‘I’ve lost my job and my house, but my wife and I are worth £650m – how can we pay less tax?’

Would you like to be featured in Money Makeover? Email money@telegraph.co.uk, let us know what your financial goals are and receive free guidance worth hundreds of pounds.

Rishi Sunak, 44, finds himself in a bind. After a highly successful career in the City of London, followed by a brief but eventful spell in politics, he has suffered a serious demotion and been evicted from his home.

He will still earn his MP’s salary, worth about £91,000, but he may now be wondering about his next steps.

On the plus side, Mr Sunak and his wife are worth £651m. Their property portfolio includes a $7.2m (£5.6m) penthouse apartment in California and a Grade-II listed Georgian manor house tucked away in the North Yorkshire hills.

Add to this the £115,000 a year that a former prime minister is entitled to claim to run their office, and there’ll be no need for Mr Sunak to pawn his Star Wars collectibles.

There is potentially the offer of work in Silicon Valley, the home of America’s technology giants, though this would involve moving the family and come with tax implications.

We asked two financial experts how Mr Sunak could make the most of the opportunities now afforded to him.

Charlene Young, pensions and savings expert at AJ Bell, says:

Mr Sunak, your former role was paying just shy of £167,000 a year, split between MP earnings and a ministerial salary. This included a sum for the use of Downing Street, taxed as a benefit in kind.

That represents a significant income gap to fill, but one that was dwarfed by the amount of income and gains attributed to your investment in a US-based investment fund.

Although the amounts are not distributed to you, you’ll continue to be taxed on them. Your UK capital gains tax bill alone for the 2022-23 tax year was £359,240, which could prove another significant drain on cash each year.

You’ve mentioned that a move to the US could be on the cards, should you choose to walk away from your constituency job, but it’s unclear if you’re going for a hard exit or something softer that means you’ll keep a foot in UK public life.

The “public duty costs allowance” allows former prime ministers to claim £115,000 towards the costs of continuing to fulfil public duties. This could be staffing and administration costs of managing an office and support with visits and similar activities.

This maximum allowance (set by the Independent Parliamentary Standards Authority) has been frozen since 2011, meaning claimants also get a taste of frozen allowances in the face of rising costs – much like the rest of the UK population.

The allowance would not be subject to UK income tax, and it would appear that it’s not income under US tax rules either. Although you should seek advice from a specialist in the US.

Unfortunately, there’s no longer a special pension for ex-prime ministers leaving office, but you’ll have joined and have been paying into the Parliamentary Contributory Pension Fund when you became an MP in 2015. There’s also a section for ministers so you’ll be eligible for a pension from both.

The good news is that this plan is a “defined benefit” scheme that builds up at a rate of 1/51st of your pensionable earnings in a year for the MP section and 1/56th for the ministerial section.

You’re still some way off the scheme retirement age (currently 65 for most), but on retirement you’ll get a pension for life with inflation protection and the chance to take some of it as a tax-free lump sum. How and where the pension is taxed will depend on your tax residency at the time.

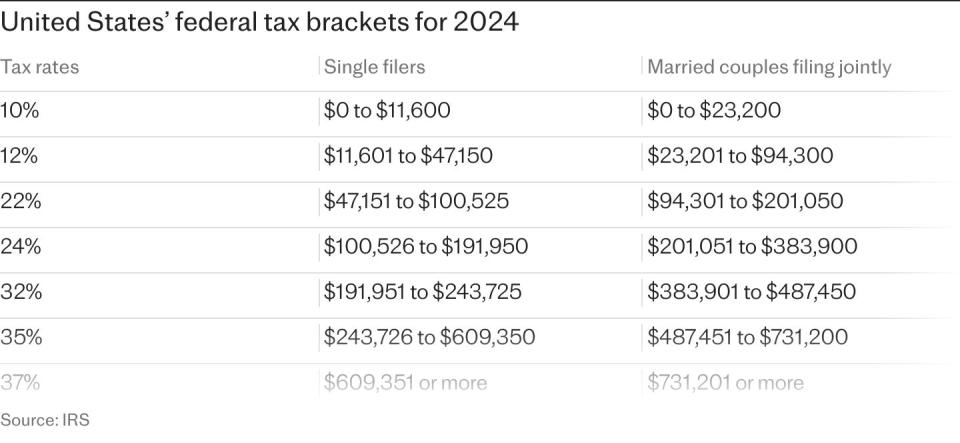

Although the UK-US tax treaty is in place to prevent double taxation, worldwide income is usually in scope for US tax residence, as well as additional paperwork and reporting. As a former green card holder, you’ll be familiar with filing US tax returns to account for your worldwide income at that time.

Making use of exemptions and tax allowances like Isas is usually top of the list of suggestions for minimising tax, but Isas are not recognised as tax-free in the US, which could also have implications for any junior Isas you might hold for your children.

Any gift you receive from a non-US tax residence is also reportable if it’s over $100,000 (£79,000) in a tax year – which could be important if your wife was looking to give money or assets to you.

Although you’ll no longer be able to live at 10 Downing Street, you could choose a UK home from your property portfolio.

In the US, you and your wife have a property in California, which could prove a handy base if you do relocate. But you’d need to decide what to do with your UK properties or how to make them work for you within the tax rules.

For example, anyone selling their UK main residence while a UK resident gets an exemption from capital gains tax, thanks to the “principal private residence” relief. For US tax residents though, the exemption is only up to $250,000 per person on the sale of a main residence.

If you wanted to rent out your UK properties while living in the US, you should be aware of the “non-resident landlord scheme”, which taxes the UK rental income of people whose “usual place of abode” is outside the UK. Tax is deducted by your letting agent or anyone who manages a property for a non-UK resident, and paid to HMRC.

David Denton, technical consultant at Quilter Cheviot, says:

After losing his job as prime minister, Mr Sunak might find himself wanting to start a new life stateside. With a property portfolio worth millions, spread across multiple jurisdictions, and a substantial annual allowance to cover public duties he needs to navigate any move carefully to mitigate against a significant tax bill.

The UK and US both have predominantly “common law” legal systems, and tax those considered as tax residents on a worldwide basis. They have a common “double tax agreement” including an agreement for UK inheritance tax and US federal estate tax. This is just as well, given they represent two of the longest and most complex tax codes in the world.

But there are far more differences than similarities, leaving ample scope for jeopardy for wealthy arrivers in the US who haven’t taken pre-arrival advice.

Unlike the UK, the US doesn’t have a similar (possibly now short-lived) “non-dom” regime, and tax-efficient structures embraced in the UK, from Isas to enterprise investment schemes, don’t have similar benefits in the US.

Worse than that, most investments accessed outside the US when stateside will be considered “passive foreign investment companies” – which normally results in additional reporting and punitive taxation.

Historic and exacting anti-avoidance legislation might also capture foreign trusts and even straightforward owned and controlled UK companies. So this is an area Mr Sunak will need to be mindful of.

The choice of state to live in is also relevant given the absence of state income taxes in some, and a variety of levels in others. For example, California is known for its high state income tax, whereas some states such as Texas and Florida don’t have state income tax at all.

However, there is one sizable benefit for a wealthy family moving permanently to the US. The UK nil-rate band for inheritance tax, frozen in value since 2009, languishes at £325,000 per person.

But Donald Trump doubled the estate and gift tax exemption for the US equivalent, estate tax. It has continued to grow to a massive $13.61m per person in 2024.

However, even here pre-arrival considerations may be critical, as gifts by a UK domicile can be unlimited, though subject to a seven-year tail. For a US citizen, a gift might only be tax-free (subject to an annual de-minimis) within the aforementioned limit.

Yahoo Finance

Yahoo Finance