Visa (V) Trading Below 50-Day SMA: A Sign to Exit Your Position?

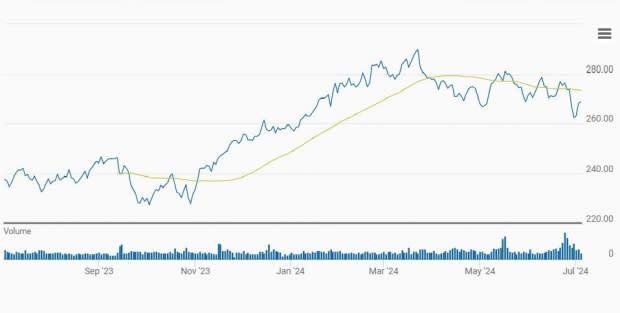

Visa Inc. V is currently trading below its 50-day simple moving average (SMA), with the stock priced at $268.99 compared to the 50-day SMA of $273.31, representing a downtrend. The 50-day SMA is a widely used technical analysis tool to predict future price trends by analyzing historical price data.

V 50-Day SMA

Image Source: Zacks Investment Research

The stock has dropped 2.9% compared with the industry’s 1.3% decline in the past month. The S&P 500 has gained 3.6% in the same time frame. Currently, the stock is down 7.6% from its 52-week high of $290.96.

1-Month Price Performance

Image Source: Zacks Investment Research

This payment technology giant, with a market cap of almost $492 billion, is favored by long-term investors who appreciate dividend growth stocks. However, its dividend yield of 0.77% is currently below the industry average of 0.80%.

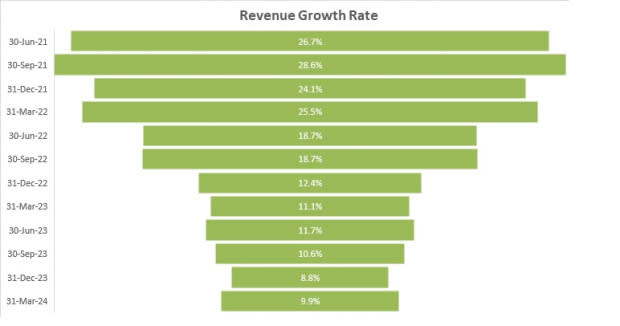

Revenue Growth Rate Cooling Down?

Visa has shown consistent revenue growth, strong financial performance and a history of beating earnings estimates. However, its revenue growth rate has fallen to single digits in the last two quarters from double digits. Further, the Zacks Consensus Estimate for the current quarter and current year revenues indicate 9.7% and 9.8% year-over-year growth, respectively.

Image Source: Zacks Investment Research

Despite challenges such as a high interest rate environment, a more than average inflation level and waning concerns about an economic slowdown, Visa is expected to grow due to resilient consumer spending, increasing cross-border volumes and strong e-commerce trends. Rising payments volume and processed transactions are set to boost profits, with the Zacks Consensus Estimate for current year earnings indicating a 13.3% year-over-year increase. It beat earnings estimates in each of the past four quarters, with an average surprise of 3.4%.

Will Regulatory Hurdles Impact Margins?

Its business might face some regulatory hurdles, which can affect the growth rate, at least in the short run. Ongoing and potential legal battles, including some lawsuits, could lead to financial liabilities and increased competition. The Credit Card Competition Act of 2023, which is designed to introduce more competition into the credit card network market and reduce costs for merchants, may also affect V’s growth rate.

Another major payment company, Mastercard Incorporated MA, is also the target of the bill, where the congress intends to curb the duopoly these two companies are enjoying now (outside the Eastern Hemisphere, where UnionPay dominates).

Visa and Mastercard are estimated to have control over 80% of the U.S. credit card market. To counter the situation, the bill will likely increase competition through the usage of alternative credit card processing networks. This is expected to increase the decision-making power of the merchants. Currently, both companies are facing multiple lawsuits over merchant fees in different regions.

Last month, U.S. District Judge Margo Brodie of the Eastern District of New York rejected a $30 billion settlement and suggested that these companies could likely withstand a "substantially greater" settlement. This will likely leave room for further litigation or a new settlement.

Some analysts also think that Visa has a new competitor now, the Fed. In July 2023, the U.S. Federal Reserve System brought its FedNow service online, a cloud-based real-time gross settlement system enabling instant payments. By the end of 2023, more than 300 banks joined the system and the number rose to 400 early this year.

The regulatory scrutiny and legal battles are making some investors cautious. Also, if the competition in the market is enforced by law, and swipe fees decline or are capped in favor of the merchants, it might impact Visa’s business operations and profit growth.

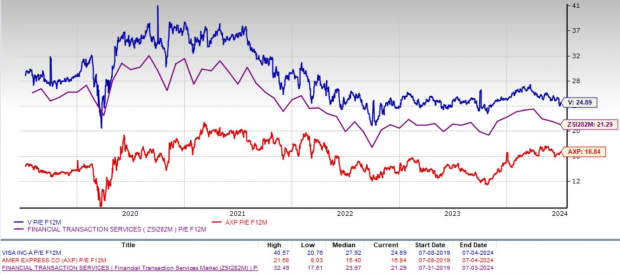

Is the Stock Overvalued?

Visa's P/E ratio indicates that it is overvalued compared to industry peers, which could limit short-term gains, making it less attractive than other investment opportunities. The company currently carries a Zacks Rank #4 (Sell) and is trading at 24.89X forward 12-month earnings compared to the industry average of 21.29X. This premium valuation suggests that it might be a good time for profit-taking. In comparison, its peer, American Express Company AXP, is growing thanks to increasing card member spending and is trading at 16.84X.

Valuation Comparison

Image Source: Zacks Investment Research

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Final Thoughts

Investors are expected to benefit from weighing these factors against Visa's long-term potential and their own investment strategy before making a decision. For long-term investors, Visa's stability, market position and growth prospects make it a compelling stock to retain in the portfolio. However, if you're seeking short-term gains or are concerned about overvaluation, regulatory hurdles and the potential of increased competition, it may be prudent to consider other investment options.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance