Walgreens Boots (WBA) Benefits From Innovation Amid Margin Woe

Walgreens Boots' WBA various strategic partnerships are expected to benefit the company over the long run. However, the prevailing tough macroeconomic environment might hamper the company’s margin. The stock carries a Zacks Rank #3 (Hold).

Walgreens exited first-quarter fiscal 2023 with better-than-expected earnings and revenues. The company’s U.S. Healthcare business grew, led by key contract wins, continued partnership growth and a strong focus on execution. The company achieved the calendar-year 2022 target for co-located VillageMD clinics of 200.

The company continues to play a leading role in COVID-19 vaccinations and testing, administering 8.4 million vaccinations in the reported quarter. Walgreens raised its U.S. Healthcare target in November, including the fiscal 2025 sales goal of $14.5-$16.0 billion, up from $11.0-$12.0 billion previously. Moreover, the company raised its 2023 sales guidance, reflecting continued growth momentum.

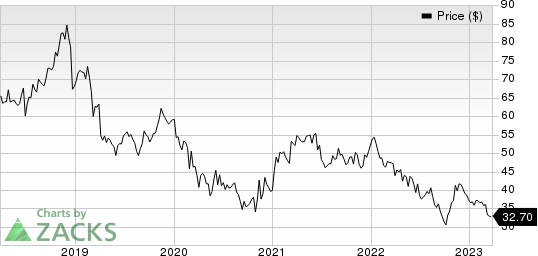

Walgreens Boots Alliance, Inc. Price

Walgreens Boots Alliance, Inc. price | Walgreens Boots Alliance, Inc. Quote

During the first-quarter fiscal 2023 earnings update, Walgreens stated that it has launched 24-hour same-day delivery, offering the widest range of retail items for around-the-clock delivery across the country. This adds to the company’s broad range of channel access, including one-hour delivery and 30-minute pickup.

In June 2022, Walgreens launched its clinical trial business to redefine the patient experience and bolster access and retention in sponsor-led drug development research. In March 2022, the company, in collaboration with Laboratory Corporation of America Holdings, announced the nationwide availability of “Pixel by LabCorp COVID-19 at-home collection kit” at no cost to individuals who meet clinical guidelines.

In terms of new partnerships, in November 2022, VillageMD entered into a definitive agreement to acquire Summit Health-CityMD — a leading provider of primary, specialty and urgent care.

In October 2022, Walgreens announced the acceleration of its plans to acquire full ownership of CareCentrix, expanding its reach into the growing homecare sector and advancing its healthcare long-term growth strategy.

On the flip side, over the past year, Walgreens has underperformed the industry. The stock has lost 31.4% compared with the industry’s 30.1% decline.

During the first quarter of fiscal 2023, Walgreens’ Pharmacy sales decreased 4.2% compared with the year-ago quarter, negatively impacted by a 7.8 percentage point headwind from AllianceRx Walgreens. Comparable pharmacy sales declined 0.9%, reflecting lower demand for COVID-19 services. The International segment declined year over year due to an adverse currency impact of 15.4%.

In the last few years, the slowdown in generic introduction has been affecting Walgreens’ margins. In addition, increased reimbursement pressure and generic drug cost inflation have been hampering its margin on a significant level. In the first quarter of fiscal 2023, gross profit fell 8.2% year over year. Gross margin contracted 152 basis points to 20.8%. Selling, general and administrative expenses were up 105.9%. The company reported an adjusted operating loss of $6.2 million for the quarter under review against $1.3 million of operating profit in the year-ago period.

Key Picks

Some better-ranked stocks in the overall healthcare sector are Haemonetics Corporation HAE, Catalyst Pharmaceuticals CPRX and Avanos Medical AVNS. Haemonetics and Catalyst Pharmaceuticals each sport a Zacks Rank #1 (Strong Buy), while Avanos Medical has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 29% in the past year. Earnings estimates for Haemonetics have remained constant at $2.94 in 2023 and $3.29 in 2024 in the past 30 days.

HAE’s earnings beat estimates in all the last four quarters, delivering an average surprise of 10.98%. In the last reported quarter, it reported an earnings surprise of 7.59%.

Estimates for Catalyst Pharmaceuticals’ 2023 earnings have increased from $1.17 to $1.42 in the past 30 days. Shares of the company have increased 102% in the past year.

CPRX’s earnings beat estimates in three quarters while beating the same in one, the average surprise being 3.35%. In the last reported quarter, Catalyst Pharmaceuticals delivered an earnings surprise of 4.76%

Estimates for Avanos Medical’s 2023 earnings have remained constant at $1.68 in the past 30 days. Shares of the company have declined 15.2% in the past year compared with the industry’s fall of 16.3%.

AVNS’ earnings beat estimates in all the trailing four quarters, the average surprise being 11.01%. In the last reported quarter, Avanos Medical delivered an earnings surprise of 25%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Catalyst Pharmaceuticals, Inc. (CPRX) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance