Unveiling US Growth Companies With High Insider Ownership In June 2024

The United States stock market has shown robust growth, rising 1.4% in the last week and achieving a 23% increase over the past year, with earnings projected to grow by 15% annually. In this thriving market environment, companies with high insider ownership often signal strong confidence in the company's future prospects, making them particularly interesting to investors looking for sustainable growth.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.8% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

BBB Foods (NYSE:TBBB) | 23.6% | 99.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Let's explore several standout options from the results in the screener.

Clarus

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Clarus Corporation, with a market capitalization of $255.83 million, designs, develops, manufactures, and distributes outdoor equipment and lifestyle products both in the United States and internationally.

Operations: The company's revenue is primarily generated from two segments: outdoor equipment, contributing $198.30 million, and adventure products, adding $86.75 million.

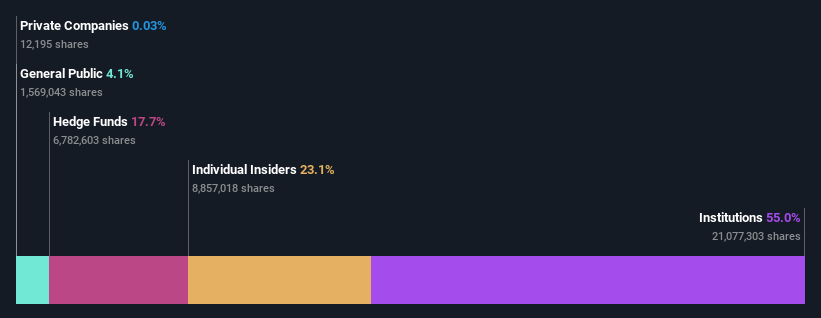

Insider Ownership: 23.1%

Clarus Corporation, with high insider ownership, showcases a commitment to growth despite a challenging fiscal environment. Recent financials reveal a significant net income increase in Q1 2024 to US$21.88 million from US$1.6 million year-over-year, though revenue slightly declined. The firm reaffirmed its 2024 sales forecast between US$270 million and US$280 million, indicating stability amidst volatility. Notably, the stock's price has been highly volatile over the past three months, reflecting market uncertainties yet underscoring potential for agile investors attracted by insider conviction and recent strategic corporate activities including consistent conference engagements and dividend affirmations.

Click here to discover the nuances of Clarus with our detailed analytical future growth report.

Our expertly prepared valuation report Clarus implies its share price may be too high.

Robinhood Markets

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Robinhood Markets, Inc. operates a financial services platform in the United States, with a market capitalization of approximately $18.26 billion.

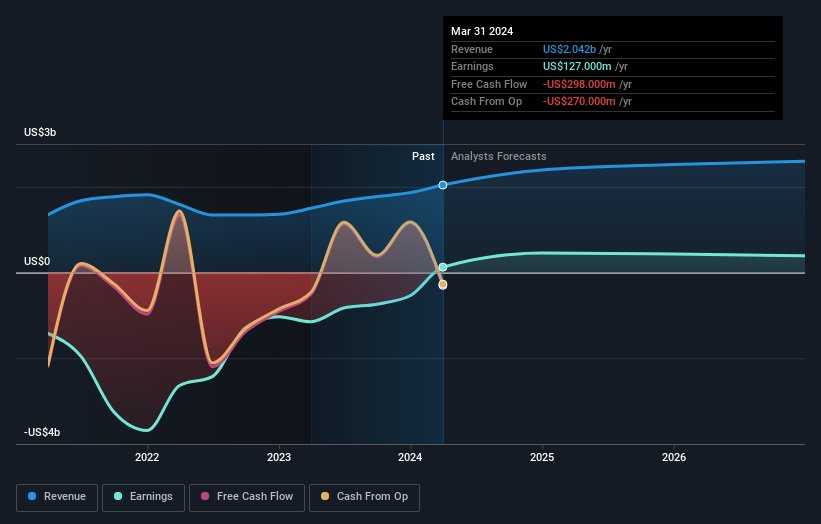

Operations: The company generates its revenue primarily through its brokerage services, amounting to approximately $2.04 billion.

Insider Ownership: 14.7%

Robinhood Markets, with substantial insider ownership, recently announced a significant share repurchase program valued at US$1 billion. This move underscores management's confidence in the company's prospects following a robust first quarter in 2024 where revenue surged to US$618 million from US$441 million year-over-year and net income reached US$157 million, reversing a prior loss. Despite this positive momentum, forecasted annual earnings growth of 26.3% outpaces the market, yet its return on equity is expected to remain low at 4.2%.

Paylocity Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paylocity Holding Corporation offers cloud-based human capital management and payroll software solutions in the United States, with a market capitalization of approximately $7.89 billion.

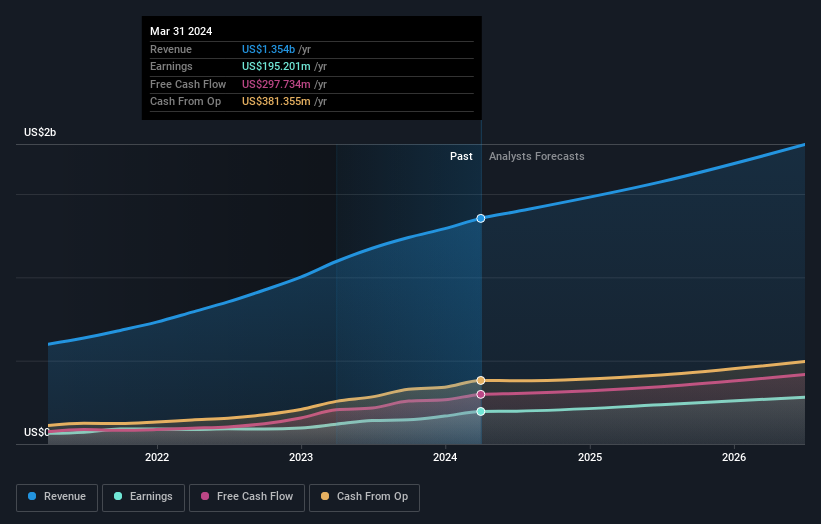

Operations: The company generates its revenue primarily from cloud-based software solutions, totaling approximately $1.35 billion.

Insider Ownership: 21.3%

Paylocity Holding, a growth-oriented company with high insider ownership, is expected to see its revenue grow by 11.6% annually, outpacing the US market average. Earnings are projected to increase by 16% per year, slightly above the market trend. Despite trading at 62.8% below its estimated fair value, it's not growing as fast as some might prefer for a high-growth category. Recent activities include guidance for significant revenue growth in Q4 and full-year 2024 and a substantial share buyback plan of up to US$500 million, signaling strong confidence from management in the company’s financial health and future prospects.

Click to explore a detailed breakdown of our findings in Paylocity Holding's earnings growth report.

Next Steps

Click through to start exploring the rest of the 175 Fast Growing US Companies With High Insider Ownership now.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:CLAR NasdaqGS:HOOD and NasdaqGS:PCTY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance