Vodafone in talks with Openreach over big investment in ultrafast UK broadband

Vodafone is in talks with BT’s network subsidiary Openreach about a groundbreaking joint investment in new ultrafast fibre-optic broadband for British cities.

The two companies are in what are described by industry sources as “early but serious” discussions about combining their financial strength to build large-scale new infrastructure to replace ageing copper telephone lines.

It is understood Vodafone plans to target the upgrades at major metropolitan areas initially, to allow it to provide faster and more reliable broadband to swathes of homes and businesses quickly.

The proposed joint investment has uncertain costs, with the price of new lines falling and under negotiation, but could run into billions of pounds over time. It would signal a radical shift in Britain’s telecoms industry.

Previously the only large-scale infrastructure investors have been Openreach - which provides regulated wholesale access to its network to BT’s rivals including Vodafone, Sky and TalkTalk - and Virgin Media.

The cable operator is the only retailer of broadband via its network and is currently able to trade on its speed advantage over the Openreach network. Large-scale investment in cities by Vodafone and Openreach could threaten Virgin Media by leapfrogging its technology.

It could also kill off speculation that Vodafone could one day merge with Virgin Media’s parent company Liberty Global, or hand its UK mobile operation over in exchange for cable assets in Europe.

Sources said the regulations faced by Openreach were currently viewed as a potential hurdle to a joint investment with Vodafone.

Under rules set by Ofcom, the former state telecoms monopoly must sell access to its network on equal terms to all retailers including BT’s consumer arm. Vodafone is understood to be demanding a period of exclusivity over any new infrastructure, however, to allow it to build its position in the market.

It is understood that Openreach and Ofcom have held early talks over how the regulations could be relaxed to allow Vodafone to invest. The operator could have sole use of new broadband lines at first, for instance, and access to faster speeds than rivals once the infrastructure is opened up to competition.

Sources suggested that given pressure from the Government for Britain to catch up with European economies with better internet infrastructure, Ofcom was likely to be flexible.

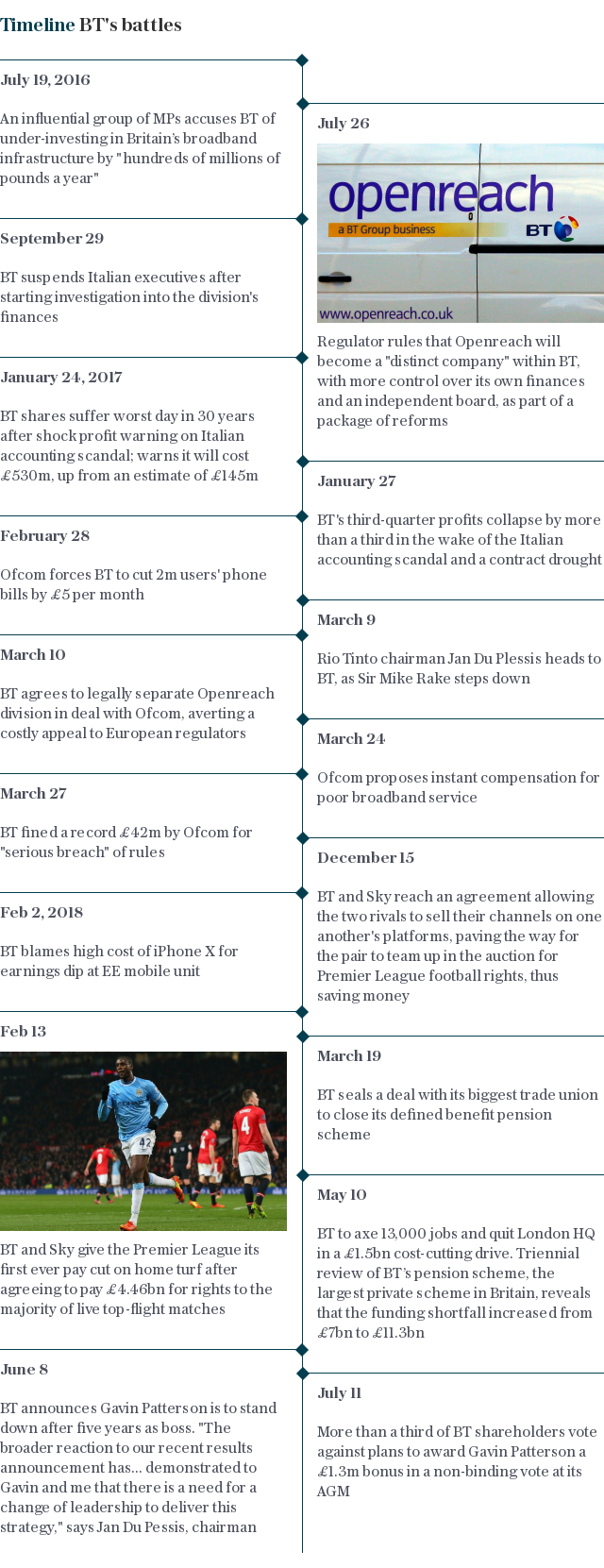

The talks have been spurred by Openreach’s new independence. After a long row with the regulator, BT agreed this year to make it a legally separate subsidiary with its own board and more autonomy to conduct confidential discussions with industry players.

Vodafone chief executive Vittorio Colao is a longstanding advocate of joint investment and has ploughed billions into projects with Portugal Telecom and Orange in Spain, among others.

As BT battled Ofcom two years ago, he said: “We would be prepared to put some equity in a vehicle that could deliver fibre at good conditions to us and also to others, whether that is an independent Openreach or another company.

“If the investment is big, it is much better to share and then compete at the level of service.”

Openreach’s bilateral discussions with Vodafone are taking place alongside a wider industry consultation on the appetite for ultrafast broadband.

Openreach has so far committed to building two million fibre-optic lines but has said it would like to get to 10 million by 2025 if retailers agree to abandon their old technology.

Sky sources said it was understood to be exploring a “take or pay” approach to fibre-optic upgrades. It would identify postcodes where it is ready to abandon copper telephone lines and deliver pay-TV over the internet, giving Openreach more confidence to invest. If Sky failed to use the new infrastructure, it would be liable to pay a penalty.

Vodafone has seized on the opportunity to become more deeply involved and share the heavy cost of fibre-optic upgrades in its home territory after arriving late to the broadband market. It has around 250,000 subscribers compared with millions for its main rivals.

Becoming an infrastructure owner and early leader in ultrafast services is viewed by the company as one way to address the problem. Fibre-optics are also expected to become more important to its mobile network as it is upgraded to 5G technology requiring more masts in the next few years.

An Openreach spokesperson said: “We’ve said before that a new, more independent Openreach is open to co-investment models.”

“We’re currently consulting with all of our wholesale customers on the case for a large-scale ‘full fibre’ broadband network. As part of this we’re asking about their potential interest in different forms of commitment to new Fibre-to-the-Premises infrastructure, including co-investment.

“As with all our consultation processes, responses are confidential.

“We’re optimistic that this approach will lead to greater openness and collaboration across our industry, which will in turn achieve better outcomes for connected homes, businesses and people throughout Britain.”

Vodafone declined to comment.

Yahoo Finance

Yahoo Finance