Vertical Software Stocks Q1 Highlights: 2U (NASDAQ:TWOU)

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the vertical software industry, including 2U (NASDAQ:TWOU) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 16 vertical software stocks we track reported a slower Q1; on average, revenues beat analyst consensus estimates by 0.9%. while next quarter's revenue guidance was 2.3% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, and vertical software stocks have held roughly steady amidst all this, with share prices up 0.1% on average since the previous earnings results.

2U (NASDAQ:TWOU)

Originally named 2tor after the founder's dog Tor, 2U (NASDAQ:TWOU) provides software for universities and colleges to deliver online degree programs and courses.

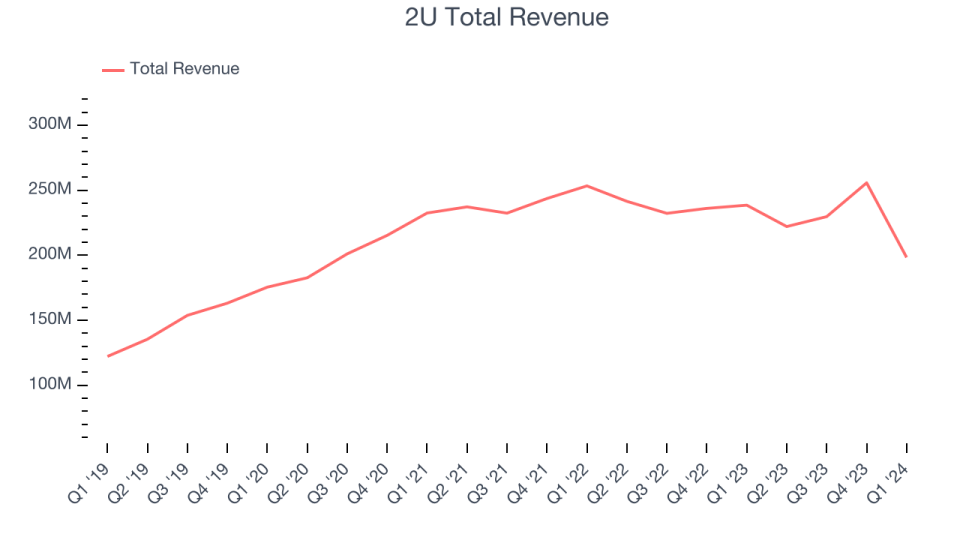

2U reported revenues of $198.4 million, down 16.8% year on year, topping analysts' expectations by 1.3%. It was a mixed quarter for the company, with a solid beat of analysts' billings estimates but a decline in its gross margin.

"With our leading position in the education industry, 2U has a significant opportunity to respond to and support the current technology moment, where advances in generative AI are driving strong demand for workforce development," said Paul Lalljie, Chief Executive Officer of 2U.

2U delivered the slowest revenue growth of the whole group. The stock is down 28.1% since the results and currently trades at $5.85.

Read our full report on 2U here, it's free.

Best Q1: Toast (NYSE:TOST)

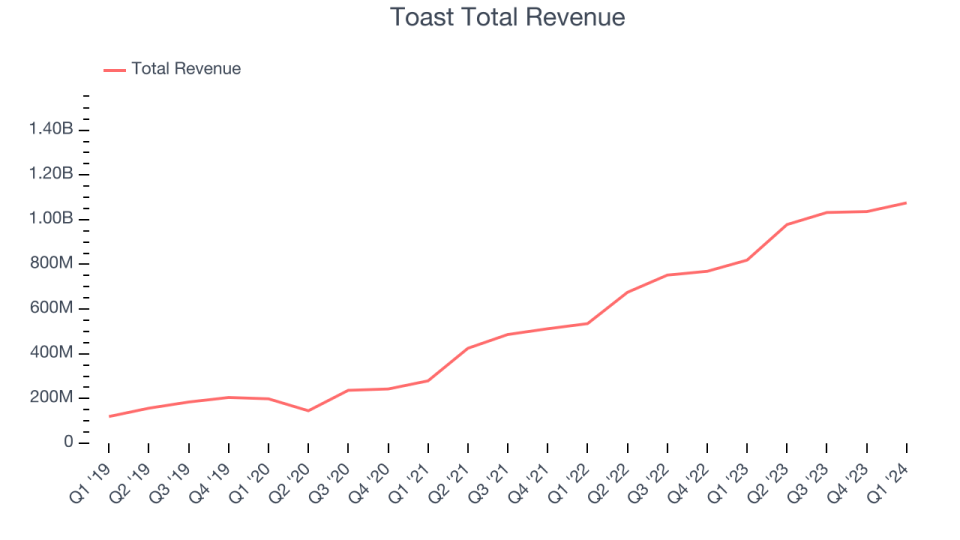

Founded by three MIT engineers at a local Cambridge bar, Toast (NYSE:TOST) provides integrated point-of-sale (POS) hardware, software, and payments solutions for restaurants.

Toast reported revenues of $1.08 billion, up 31.3% year on year, outperforming analysts' expectations by 3.3%. It was a very strong quarter for the company, with a significant improvement in its gross margin and a solid beat of analysts' billings estimates.

Toast pulled off the fastest revenue growth among its peers. The stock is up 7.4% since the results and currently trades at $25.49.

Is now the time to buy Toast? Access our full analysis of the earnings results here, it's free.

Weakest Q1: ANSYS (NASDAQ:ANSS)

Used to help design the Mars Rover, Ansys (NASDAQ:ANSS) offers a software-as-a-service platform that enables simulation for engineering and design.

ANSYS reported revenues of $466.6 million, down 8.4% year on year, falling short of analysts' expectations by 15.9%. It was a weak quarter for the company, with a decline in its gross margin and a miss of analysts' average contract value estimates.

ANSYS had the weakest performance against analyst estimates in the group. The stock is up 1.1% since the results and currently trades at $324.88.

Read our full analysis of ANSYS's results here.

Autodesk (NASDAQ:ADSK)

Founded in 1982 by John Walker and growing into one of the industry's behemoths, Autodesk (NASDAQ:ADSK) makes computer-aided design (CAD) software for engineering, construction, and architecture companies.

Autodesk reported revenues of $1.42 billion, up 11.7% year on year, surpassing analysts' expectations by 1.3%. It was a weaker quarter for the company, with a miss of analysts' billings estimates.

The stock is up 15.3% since the results and currently trades at $243.93.

Read our full, actionable report on Autodesk here, it's free.

PTC (NASDAQ:PTC)

Used to design the Airbus A380 and Boeing 787 Dreamliner commercial airplanes, PTC’s (NASDAQ:PTC) software-as-service platform helps engineers and designers create and test products before manufacturing.

PTC reported revenues of $603.1 million, up 11.2% year on year, surpassing analysts' expectations by 4.6%. It was a slower quarter for the company, with full-year revenue guidance missing analysts' expectations.

The stock is up 0.7% since the results and currently trades at $176.03.

Read our full, actionable report on PTC here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance