Wabtec (WAB) Q1 Earnings & Revenues Beat, 2024 EPS View Up

Wabtec Corporation WAB reported first-quarter 2024 earnings (excluding 36 cents from non-recurring items) of $1.89 per share, which surpassed the Zacks Consensus Estimate of $1.49. The bottom line improved 47.66% year over year owing to higher sales.

Revenues of $2.50 billion surpassed the Zacks Consensus Estimate of $2.35 billion. The top line grew 13.81% year over year due to higher sales of the Freight and Transit segments.

Total operating expenses in the reported quarter increased by $14 million to $403 million. The operating ratio (operating expenses as a percentage of revenues) improved to 16.2% from the year-ago quarter figure of 17.7%. A lower value of the metric is preferable.

The adjusted operating margin increased 3.4 points to 19.8%. The operating margin benefited from higher sales and improved price/mix and productivity.

During the March quarter, WAB generated cash from operations of $334 million compared with cash used for operations of $25 million a year ago. The improvement was due to higher earnings and improved working capital management.

WAB exited the quarter with cash, cash equivalents and restricted cash of $639 million and a total debt of $4 billion. In the first quarter of 2024, WAB’s total available liquidity was $2.13 billion. WAB repurchased shares worth $175 million in the March quarter, apart from paying dividends worth $36 million.

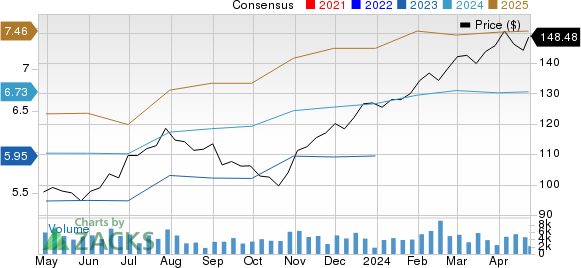

Westinghouse Air Brake Technologies Corporation Price and Consensus

Westinghouse Air Brake Technologies Corporation price-consensus-chart | Westinghouse Air Brake Technologies Corporation Quote

Segmental Highlights

Freight net sales of $1.8 billion exceeded our expectations of $1.7 billion. Results were boosted by the strong performance of Equipment and Services. Freight operating margin increased to 20.2% from 14.5% in the first quarter of 2023.

In the Transit segment, net sales grew 5.5% year over year to $673 million due to strong aftermarket sales. The actual segmental sales figure was higher than our projection of $659 million. The segmental adjusted operating margin decreased to 12.7% from 12.9% in the first quarter of 2023.

2024 Guidance

Wabtec now expects sales in the $10.25-$10.55 billion band. The midpoint of the guided range, i.e., $10.3 billion, is above the Zacks Consensus Estimate of $10.14 billion. The earlier guidance was in the band of $10.05-$10.35 billion.

Adjusted earnings per share are now estimated to be between $7.00 and $7.40. The midpoint of the guided range, i.e., $7.2, is above the Zacks Consensus Estimate of $6.73. The earlier guidance was in the $6.50-$6.90 range. Management anticipates strong cash flow generation, with operating cash flow conversion exceeding 90%.

Currently, Wabtec carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Q1 Performances of Some Other Transportation Companies

Delta Air Lines’ DAL first-quarter 2024 earnings (excluding 39 cents from non-recurring items) of 45 cents per share comfortably beat the Zacks Consensus Estimate of $0.36 and improved 7.75% year over year.

Revenues of $13.75billion surpassed the Zacks Consensus Estimate of $12.84 billion and increased 7.75% on a year-over-year basis. Adjusted operating revenues (excluding third-party refinery sales) came in at $12.6 billion, up 6% year over year.

United Airlines UAL reported a first-quarter 2024 loss (excluding 23 cents from non-recurring items) of 15 cents per share, narrower than the Zacks Consensus Estimate of 53 cents and improved 76.19% year over year.

Operating revenues of $12.54 billion beat the Zacks Consensus Estimate of $12.43 billion. The top line increased 9.71% year over year due to upbeat air travel demand. Cargo revenues fell 1.8% year over year to $391 million. Revenues from other sources jumped 10.3% year over year to $835 million.

J.B. Hunt Transport Services’ JBHT first-quarter 2024 earnings per share of $1.22 missed the Zacks Consensus Estimate of $1.53 and declined 35.45% year over year.

Total operating revenues of $2.94 billion lagged the Zacks Consensus Estimate of $3.12 billion and fell 9% year over year. Total operating revenues, excluding fuel surcharge revenues, decreased approximately 6.5% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance