Wall Street is fed up with Meta - but Zuck’s full steam ahead with his massive metaverse bet.

Happy Friday, team. I'm Phil Rosen. Yes, readers, it is true — after months of trying to get out of the $44 billion deal, Elon Musk is officially Twitter's new owner. But more on that later.

First, with Halloween around the corner, Big Tech's seeing its own version of spooky season. Its latest batch of corporate earnings were enough to make Freddy Krueger quiver.

Still, if anyone should be excited for the weekend, it's Mark Zuckerberg.

Since Meta reported earnings on Wednesday, its stock has shed more than 23%. Over the last two days, 38-year-old Zuckerberg has seen his fortune slashed by roughly $11 billion.

While most of us all indulge in tricks and treats over the weekend, Zuck can rest easy knowing his net worth will remain stable for a moment — at least until the market opens again on Monday.

If this was forwarded to you, sign up here. Download Insider's app here.

1. Everyone on Wall Street is mad that Meta keeps spending so much. Investors and analysts took the day yesterday to digest the tech giant's latest earnings, and it's clear patience is wearing thin.

While Zuckerburg has urged investors to remain patient on his massive metaverse bet, Meta's cratering stock price and a slate of bank analysts sounding off on the earnings miss show that Wall Street is souring on this pivot away from the company's core asset.

JPMorgan analysts said Thursday that Zuck's fixation on the metaverse-branch of the company, Reality Labs, isn't enough to offset the disappointing outlook for next year.

Morgan Stanley went even further, slashing the Facebook parent's "buy" rating. The analysts cut their price target to $105 from $205 and said the company's results were "thesis changing."

Here's one tidbit that drew attention this week: Meta spent $45 billion buying its own stock last year, at $330 a share. But this week's earnings have sent prices tumbling to about $100 a pop.

But it's not just the inner workings of the business that Wall Street's fed up with. External headwinds will weigh on the company too.

As Bank of America put it: "We believe in the near-term, Meta's topline will remain under pressure as higher interest rates weigh on economic growth and online advertising demand."

Mega-cap tech stocks like Zucks' behemoth are facing a possible crisis, with other giants like Google parent Alphabet reporting slowdowns in digital advertising growth.

"It's clear that there are headwinds for the industry after a period of unsustainable growth coming out of the pandemic, IOS privacy changes, growing competition and macro headwinds," Michael Reinking, senior strategist for the New York Stock Exchange, told me yesterday.

He added that there's likely more pain to come for Big Tech, and those previously high-flying stocks could face a valuation reset.

"This quarter has made it clear that investors are now screaming for financial discipline from these companies after a period of aggressive hiring and spending," Reinking said.

Is the slowdown in ad revenue facing big tech firms that have reported results so far a sign of:

A) Intense competition from the likes of TikTok and other industry headwinds?

B) Deeper issues in the economy related to consumer behavior and spending?

Let me know on Twitter (@philrosenn) or email me (prosen@insider.com).

In other news:

2. US stock futures fall early Friday, as Amazon shares dropped almost 14% in premarket trading after a disappointing earnings report. Meanwhile, Elon Musk completed his $44 billion takeover of Twitter and reportedly fired at least four top executives at the company, including CEO Parag Agrawal — here's the latest on the takeover.

3. On the docket:, Acura Pharmaceuticals Inc, Barnes Group Inc, and more, all reporting.

4. Buy this batch of high dividend-paying stocks that analysts are overwhelmingly recommending right now. These types of stocks look attractive, according to a company that ranks them, because they can typically outperform during an inflationary environment. Get the full list here.

5. Tankers filled with dirty Russian oil are piling up around Asian ports just weeks away from when new EU sanctions are set to kick in. Near Malaysia and Singapore, there are a fleet of ships with high-sulfur fuel oil from Moscow, according to a Bloomberg report. Here's what you want to know.

6. Wall Street is grappling with the "revenge of the old economy" as tech and growth stocks crash. Goldman Sachs' commodities chief Jeff Currie pointed out that energy and industrial companies have largely reported upbeat earnings even as names like Tesla, Microsoft and Meta do the opposite. He thinks that a new supercycle is underway — and expects it to last beyond 2030.

7. The International Energy Agency forecasted that demand for fossil fuels will peak this decade. Russia's war on Ukraine is reshaping the world energy order, the group said. But it added that's also what will help pave the way for an accelerated shift toward renewables.

8. A 27-year-old real estate investor who owns 11 rental units isn't buying properties right now. Stephen Yin is waiting until either mortgage rates go down again or there's a fire sale before he's reentering the market. "The rates are way too high. I can't make money in the way I want to make money."

9. Home prices in these eight markets are falling the fastest. New Case-Shiller data shows that homes are on a downward trend at a national level, and the US housing market is slowing down at the quickest pace ever. See which cities are leading the charge.

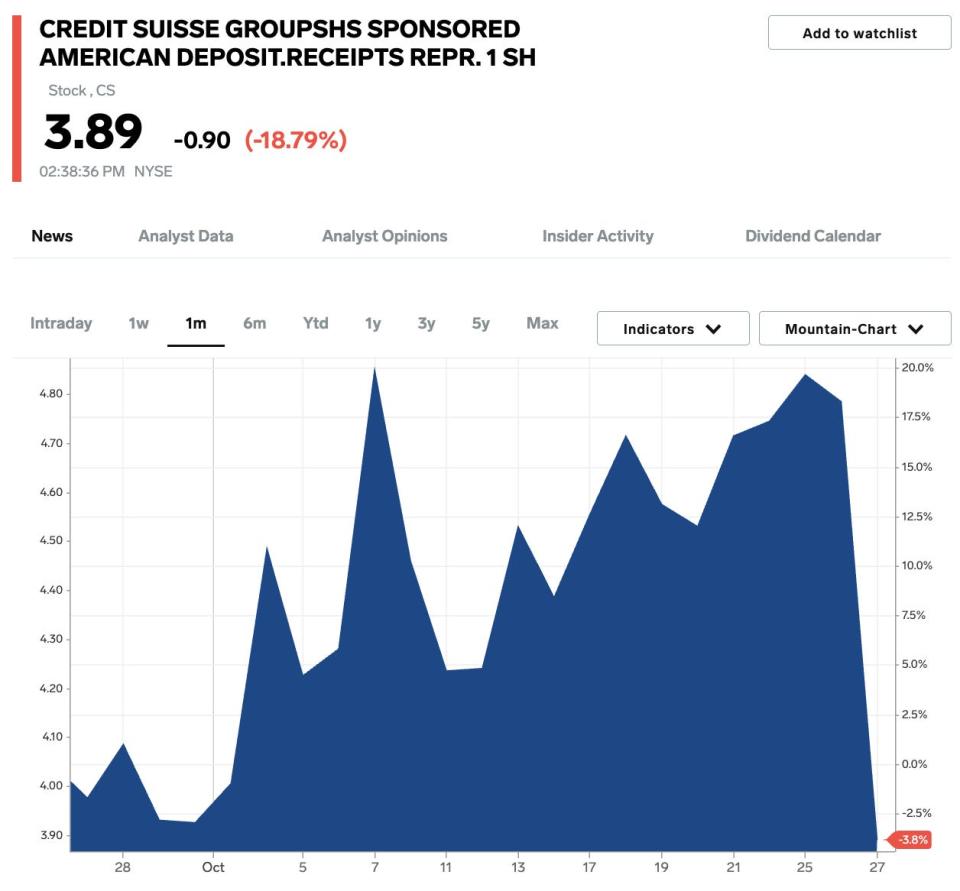

10. Credit Suisse shares have plunged dramatically as it promises to overhaul its business. The scandal-plagued Swiss bank recently posted a huge loss that fell short of analysts' expectations, which its CEO attributed to "continued challenging market and macroeconomic conditions."

Keep up with the latest markets news throughout your day by checking out The Refresh from Insider, a dynamic audio news brief from the Insider newsroom. Listen here.

Curated by Phil Rosen in New York. Feedback or tips? Tweet @philrosenn or email prosen@insider.com

Edited by Max Adams (@maxradams) in New York and Hallam Bullock (@hallam_bullock) in London.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance