US Growth Companies With High Insider Ownership And Up To 20% Revenue Growth

The United States stock market has shown robust performance recently, with a 1.8% increase over the past week and a significant 26% rise over the last year. In this thriving environment, companies with high insider ownership and strong revenue growth up to 20% stand out as particularly compelling, potentially benefiting from aligned interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 26% | 21% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 22.4% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 28.2% |

Li Auto (NasdaqGS:LI) | 29.3% | 21.4% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.8% | 98% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.1% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 91.8% |

BBB Foods (NYSE:TBBB) | 23.6% | 75.4% |

Underneath we present a selection of stocks filtered out by our screen.

Independent Bank Group

Simply Wall St Growth Rating: ★★★★☆☆

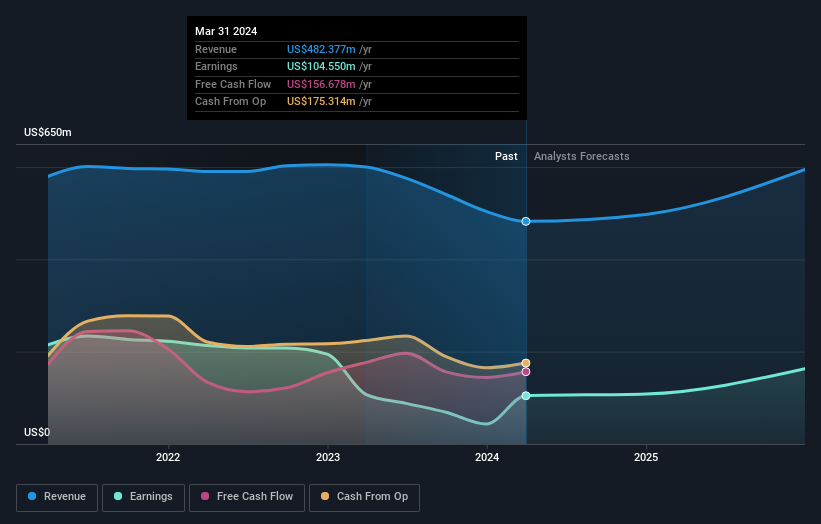

Overview: Independent Bank Group, Inc., operating through its subsidiary Independent Bank, offers a range of commercial banking services to businesses, professionals, and individuals across the United States, with a market capitalization of approximately $1.82 billion.

Operations: The company generates its revenue primarily from banking services, totaling approximately $482.38 million.

Insider Ownership: 13.4%

Revenue Growth Forecast: 12.6% p.a.

Independent Bank Group, recently agreeing to a merger with SouthState Corporation for US$2 billion, shows promising growth prospects. Its earnings are expected to grow 27.64% annually, outpacing the US market prediction of 14.6%. Although its revenue growth doesn't meet the high threshold of 20% per year, at 12.6%, it still surpasses the market average of 8.3%. The company also maintains a stable dividend yield of 3.46%, enhancing its attractiveness amidst significant corporate changes and solid financial performance in Q1 2024 after recovering from a previous loss.

Sprinklr

Simply Wall St Growth Rating: ★★★★☆☆

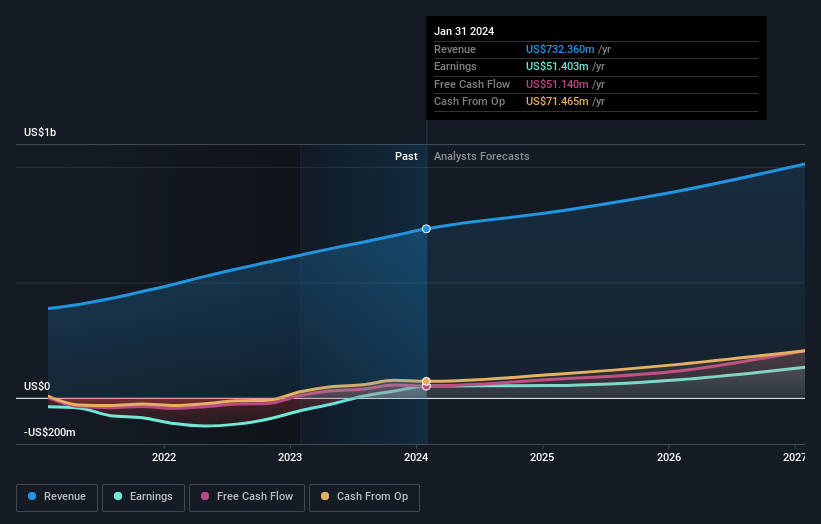

Overview: Sprinklr, Inc. operates globally, offering enterprise cloud software products with a market capitalization of approximately $3.38 billion.

Operations: The company generates its revenue primarily from the Software & Programming segment, totaling $732.36 million.

Insider Ownership: 22.4%

Revenue Growth Forecast: 10.3% p.a.

Sprinklr, a company with high insider ownership, recently expanded its product offerings and leadership team. On May 9, 2024, Marlise Ricci was appointed as Chief Accounting Officer. Earlier in the month, Sprinklr launched Sprinklr Surveys and Sprinklr Digital Twin technologies to enhance customer feedback management and AI capabilities. Despite these innovations and a positive shift in earnings from a net loss last year to substantial profits this year (US$51.4 million), the company's revenue growth forecast remains modest at 10.3% annually, below the high-growth benchmark of 20%.

Live Oak Bancshares

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Live Oak Bancshares, Inc. serves as the bank holding company for Live Oak Banking Company, offering a range of banking products and services across the United States with a market capitalization of approximately $1.65 billion.

Operations: The company generates revenue primarily through its banking segment, which contributed $414.49 million, and its fintech operations, which added $6.77 million.

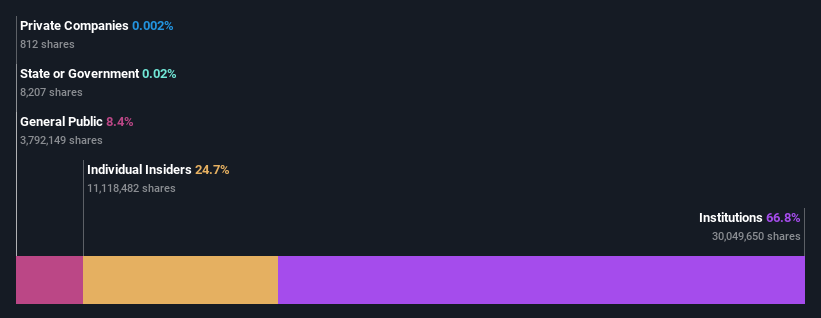

Insider Ownership: 24.7%

Revenue Growth Forecast: 21% p.a.

Live Oak Bancshares displayed a robust financial performance in Q1 2024, with significant improvements in net interest income and net income. Despite no substantial insider purchases recently, the company has experienced considerable earnings growth, projected at 17.41% annually, outpacing the US market average. However, it faces challenges with a high bad loans ratio of 2.3% and a low allowance for these loans at 67%, indicating potential risks in asset quality management.

Taking Advantage

Reveal the 180 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:IBTX NYSE:CXM and NYSE:LOB.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance