Veeva Systems (VEEV) Q1 Earnings Beat Estimates, Margins Up

Veeva Systems, Inc. VEEV reported adjusted earnings per share (EPS) of $1.50 for the first quarter of fiscal 2025, which increased 64.8% from the year-ago figure of 91 cents. Adjusted EPS surpassed the Zacks Consensus Estimate by 4.9%.

GAAP EPS in the fiscal first quarter was 98 cents, up 20.9% from the year-ago period’s 81 cents.

Revenues

For the quarter, the company’s revenues totaled $650.3 million, outpacing the Zacks Consensus Estimate by 1.3%. On a year-over-year basis, the top line improved 23.6%.

The fiscal first-quarter top line was driven by Veeva Systems’ robust segmental performance.

Segmental Details

Veeva Systems derives revenues from two operating segments — Subscription services and Professional services and other.

In the fiscal first quarter, Subscription services revenues improved 28.8% from the year-ago quarter to $533.9 million. Per management, this uptick was driven by both its established and newer solutions. Our projection for fiscal first-quarter revenues was $528.6 million.

Professional services and other revenues were up 4.1% year over year to $116.4 million, primarily resulting from strong demand for Veeva Business Consulting services. Our projection for fiscal first-quarter revenues was $112.5 million.

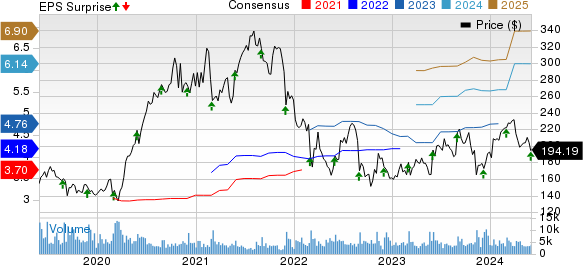

Veeva Systems Inc. Price, Consensus and EPS Surprise

Veeva Systems Inc. price-consensus-eps-surprise-chart | Veeva Systems Inc. Quote

Margin Details

In the quarter under review, Veeva Systems’ gross profit improved 32.5% to $476.5 million. The gross margin expanded 493 basis points (bps) to 73.3%.

We had projected 70.9% of gross margin for the fiscal first quarter.

Sales and marketing expenses rose 9.9% to $97.3 million. Research and development (R&D) expenses went up 10.7% year over year to $162.7 million, while general and administrative expenses declined 2.2% to $61.3 million. Total operating expenses of $321.3 million increased 7.8% year over year.

Operating profit totaled $155.2 million, which increased 152.2% from the prior-year quarter. The operating margin in the fiscal first quarter expanded a huge 1217 bps to 23.9%.

We had projected a 20.8% operating margin for the fiscal first quarter.

Financial Position

The company exited first-quarter fiscal 2025 with cash and cash equivalents and short-term investments of $4.77 billion compared with $4.03 billion at fiscal 2024-end.

Net cash provided by operating activities at the end of the quarter was $763.5 million compared with $505.9 million a year ago.

Guidance

Veeva Systems has revised its financial outlook for fiscal 2025 and provided its estimates for the second quarter of fiscal 2025.

For the quarter, the company expects total revenues between $666 million and $669 million. The Zacks Consensus Estimate is currently pegged at $673.7 million.

Subscription revenues and Professional services and other revenues are estimated to be approximately $554 million and $112 million-$115 million, respectively, for the fiscal second quarter.

Adjusted EPS is projected between $1.53 and $1.54. The Zacks Consensus Estimate is pegged at $1.51.

Veeva Systems now expects revenues for fiscal 2025 between $2,700 million and $2,710 million, lower than the earlier outlook of $2,725 million and $2,740 million. The Zacks Consensus Estimate is currently pegged at $2.73 billion.

Subscription revenues are now expected to be $2,245 million, lower than the previous outlook of $2,250 million. This consists of Commercial Solutions’ subscription revenues of around $1,080 million (up from the prior outlook of $1,068 million) and R&D Solutions’ subscription revenues of approximately $1,165 million (lower than the previous outlook of $1,182 million).

Professional services and other revenues for fiscal 2025 are now expected to be between $455 million and 465 million, lower than the earlier guidance of $475 million and $490 million.

Adjusted EPS for the year is continued to be expected at $6.16. The Zacks Consensus Estimate is pegged at $6.14.

Our Take

Veeva Systems exited the first quarter of fiscal 2025 with better-than-expected results. The uptick in the overall top line and bottom line and robust performance by both segments during the quarter were impressive. The company continues to benefit from its flagship Vault platform, which is encouraging. In Veeva Vault Quality, VEEV added 15 Vault QualityDocs customers, including a large, multinational contract development and manufacturing organization, as they modernize operations and continue to scale. The company also released Vault Basics, a new offering for emerging biotechs.

VEEV saw broad-based adoption in all areas of Development Cloud, including significant top 20 biopharma wins spanning multiple products during the quarter. The expansion of both margins bodes well.

On the flip side, management’s expectations of lower total revenues for fiscal 2025 raise our apprehension. It also sounded cautious on the earnings call about the persistent overall macroeconomic challenges and uncertainties resulting from inflation, higher interest rates, global conflicts and political instability, among others. This does not bode well for the stock.

Zacks Rank and Key Picks

Veeva Systems currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, ResMed Inc. RMD and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted EPS of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

ResMed reported third-quarter fiscal 2024 adjusted EPS of $2.13, beating the Zacks Consensus Estimate by 10.9%. Revenues of $1.19 billion surpassed the Zacks Consensus Estimate by 1.9%. It currently carries a Zacks Rank #2.

ResMed has a long-term estimated growth rate of 13.2%. RMD’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Veeva Systems Inc. (VEEV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance