Vanguard Markets & Economy Perspective: Our Investment and Economic Outlook, May 2024

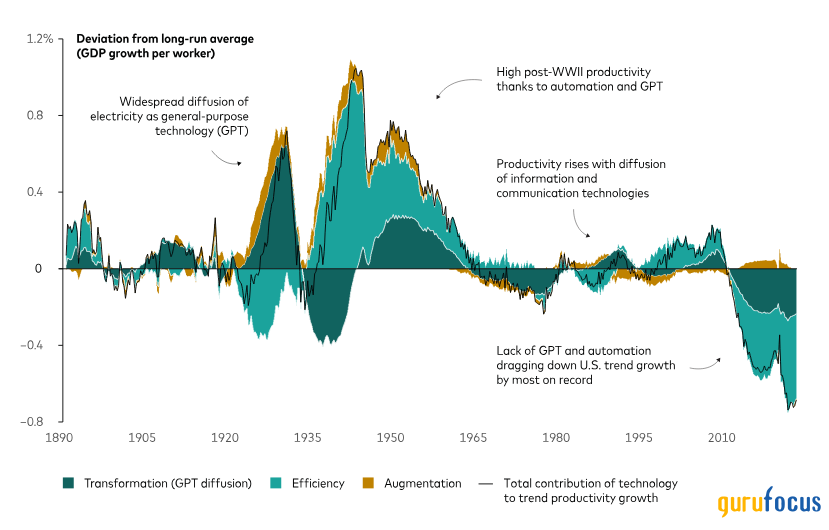

For the last decade-plus, a lack of both automation and new general-purpose technologies (GPTs) have weighed on U.S. economic growth. But new Vanguard research suggests that artificial intelligence (AI) will prove to be the next GPT, powering above-trend growth. Our forthcoming Megatrends research paper, due for release in June, discusses the importance of GPTs in driving periods of above-trend growth over the last 130-plus years.

If the AI impact approaches that of electricity, our base case is that [productivity] growth will offset demographic pressures, producing an economic and financial future that exceeds consensus expectations, Joe Davis, Vanguard global chief economist and the lead researcher, writes in this recent commentaryOpens in a new tab.

The new research harnesses a uniquely long and rich dataset that captures historical shifts in megatrends that have driven about 60% of the change in per capita GDP growth. It finds that, among megatrends that also include demographics, fiscal deficits, and globalization, only technology has been a consistent, powerful driver of not only growth but also the Federal Reserve's nominal target for short-term interest rates, inflation, and stock market valuations.

Quantifying technology's role in transforming the economy

Notes: The chart breaks down three drivers of technology: augmentation, efficiency, and transformation. Augmentation refers to technological advances where humans benefit from machines, such as personal computers and power tools, raising productivity and trend employment. Efficiency refers to advances that raise GDP per worker, usually by automating away tasks previously performed by human labor. Transformation refers to GPTs that (eventually) unleash creative destruction through the economy. Our forthcoming research quantifies the prospects of AI transforming the economy in the years ahead.

Source: Vanguard calculations, as of May 2024.

Vanguard's outlook for financial markets

We have updated our forecasts for the performance of major asset classes, based on the March 31, 2024, running of the Vanguard Capital Markets Model. Detailed projections, including annualized return and volatility estimates covering both 10- and 30-year horizons, are available in interactive charts and tablesOpens in a new tab.

Region-by-region outlook

The views below are those of the global economics and markets team of Vanguard Investment Strategy GroupOpens in a new tab as of May 15, 2024.

United States

Inflation isn't yet on a sustainable path toward the Federal Reserve's 2% target. The headline Consumer Price Index rose 3.4% year over year and 0.3% month over month in April. Core inflation, which excludes volatile food and energy prices, remained elevated, at 3.6% year over year and 0.3% month over month.

Another closely watched indicator, retail sales volumes, changed little in April compared with March. The pace of sales matters, and Vanguard will watch this indicator closely. But we continue to believe the U.S. consumer remains resilient and will be a catalyst for growth, as this recent articleOpens in a new tab discusses.

On top of a greater-than-expected rise in producer prices (0.5% month over month) in April, the data underscore our view that the Fed won't likely be in position to cut its monetary policy interest rate target (currently, 5.25%5.5%) this year.

We recently increased our forecast for 2024 core Personal Consumption Expenditures (PCE) price index inflation from 2.6% to 2.9%. The PCE is the Fed's preferred inflation measure to guide policymaking,

We continue to foresee full-year 2024 economic growth slightly above trend around 2%.

Canada

Will the Bank of Canada (BOC) begin a rate-cutting cycle next month? The Consumer Price Index (CPI) for April, which Statistics Canada is set to release on May 21, could be key. We expect the BOC to cut its overnight rate target by 25 basis points on June 5, but a rate cut could be in jeopardy if the pace of inflation rises for a second consecutive month.

As in the U.S., the last mile of inflation reduction could be the most challenging. We continue to foresee the year-over-year pace of core inflation falling by year-end into the BOC's target range of 2%2.5%. Shelter prices, up 6.5% year over year in March, remain an upside risk amid immigration-fueled population growth.

We foresee the BOC trimming its overnight policy rate by 50 to 75 basis points this year, to a year-end range of 4.25%4.5%. (A basis point is one-hundredth of a percentage point.)

We recently increased our forecast of 2024 economic growth from about 1% to a range of 1.25%1.5%. Still, restrictive monetary policy skews risks to the downside.

We forecast a year-end unemployment rate of 6%6.5% amid weak economic growth. It held steady at 6.1% in April.

Euro area

Stronger growth momentum, higher energy prices, and a more hawkish outlook for the U.S. Federal Reserve have led us to raise our outlook for the European Central Bank (ECB) deposit facility rate at year-end. We've also increased our forecasts for full-year GDP growth and core inflation.

We foresee three ECB quarter-point rate cuts this year, down from our previous outlook for five such cuts. That would leave the key monetary policy rate at 3.25% at year-end. We continue to anticipate thefirst rate cutoccurring at the ECB's June 6 meeting.

We have nudged up our year-end 2024 core inflation forecast to 2.2% from 2.1%.

We've increased our outlook for full-year economic growth to 0.8% from 0.6%.

Unemployment remained steady at 6.5%, a record low, in March and likely will end 2024 around that level. However, we believe the labor market is softer than unemployment would suggest, as job vacancy rates have receded, labor hoarding remains elevated, and the number of hours worked has stagnated.

United Kingdom

Recent signals point to an uptick in economic activity and a firming of inflation persistence, leading Vanguard to increase its outlook for 2024 GDP growth, from 0.3% to 0.7%, and its outlook for year-end core inflation, from 2.6% to 2.8%.

We continue to believe the Bank of England (BOE) will cut interest rates in August, but amid more hawkish global monetary policy developments we have dialed down our expectations for the depth of cuts this year. We anticipate a quarterly cadence of monetary policy easing, translating to two cuts in 2024 and four in 2025. That would bring the bank rate to 4.75% by year-end and 3.75% by year-end 2025.

Our higher full-year GDP forecast reflects a first-quarter recovery, which occurred amid gradually rising real incomes, loosening financial conditions, and improved activity in the euro area. However, we expect full-year 2024 growth to be below trend due to headwinds from still-contractionary monetary and fiscal policy.

As in the euro area, the labor market's gradual loosening appears mainly driven by soft factors such as reduced vacancies and fewer hours worked, rather than an increase in unemployment. We foresee a year-end 2024 unemployment rate in a range of 4%4.5%.

China

After a strong start to the year and with a four-month deflationary period apparently behind it, China's economy seems on its way to 2024 GDP growth of around 5%, the target set at a Politburo meeting two months ago. However, given continued pressure on the property sector and weak consumer confidence, we remain cautious about the sustainability of growth momentum.

Especially weak credit data make China's economic challenges hard to ignore. Total social financing, the broadest indicator of China's aggregate credit demandincluding government bonds, bank loans, and even the shadow banking systemdeclined by 200 billion yuan (28 billion U.S. dollars) in April, the first negative reading since the indicator was first tracked in 2002. For the first four months of the year, total social financing is down by nearly 20% year over year.

As part of efforts to stimulate the economy, the government on May 17 will hold the first sales of what is expected to be a 1 trillion yuan (138 billion U.S. dollars) issuance of special long-term treasury bonds. Similar bonds were issued during the 1997 Asian financial crisis, the 2008 global financial crisis, and the 2020 onset of COVID-19. The risk for structural imbalances remains, given policy priorities for investment and manufacturing upgrades over more direct measures to support consumer spending.

We foresee full-year core inflation around 1% and full-year headline inflation of 0.8%well below the 3% inflation target set by the People's Bank of China (PBOC).

To support the economy and given low levels of inflation, we expect the PBOC to ease its policy rate from 2.5% to 2.2% in 2024 and to cut banks' reserve requirement ratios. However, we expect any easing in the near-term to be marginal. The Fed's policy pause may limit room for the PBOC to ease meaningfully.

Australia

Sticky inflation continued in the first quarter, a development that the Reserve Bank of Australia (RBA) underscored in its May 7 monetary policy announcement. The RBA left its cash rate target unchanged at 4.35%, a more than 12-year-high level that has been in place for more than six months.

We forecast that core inflation will fall to 3% on a year-over-year basis by year-end, still above the midpoint of the RBA's 2%3% target range. We foresee the RBA being one of the last central banks in developed markets to cut rates, doing so only in 2025.

We expect the unemployment rate to rise to around 4.6% by year-end, as financial conditions tighten in an environment of elevated interest rates. It was 3.8% in March.

Productivity has been slow to pick up, contributing to unit labor costs growing at a rate above what would be consistent with the RBA's 2%3% inflation target and prolonging the RBA's path to eventual monetary policy easing.

We continue to expect that Australia will avoid recession in 2024, with below-trend economic growth around 1%. GDP grew by 1.5% for all of 2023. Australia's economy was last in recession in 1991.

Emerging markets

Sticky inflation and the path of U.S. policy rates have the attention of central bankers in Latin America's leading economies. On May 8, Brazil's central bank cut its key interest rate to 10.5%. Though a smaller cut than it had signaled at its previous policy meeting, it was the bank's seventh consecutive rate reduction. One day later, Mexico's central bank held rates steady, having initiated its first cut of the policy cycle a meeting earlier.

While Banco de Mexico (Banxico) maintained its 11% target for the overnight interbank rate, we have raised our outlook for Banxico's year-end policy rate by 50 basis points to a range of 9.5%10%, suggesting cuts of 100 to 150 basis points over the remainder of 2024. (A basis point is one-hundredth of a percentage point.)

We've also modestly increased our forecast for year-end core inflation in Mexico to 3.7%3.9%, largely in line with Banxico's view.

Amid continued strength in the U.S. economy, we recently upgraded our forecast of GDP growth in Mexico. U.S. demand for Mexican goods has remained strong, and domestic wages and consumption are holding up. We expect below-trend 2024 GDP growth of 1.75%2.25%.

We continue to forecast about 4% average 2024 GDP growth for emerging markets worldwide, led by growth of about 5% for emerging Asia. We anticipate growth of 2%2.5% for emerging Europe and Latin America, though U.S. growth could have positive implications for Mexico and all of Latin America.

Notes:

All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance