Want to retire early? Here's our step-by-step guide

Simple changes to make now for a richer retirement

Soloviova Liudmyla/Shutterstock

Most of us expect to work well into our 60s and maybe even 70s. But what if you don’t want to work into your golden years? Early retirement might seem like an unattainable dream, but there are some simple steps you can take to help make it a reality.

Read on to discover what they are.

1. Rely on yourself

Aaban/Shutterstock

Let’s face it, a comfortable early retirement is not just going to happen naturally. As the population gets older, most governments are raising the age at which you can claim state benefits. If you want to stop work early, you are going to have to make plans to do it with your own money. Anything else should be considered a bonus.

2. Be realistic about your goals

Spotmatik Ltd/Shutterstock

Early retirement is a luxury in itself. When making your retirement plan, be realistic about what it means for you and maybe give up on the dreams of a yacht and a penthouse. Work out a net figure that will give you enough to live on each year in a lifestyle that not only suits you, but is attainable. Setting yourself unachievable goals will only set you up for failure.

3. Make a plan

Shutterstock

Make a plan and crunch the numbers to determine what sort of income you are going to need to give up work completely. Ask yourself tough questions: how much luxury are you expecting? Will you want to be able to travel? Have you taken insurance and possible later-life care into account? Once you have these figures, you can set out a realistic roadmap for saving and investing.

4. Start saving

Boryana Manzurova/Shutterstock

The obvious place for readying yourself for retirement is to save as much as you can while you're still working. Having a healthy pot of savings will make things easier down the line and smooth over income cracks you might have in retirement – but be aware that savings alone will not get you there. Barney Whiter, known within the Financial Independence Retire Early (FIRE) community as The Escape Artist, retired at 43 and he recommends saving a pot of money worth 25 times your annual living expenses before giving up work.

5. Don't be afraid of investing

Image/The Escape Artist

Financial success relies on three factors: how much you invest, how much your investments grow and the amount of time you invest for. That means it's best to start early. If you find the idea of investing intimidating, there are plenty of companies offering easy-to-understand platforms where you can get started. As Whiter, aka The Escape Artist (pictured), says: "It's as easy to invest in the stock market and manage your portfolio as it is to manage an online bank account."

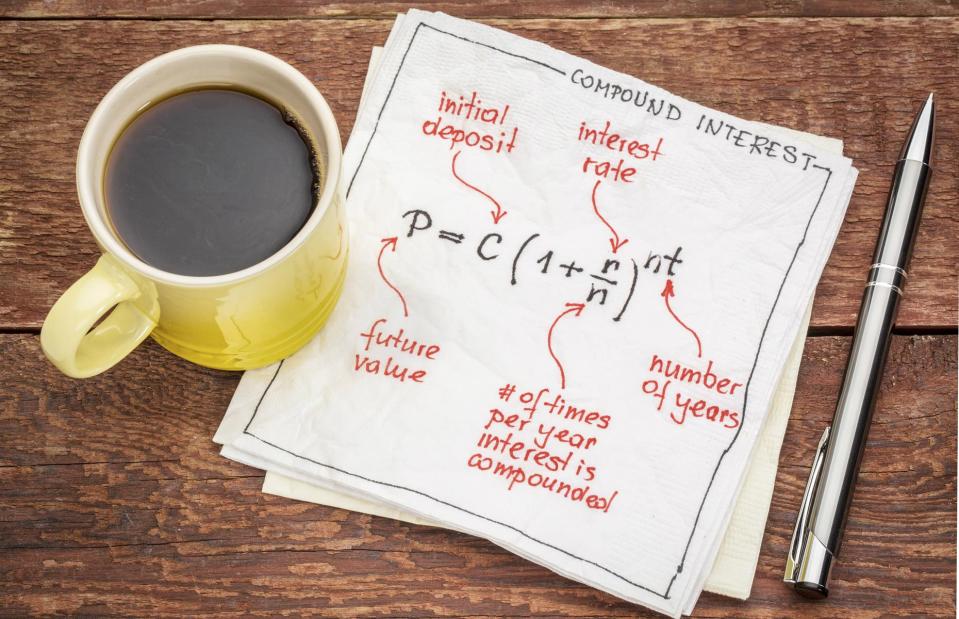

6. Embrace the power of compound interest

marekuliasz/Shutterstock

Compound interest is the big name for a simple concept: any interest that you make on an invested amount will itself earn interest in the future. Say you invest $100 at 3% interest a year. That means that by the second year, you'll have $103 invested. Assuming interest remains the same, in the third year you'll have $106.09 and the year after that you'll have $109.27 and so on.

7. Start early

Foxy burrow/Shutterstock

Compound interest also means that when you start saving can be more important than how much you save. For example, if you start saving at the age of 25, you'll rack up 35% more over your career than somebody who starts saving aged 35. In both cases if you save the same amount each year, starting to save with compound interest in your 20s means that you'll get almost double the amount of the person who starts at 35. Start early, and be consistent – it pays off!

8. Monitor your finances

Jim Watson/Getty Images

Even if you have a plan and you are saving and investing, it can all go down the drain if you are not on top of your income and outgoings. Interest rates can fluctuate wildly over the years, stocks peak and trough and the value of assets can change too. Make sure you periodically calculate your net worth, which you can do using this calculator. You might not be topping the Forbes Billionaires List Jeff Bezos-style but you don't need to be worth billions to make sure you are on track to retire when you want.

9. Be tax savvy

View Apart/Shutterstock

While you can't get away with not paying your taxes, you can make the most of tax breaks. Putting more money into your pension scheme will help you reach your goal, but if done right it could even help to reduce your tax bill. Make sure you are fully aware of the tax options in your country and if you're not happy with them, you could consider retiring abroad where tax rates can be a lot lower, or even non-existent.

10. Keep fixed costs down

Rawpixel.com/Shutterstock

Being serious about retiring early is all about putting as much of your income to work while you are still employed. That means being clever with how much you pay for your fixed costs. Cutting down the amount you spend on living costs and regularly switching service providers to get cheaper deals can help you to spend less. Also re-assess your outgoings regularly: if you've only been to the gym once in the last two months and that weekly magazine is still unread, it's probably worth cancelling those subscriptions.

11. Start making some sacrifices

STEPHANE DE SAKUTIN / Contributor

Let’s be realistic: short of winning the lottery, the only way you will retire early is through hard work, clever finances and sacrifice. Start with small cuts. Give up your daily coffee shop latte, and at the end of the month calculate how much you’ve saved and pop it in the bank. You’ll be surprised how much cash you’re drinking away. Then go on from there.

12. Be prepared to make some tough choices

fotoliza/Shutterstock

The younger generation has become somewhat renowned for choosing to spend money on experiences rather than material objects, but these still don't come cheaply and they won't help towards your savings. To retire early you will have to make some tough choices and may have to live more frugally in your youth – that might mean less seeing the world and more saving.

13. Diversify your income

katjen/Shutterstock

A key tip for retiring early is diversifying your income. That means making sure you have more than one source of income when you give up work. You might want to consider “investing for income” as a good way to supplement your cash. That means opting for an investment strategy that will give you a steady and predictable income. Some people like to invest in stocks, shares or bonds, while others prefer property. It is best to compare yields and do a mixture of investments to get the best return.

14. Take the right risks

Olivier Le Moal/Shutterstock

Make sure you are investing with the right level of risk. If you are a 25-year-old planning on retiring at 45 you can afford to take risks that a 40-year-old planning on retiring at 45 can’t. Taking too little risk can cost you thousands in returns, but similarly too much risk can cost you in losses. It’s a delicate balancing act. It's also important to point out that any kind of investment has some element of risk to it.

15. Mind the fees

fizkes/Shutterstock

Another golden rule of investing: be mindful of what fees you agree to pay. A $100,000/£100,000 investment portfolio with a 1% ongoing fee will be worth around $20,000/£20,000 less over 20 years than the same portfolio with a 0.25% fee. Sometimes fees are inevitable, but modern technology and the rise of cheaper self-investing platforms mean that you do have options to choose from.

16. Resist the herd mentality

fizkes/Shutterstock

FOMO – the fear of missing out – is the tendency to copy what our peers are doing. Buying a new phone, or even a house, because it feels like something you are supposed to do rather than something that you need or want to do can set you back from your goal. Getting a mortgage when your retirement goal is to travel the world can be the wrong decision, but it could be right for your friend who just wants to retire in the countryside with a big family. Resist FOMO and make thoughtful decisions.

17. And be happy with less

Soloviova Liudmyla/Shutterstock

Saving and cutting costs is vital, but equally important is a mindset where you are happy with less. It takes a lot of strength to see your friends in big houses and driving expensive cars when you choose to live in a small apartment and ride a bike. Be confident you’ve made the right decision for you and the other steps won't seem as much of a struggle.

Now take a look at the ages at which people around the world really retire

Yahoo Finance

Yahoo Finance