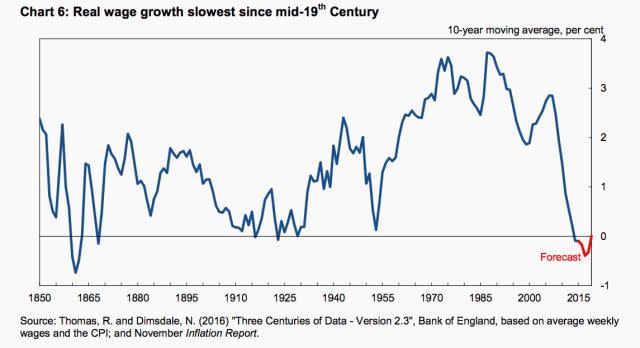

Wage growth in the UK hasn’t been this bad since the 1860s

The UK is mired in its “first lost decade since the 1860s,” according to Bank of England governor Mark Carney.

How so? Behold:

“Over the past decade real earnings have grown at the slowest rate since the mid-19th century,” Carney said in a remarkably candid speech in the north of England this week. Politicians and economists need to recognize that trade and open markets haven’t benefitted everyone directly, he added. While the economy has benefited as a whole from trade, technology, and post-crisis monetary stimulus, too few people are sharing in the prosperity.

No one alive today has ever experienced this kind of wage stagnation before, and won’t improve any time soon. Next year, Brexit-linked inflation is expected to overtake wage growth once again, ending a fleeting period of above-inflation pay rises.

The Institute of Fiscal Studies, the UK’s official fiscal watchdog, warned last month (pdf) that real wage growth in 2021 will still be lower than it was in 2008. “One cannot stress enough how dreadful that is,” said Paul Johnson, director of the IFS.

In times of slow growth, the distribution of income becomes even more contentious. For the young, the “lost decade” is particularly wrenching. Since 2007, people aged 22 to 30 have seen their inflation-adjusted income fall by 7%, while people over 60 have enjoyed an 11% rise over the same period.

Sign up for the Quartz Daily Brief, our free daily newsletter with the world’s most important and interesting news.

More stories from Quartz:

Yahoo Finance

Yahoo Finance