Vale's (VALE) Q4 Earnings Beat Estimates, EPS Improves Y/Y

Mining giant Vale S.A.’s VALE fourth-quarter 2017 adjusted earnings of 36 cents per share surpassed the Zacks Consensus Estimate of 23 cents. However, the bottom line came in lower than the year-ago tally of 52 cents per share.

For 2017, adjusted earnings came in at $1.35 per share, outpacing the Zacks Consensus Estimate of $1.22. The bottom line came in higher than the year-ago tally of 96 cents per share.

Inside the Headlines

Net operating revenues edged down 1.1% year over year to $9,167 million.

Of the total net operating revenues, sales of ferrous minerals accounted for 73.1%, coal contributed 4.4%, base metals comprised 21.8%, and the remaining 0.7% was sourced miscellaneously.

Geographically, 14.3% of revenues were generated from South America, 59.7% from Asia, 7% from North America, 13.7% from Europe, 3.3% from the Middle East, and 2% from Rest of the World.

Net operating revenues for 2017 came in at $33,967 million, up from $27,488 million recorded in the year-ago period. The upswing was primarily backed by a favorable pricing environment.

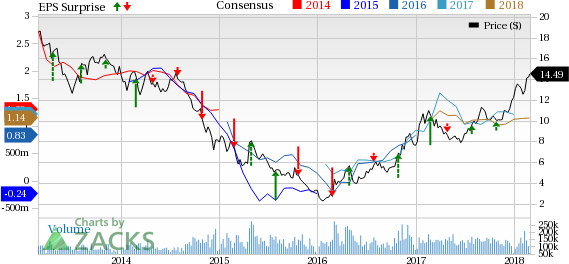

VALE S.A. Price, Consensus and EPS Surprise

VALE S.A. Price, Consensus and EPS Surprise | VALE S.A. Quote

Expenses

In the fourth quarter, cost of goods sold totaled $5,791 million, up 13.5% year over year. Gross profit margin came in at 36.8%, contracting 810 basis points (bps) year over year.

Selling, general and administrative expenditure was up 7.4% to $146 million, while research and development expenses dipped 7.1% to $104 million, both on a year-over-year basis.

Gross profit margin for 2017 came in at 38.1%, up 230 bps year over year.

Balance Sheet/Cash Flow

Vale exited the fourth quarter with cash and cash equivalents of $4,328 million compared with $4,262 million recorded in the prior-year period. Net debt in the quarter was $18,143 million, down from $25,042 million witnessed in the year-ago period.

In the reported quarter, net cash provided from operating activities came in at $4,298 million, as against $3,685 million recorded in the year-earlier quarter. Capital spending summed $977 million, as against $1,323 million recorded in fourth-quarter 2016.

Outlook

Vale intends to boost its near-term competency on the back of improved product prices, stronger mining productivity and new growth investments. This Zacks Rank #2 (Buy) stock intends to deleverage its balance sheet by lowering debt on the back of increased cash generation.

Other Stocks to Consider

Some other well-ranked stocks within the Zacks Basic Materials sector are listed below:

The Andersons, Inc. ANDE sports a Zacks Rank #1 (Strong Buy). The company has pulled off a positive average earnings surprise of 0.62% for the last four quarters. You can see the complete list of today’s Zacks #1 Rank stocks here.

Allegheny Technologies Inc. ATI sports a Zacks Rank #1. The company has pulled off a positive average earnings surprise of 41.72% for the last four quarters.

Air Products and Chemicals, Inc. APD holds a Zacks Rank #2. The company has pulled off a positive average earnings surprise of 4.68% for the last four quarters.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Products and Chemicals, Inc. (APD) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Allegheny Technologies Incorporated (ATI) : Free Stock Analysis Report

The Andersons, Inc. (ANDE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance