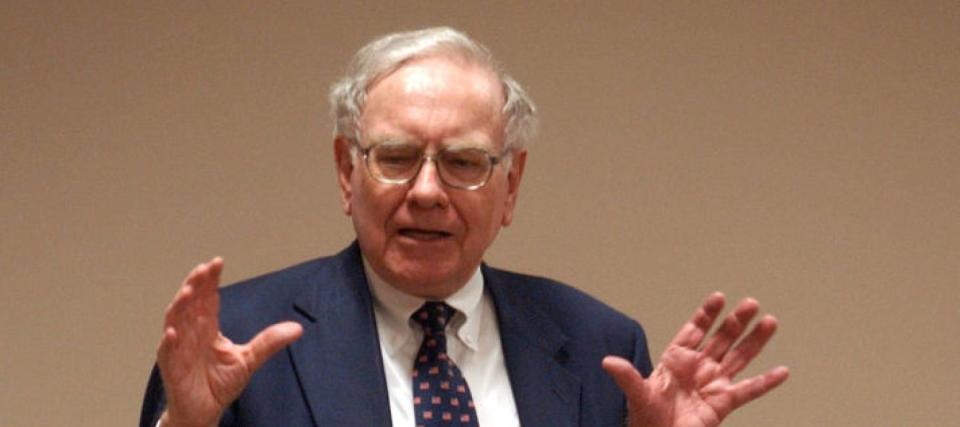

Warren Buffett once shared how he could've turned $114 into $400K with his dead-simple signature investing style

Warren Buffett started his investment journey at an early age, making his first entry into the stock market at just 11 years old.

“I bought my first stock when I was 11 years old. It was the first quarter of 1942, shortly after Pearl Harbor. I spent $114.75,” he shared in a 2018 interview with Yahoo Finance.

Don't miss

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here's how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

Cost-of-living in America is still out of control — use these 3 'real assets' to protect your wealth today, no matter what the US Fed does or says

These 5 magic money moves will boost you up America's net worth ladder in 2024 — and you can complete each step within minutes. Here's how

He used that money to purchase three shares of Cities Service preferred stock, a natural gas company that no longer exists today.

Buffett shared this story not to emphasize how early he started investing, nor did he disclose the performance of that particular investment. Instead, he highlighted the potential growth that could have been achieved by adopting a simpler, long-term investment strategy rather than actively picking stocks.

“If I put that $114 into the S&P 500 at that time, and reinvested the dividends, think of a figure as to what it would be worth today?” he posited.

The amount is significant.

“The answer is about $400,000,” Buffett revealed. “So if I as a little kid had taken that 114 bucks I’d saved shoveling snow or whatever I’d done — $400,000 today. One person’s lifetime. That’s America.”

‘Huge tailwind’ for investors

Remember, Buffett made that comment in 2018. And the S&P 500 has continued to climb since the interview, meaning the $400,000 would have kept growing.

In his letter to Berkshire Hathaway shareholders published in February 2019, Buffett provided an update to the calculation, writing, “If my $114.75 had been invested in a no-fee S&P 500 index fund, and all dividends had been reinvested, my stake would have grown to be worth (pre-taxes) $606,811 on January 31, 2019 (the latest data available before the printing of this letter). That is a gain of 5,288 for 1.”

And that’s not the end of the story, as the S&P 500 continued its upward trajectory, despite experiencing ups and downs along the way.

In just the last five years, the benchmark index has surged by about 90%.

Buffett told Yahoo Finance that the scenario of turning $114 to $400,000 doesn’t require his personal skill.

“That isn't me. It is the huge tailwind the American economy gives to any equity investor,” he remarked.

Read more: Rich young Americans have lost confidence in the stock market — and are betting on these assets instead. Get in now for strong long-term tailwinds

Through thick and thin

While simply riding with the S&P 500 Index would have yielded massive returns, it's important to remember that the market journey wasn't always smooth sailing.

Buffett pointed out that there were many bumps along the way.

“Now, the market’s gone down many times during that time, people have panicked during that time, headlines have been terrible,” he said. “But America is a powerful economic machine that, since 1776, it’s worked and it’s going to keep working.”

In other words, investors need to be patient to benefit from the tailwind generated by the American economic machine.

Buffett emphasized the importance of adopting a long-term investment horizon.

“Now, you don’t want to buy to hold for a year, you don’t want to buy with the idea that you could sell it in two years or three years necessarily and make money. You could lose money that way,” he explained.

“But if you buy it for $10, $20, just keep buying the S&P 500 index and forget about all the other nonsense that’s being sold to you because I’ll guarantee you one thing about the stuff being sold to you, it will carry bigger fees than what I’m talking about.”

Indeed, tracking the benchmark index can be done at minimal cost these days. For instance, the Vanguard S&P 500 ETF (VOO), which follows the S&P 500, has a low expense ratio of 0.03%. Similarly, the SPDR S&P 500 ETF Trust (SPY) tracks the same index and carries an expense ratio of 0.0945%.

What to read next

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

‘Baby boomers bust': Robert Kiyosaki warns that older Americans will get crushed in the 'biggest bubble in history' — 3 shockproof assets for instant insurance now

The 5 most expensive mistakes in options trading and how to avoid them

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Yahoo Finance

Yahoo Finance