US Lawmakers Look to Bar Chips Act Winners From Using Chinese Tools

(Bloomberg) -- US lawmakers want to prevent companies that win federal chipmaking funds from using Chinese-made equipment at government-backed factories, part of efforts to limit Beijing’s influence on domestic chip production.

Most Read from Bloomberg

At Blackstone’s $339 Billion Property Arm, the Honeymoon Is Over

CDK Tells Car Dealers Their Systems Will Likely Be Down for Days

Putin’s Hybrid War Opens a Second Front on NATO’s Eastern Border

Under a bipartisan bill introduced Tuesday, companies such as Intel Corp. and Taiwan Semiconductor Manufacturing Co. would be barred from buying chipmaking gear from entities owned or controlled by China, as well as Russia, North Korea and Iran. The ban would apply only to US facilities supported by funds from the 2022 Chips and Science Act, not to manufacturers’ overseas operations.

“As the United States revitalizes its domestic semiconductor manufacturing industry, we must do everything in our power to stop China and other foreign entities of concern from compromising our microchip manufacturing facilities,” Senator Mark Kelly, an Arizona Democrat, said in a statement. Kelly is sponsoring the bill alongside Republican Senator Marsha Blackburn, while Representatives Frank Lucas, an Oklahoma Republican, and Zoe Lofgren, a Democrat from California, are leading a companion measure in the House.

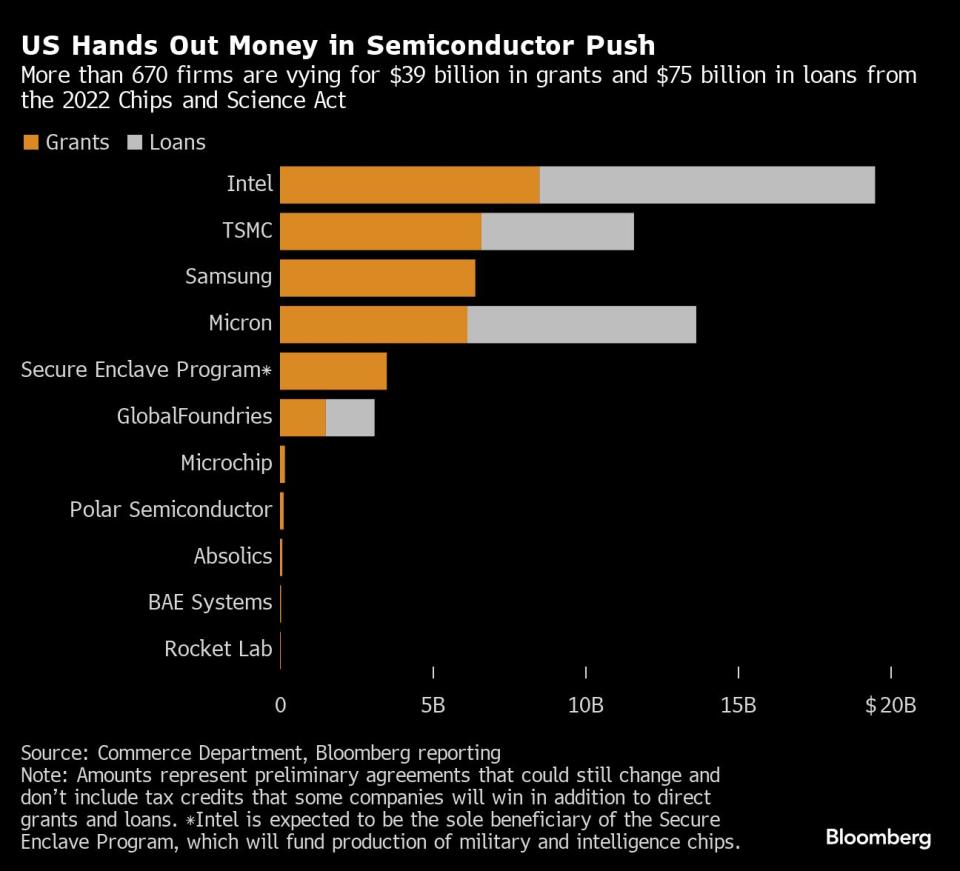

The Chips Act set aside $39 billion in grants — plus 25% tax credits, and loans and guarantees worth $75 billion — to revitalize the domestic industry after decades of production shifting to Asia. Companies responded by announcing more than $400 billion in US semiconductor investments. And they’ve begun putting that money to work: Computer and electronics construction spending surged in 2024, reaching an annual pace that’s more than 20 times the pre-Chips Act average.

Around 85% of the grant money is allocated, with most of it set aside for leading-edge projects by Intel, TSMC, Samsung Electronics Co. and Micron Technology Inc. Officials have unveiled several smaller preliminary awards in recent weeks, including the first for a supply-chain project, and additional announcements are expected through the end of this year.

The US program set off a global subsidy race, with governments from Brussels to Seoul fashioning their own programs to shore up domestic chip supplies. China, meanwhile, continues to build up its own industry. Last month, it unveiled the largest semiconductor investment fund in its history.

That $47.5 billion vehicle, known as Big Fund III, aims to support a standalone Chinese supply chain. The push includes fostering areas like chip equipment that are dominated by firms in the US, Japan and the Netherlands. It’s part of Beijing’s efforts to counteract years of US-led export controls, which have cut off China’s access to cutting-edge chips and equipment from those three countries.

The US lawmakers cited that fund — plus a reported push by Huawei Technologies Co. in equipment research — in Tuesday’s statement. They’re concerned about both cutting-edge gear and so-called legacy tools, which are used for production of less-advanced chips.

Already, Chips Act recipients are barred from substantially expanding their output in China or adding to their physical manufacturing space in the country.

“If left unchecked, Chinese state subsidies and aggressive market tactics could lead Chinese-made legacy tools to be placed in manufacturing facilities in the US and allied nations in the future,” according to the statement.

Chinese equipment makers have made significant headway in the industry. They’re now offering tools to American companies, which are at least holding conversations about using the machinery, according to a person familiar with the matter. But the discussions may be more about gaining leverage in pricing conversations with American toolmakers Applied Materials Inc., Lam Research Corp. and KLA Corp., the person said.

--With assistance from Ian King.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance