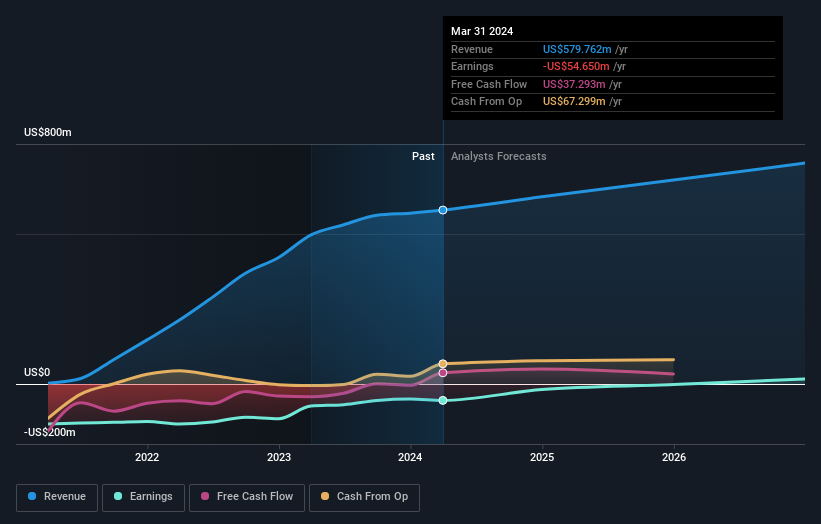

Lindblad Expeditions Holdings

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lindblad Expeditions Holdings, Inc. operates globally, offering marine expedition adventures and travel experiences with a market capitalization of approximately $452.89 million.

Operations: The company generates revenue primarily through its marine expeditions, which contribute approximately $400.22 million, and land experiences, contributing about $179.55 million.

Insider Ownership: 31.3%

Earnings Growth Forecast: 117.3% p.a.

Lindblad Expeditions Holdings is poised for growth with a forecasted annual revenue increase of 8.7%, slightly above the US market average. The company is expected to turn profitable within three years, outpacing typical market growth rates. Recent insider buying trends underscore strong confidence from within, despite facing challenges such as a recent executive shuffle and reporting a net loss in the latest quarter. These factors combined suggest a potentially robust future, tempered by current financial uncertainties.

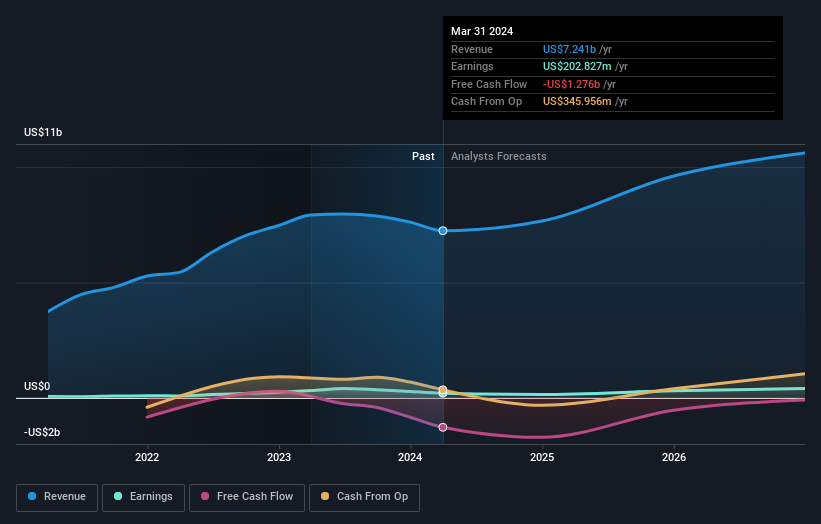

Canadian Solar

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canadian Solar Inc. operates globally, offering solar energy and battery storage solutions across Asia, the Americas, and Europe with a market capitalization of approximately $1.05 billion USD.

Operations: The revenue segments for the company include CSI Solar, which generated $6.86 billion, and Recurrent Energy with revenues of $0.52 billion.

Insider Ownership: 21.2%

Earnings Growth Forecast: 27.6% p.a.

Canadian Solar, with a Price-To-Earnings ratio of 5.9x, trades below the US market average, indicating potential value. The company anticipates significant earnings growth at 27.6% per year, outpacing the US market forecast of 14.6%. However, its debt is poorly covered by operating cash flow, and its Return on Equity is expected to remain low at 7.7%. Recently, Canadian Solar adjusted its full-year revenue projection downward from US$8.5 billion to between US$7.3 billion and US$8.3 billion while facing a patent infringement lawsuit that could impact future operations.

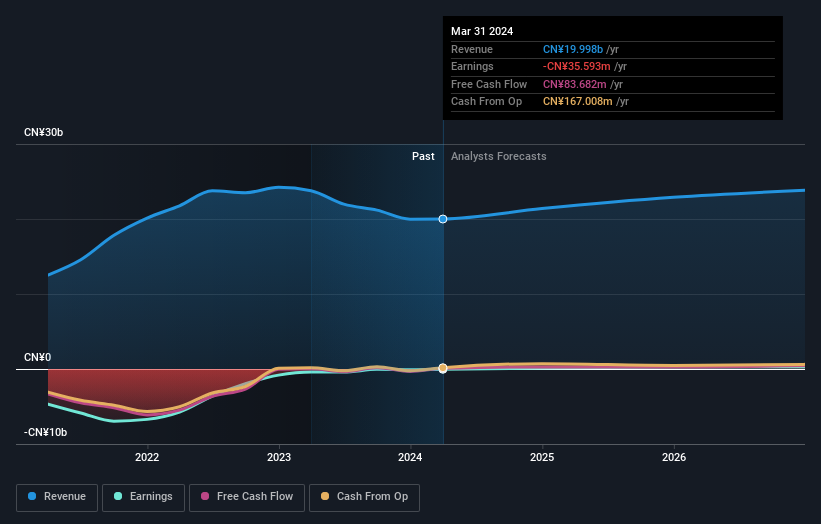

Dingdong (Cayman)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dingdong (Cayman) Limited is an e-commerce company based in China, with a market capitalization of approximately $417.25 million.

Operations: The company generates its revenue primarily from online retailing, amounting to CN¥19.998 billion.

Insider Ownership: 28.7%

Earnings Growth Forecast: 73.6% p.a.

Dingdong (Cayman) Limited, despite its slower revenue growth at 6.6% per year, is on a path to profitability within three years, with earnings growth forecasted at a robust 73.61% annually. Recent financials show a turnaround from a net loss to a net income of CNY 10.02 million in Q1 2024, and the company has raised its profit expectations for the year. Although its share price has been volatile recently, Dingdong's substantial insider ownership suggests confidence in long-term prospects.

Taking Advantage

Take a closer look at our Fast Growing US Companies With High Insider Ownership list of 179 companies by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:LIND NasdaqGS:CSIQ and NYSE:DDL.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance