Virtus Investment Partners Inc (VRTS) Q1 2024 Earnings: Mixed Results Amid Market Challenges

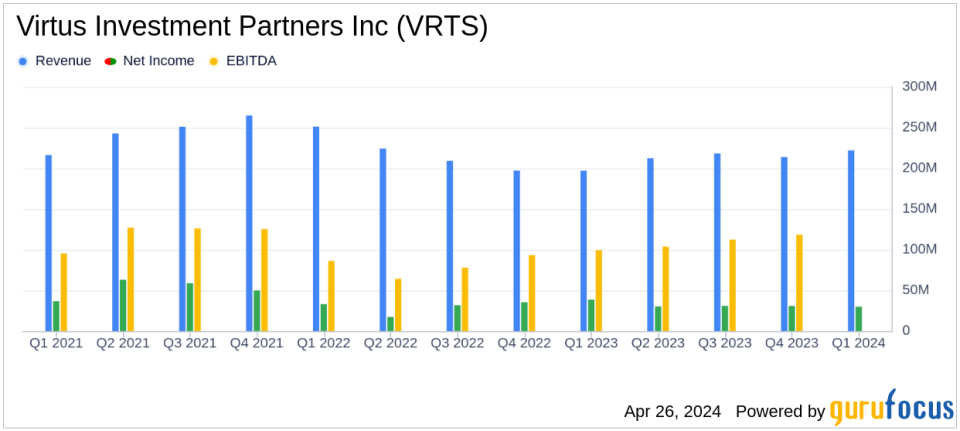

Earnings Per Share (EPS): Reported a diluted EPS of $4.10, falling short of the estimated $5.41.

Revenue: Achieved $222.0 million, surpassing the estimated $204.83 million.

Net Income: Recorded at $29.9 million, below the estimated $39.22 million.

Operating Income: Totaled $32.3 million for the quarter, reflecting a decline of 17% from the previous quarter.

Assets Under Management (AUM): Increased to $179.3 billion, up 4% from the end of the previous quarter.

Total Sales: Rose to $7.6 billion, marking a 22% increase from the previous quarter.

Net Flows: Improved to ($1.2) billion from ($3.8) billion in the prior quarter, indicating better retention and acquisition of assets.

Virtus Investment Partners Inc (NYSE:VRTS), a prominent asset management firm, disclosed its financial outcomes for the first quarter of 2024 on April 26, 2024. The company's financial performance showcased a blend of growth in revenue but a decline in net income compared to the previous year. The detailed earnings can be explored in their recent 8-K filing.

Virtus Investment Partners operates primarily in the United States, offering a range of investment management and related services through its diverse suite of products including mutual funds, exchange-traded funds, and variable insurance funds. The firm generates revenue primarily through investment management fees, supplemented by distribution and service fees.

Financial Highlights and Performance Analysis

For Q1 2024, Virtus reported a diluted earnings per share (EPS) of $4.10, with an adjusted EPS of $5.41, aligning precisely with analyst estimates. However, this represents a 21% decrease from the $5.21 EPS reported in Q1 2023. The firm achieved revenues of $222.0 million, marking a 12% increase from $197.9 million in the prior year and surpassing the estimated $204.83 million. This revenue growth reflects higher average assets under management, which were reported at $173.4 billion, up 14% from the previous year.

Despite the revenue upswing, net income attributable to Virtus Investment Partners decreased by 23% year-over-year to $29.9 million, falling short of the estimated $39.22 million. This decline was primarily due to increased operating expenses, which rose by 12% from the previous year to $189.7 million, driven by higher employment costs and variable incentive compensation.

Asset Management and Sales Dynamics

The firm's total assets under management (AUM) stood at $179.3 billion as of March 31, 2024, a 16% increase from the previous year. This growth was fueled by positive market performance and net inflows in retail separate accounts, though partially offset by outflows in institutional accounts and open-end funds. Total sales surged by 22% to $7.6 billion, driven by robust institutional and retail separate account sales.

Operational Efficiency and Challenges

The operating margin slightly improved to 14.5% from 14.4% in the previous year. However, the adjusted operating margin saw a decline to 28.2% from 33.0% in the previous quarter, reflecting the impact of seasonal employment expenses. This underscores the challenges of managing costs effectively in a fluctuating market environment.

Strategic Moves and Shareholder Returns

During the quarter, Virtus continued to return value to shareholders, repurchasing 21,108 shares for $5.0 million and settling an additional 42,588 shares for $9.9 million. The firm's approach to capital management reflects its commitment to enhancing shareholder value amidst market dynamics.

Looking Forward

As Virtus Investment Partners navigates through the evolving financial landscape, the firm remains focused on leveraging its diverse asset management portfolio to meet the varying needs of its clients. The alignment of its Q1 earnings with analyst projections, coupled with a strategic approach to asset and capital management, positions Virtus to potentially capitalize on market opportunities and address the ongoing challenges in the asset management sector.

For detailed financial figures and operational insights, investors and stakeholders are encouraged to review the full earnings release available on the Virtus website and the SEC filing.

Explore the complete 8-K earnings release (here) from Virtus Investment Partners Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance